|

|

|

|

|||||

|

|

As quantum computing edges closer to real-world applications, investors are starting to focus on the companies building the future of computational power. Rigetti Computing RGTI and IonQ IONQ are two notable contenders in this space, each bringing a distinct technological approach and business strategy to the table.

These early-stage companies offer high-risk, high-reward potential in a game-changing tech sector. As both companies ramp up commercialization and target government and enterprise contracts, the race to scale quantum systems is heating up. In this two-stock faceoff, we compare Rigetti and IonQ based on technology, business model, and growth strategy, helping investors see which one is better positioned as the quantum era unfolds.

Shares of Rigetti and IonQ have plunged 40.3% and 35.9% in the year-to-date period.

From a valuation standpoint, IONQ looks more attractive than RGTI. According to the price/book ratio, IonQ’s shares currently trade at 15.56, lower than 20.57 for Rigetti.

Rigetti uses superconducting qubits—tiny circuits built on silicon chips—leveraging existing semiconductor processes for scalability. With its fab facility, Fab-1, Rigetti controls chip design, prototyping, and production, supporting faster innovation. Its latest system, Ankaa-3, features 84 qubits and achieved 99.5% two-qubit gate fidelity in 2024, showcasing strong technical progress.

IonQ takes a different route with trapped-ion technology, using atoms suspended in a vacuum and controlled by lasers. This setup delivers high coherence, low error rates, and full qubit connectivity. Unlike superconducting systems, it works near room temperature, avoiding the need for complex cooling and offering strong precision in quantum operations.

Rigetti’s vertically integrated model gives it control across the quantum stack—from chip design and fabrication to software and cloud delivery. Revenue comes from QPU sales, cloud access via Rigetti Quantum Cloud Services, and R&D contracts. In 2024, most income was from government and commercial deals, including DARPA and the U.S. Department of Energy.

IonQ follows a cloud-first, asset-light strategy, delivering its trapped-ion systems through Amazon Braket, Azure, and Google Cloud. Its main income comes from quantum computing-as-a-service (QCaaS) and professional services to support client use cases. It is also exploring future on-premise offerings.

For 2024, RGTI registered total revenues of $10.8 million compared with IONQ’s $43.1 million. RGTI reported a loss per share of $1.09 compared with IONQ’s $1.56.

Rigetti is focused on improving its quantum systems’ performance and scalability. It plans to launch a 36-qubit modular system by mid-2025, built from four 9-qubit tiles, aiming to cut error rates in half. By year-end, the company targets a 100+ qubit system with similar fidelity improvements. It is also expanding its 84-qubit Ankaa-3 system via cloud platforms and government collaborations, including the UK's National Quantum Computing Centre.???

IonQ is scaling its quantum systems by boosting algorithmic qubit counts and improving gate fidelity with photonic interconnects and modular QPUs. The company is expanding its QCaaS model across industries via major cloud platforms. It maintains a strong IP position through exclusive tech licenses from the University of Maryland and Duke University.

Superconducting qubits currently lead the quantum computing market due to manufacturing compatibility and strong players like IBM and Google. Trapped-ion technology is gaining traction for its precision and reliability. While the market is projected to grow from $1.3 billion in 2024 to $5.3 billion by 2029, superconducting systems are expected to dominate volume deployments, with trapped-ion platforms advancing in high-fidelity, error-corrected applications.

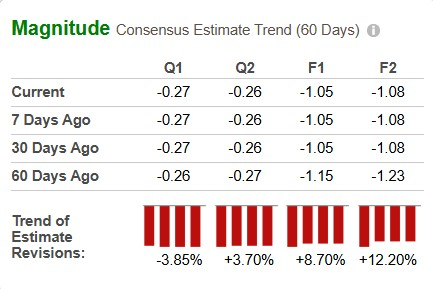

The Zacks Consensus Estimate for Rigetti's 2025 sales and earnings implies year-over-year growth of 34.57% and 44.44%, respectively. Earnings per share estimates have been trending northward over the past 60 days.

The Zacks Consensus Estimate for IonQ’s 2025 sales implies year-over-year growth of 97.34%. For 2025, loss per share is projected to be $1.05 compared with $1.56 per share a year ago. The earnings estimates have been trending upward over the past 60 days.

Both Rigetti and IonQ carry a Zacks Rank #2 (Buy) at present, along with the same Zacks Style Score of ‘F’, which makes it difficult to choose one of them. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

However, RGTI's Growth score of ‘D’ reflects its better growth potential compared with IONQ's Growth score of ‘F’.

Rigetti and IonQ are both poised for quantum computing growth, but differ in investment appeal. Rigetti’s full-stack control and technical credibility suit government and research, but has high valuation and modest growth. IonQ, with larger cash reserves and a scalable cloud-first model, offers stronger revenue growth and an aggressive roadmap, boosting its market expansion and commercial viability.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 10 hours | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite