|

|

|

|

|||||

|

|

EMCOR Group, Inc. EME and MasTec, Inc. MTZ are both leaders in the infrastructure engineering and construction services arena. Each company plays a critical role in building and maintaining essential systems – from electrical and mechanical facilities services (in EMCOR’s case) to communications networks, power grids, and energy infrastructure (in MasTec’s case).

Both have capitalized on the surge in demand for large-scale infrastructure projects, which are supported by public and private investments in data centers, renewable energy, and 5G telecommunications.

Notably, both firms posted record results in 2024 and carry hefty backlogs of future work (EMCOR’s Remaining Performance Obligations or RPOs stand at about $10.1 billion, while MasTec’s 18-month backlog hit a record $14.3 billion). These robust pipelines underscore why investors are closely watching EME and MTZ stock for near-term opportunities.

With infrastructure spending providing strong tailwinds for both companies, investors are keen to find out which stock presents a more attractive opportunity right now. Let's dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

EMCOR has built a reputation for consistent, profitable growth. The company delivered record results for 2024, with revenue climbing 15.8% to $14.57 billion and net income jumping 59% to $1.01 billion. This translated to a robust $21.52 in earnings per share (EPS) for 2024, up 61.7% from 2023, underscoring strong execution across its segments. Importantly, EMCOR’s backlog (what it calls RPOs) reached an all-time high of $10.1 billion (up 14.2% year over year), providing excellent revenue visibility into 2025. Management cited broad-based demand driving this momentum, from high-tech manufacturing and data centers to healthcare facilities and electric vehicle infrastructure, markets where EMCOR’s electrical and mechanical construction services are in high demand. The company’s focus on disciplined project execution and cost controls has boosted margins as well, with fourth-quarter 2024 operating margin reaching 10.3% (up 190 basis points or bps from a year ago).

In fact, EMCOR has beaten earnings estimates in each of the last four quarters (averaging a 29% upside surprise), which highlights its strong execution and consistent outperformance.

A key driver behind EMCOR’s bullish outlook is its strategic expansion and strong financial footing. The company has pursued acquisitions thoughtfully, most notably with its $865 million purchase of Miller Electric, which closed in February 2025. This deal significantly enhances EMCOR’s presence in fast-growing sectors such as data centers, healthcare, and industrial manufacturing, and is projected to contribute approximately $805 million in annual revenues. It is also expected to be modestly accretive to 2025 earnings, reinforcing the company’s long-term growth trajectory.

Entering 2025, EMCOR held a robust cash position of $1.34 billion and increased its share repurchase authorization by $500 million—moves that reflect management’s confidence and provide ample flexibility to drive shareholder returns. Such financial strength, combined with a record project pipeline, gives EMCOR a solid foundation to weather any macro challenges (like higher interest rates or supply chain hiccups) and continue expanding. Even though one of its segments (U.S. Building Services) saw a minor revenue dip in 2024 due to a few lost contracts, the overall business mix is firing on all cylinders.

MasTec, on the other hand, offers a story of resurgence and high growth potential – albeit with a few more caveats. This Florida-based infrastructure construction firm specializes in building the backbone of modern life — communications networks (like 5G wireless and fiber), clean energy and power delivery systems, and oil & gas pipelines. After a challenging 2023 in which MasTec took a loss, the company roared back in 2024 with $12.3 billion in revenues (up modestly from $12.0 billion in 2023) and a swing to $199 million in GAAP net income. On an adjusted basis, MasTec earned about $3.95 per share in 2024, more than double the prior year’s result, signaling a strong turnaround in profitability.

A big driver has been operational improvements and the digestion of recent acquisitions (such as its 2022 purchase of Infrastructure and Energy Alternatives, which bolstered MasTec’s renewable energy construction capabilities). By the fourth quarter of 2024, MasTec’s adjusted EBITDA margins had risen to 8%, up 110 bps from a year ago, and cash flow was robust. The company exited 2024 with a record 18-month backlog of $14.3 billion – roughly 15% higher than a year earlier – reflecting new project wins across its segments. This huge backlog (even larger than EMCOR’s) gives MasTec strong revenue visibility and growth impetus heading into 2025, and management is guiding for about 9% top-line growth this year, along with a significant jump in earnings. Adjusted EPS are anticipated to be between $5.35 and $5.84 per share (versus $3.95 in 2024).

The company’s track record of positive earnings surprises also adds confidence – MasTec has beaten consensus in each of the last four quarters, with an eye-opening average EPS surprise of 31.6% (thanks in part to conservative guidance that it consistently exceeded).

MasTec is benefiting from surging demand in telecommunications and data center projects – it booked more than $200 million in data center-related revenues in 2024 amid the boom in cloud and AI investments, and sees further growth ahead. Likewise, nationwide upgrades to energy infrastructure (from power transmission lines to renewable energy integration) provide a multi-year growth runway that MasTec is well-positioned to exploit.

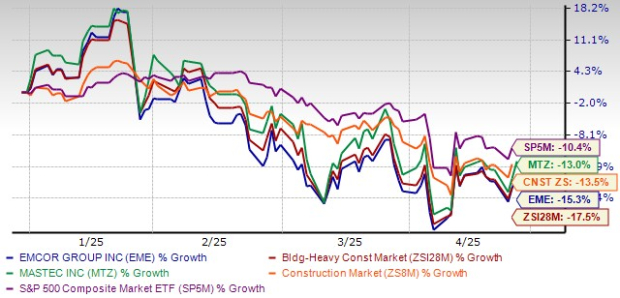

EMCOR shares skyrocketed in 2024, rising roughly 110%. However, the stock has since pulled back from its highs and lost 15.3% year to date (YTD). Investors have been weighed down by broader market volatility influenced by tariff threats and inflation concerns. Also, concerns over margin sustainability, with operating margins expected to decline slightly to 8.5%-9.2% in 2025 from 9.2% reported in 2024 (indicating a normalization after strong growth), might have been the concern.

For MasTec, after hitting an all-time high around $160 in early 2025 and gaining around 80% in 2024, the stock has since pulled back (down about 13% YTD), as investors’ sentiment has been weighed down by macroeconomic concerns and the company’s heavy investment phase. Clearly, in terms of YTD stock performance, MasTec has an edge over EMCOR.

Yet, both EME and MTZ stocks have performed somewhat better than the Zacks Building Products - Heavy Construction industry so far this year.

EME & MTZ Stock Performances

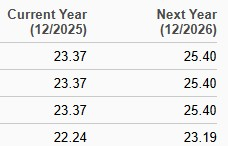

Analysts are growing increasingly optimistic about both EME and MTZ’s earnings potential. Over the past 60 days, the Zacks Consensus Estimate for EMCOR, as well as MasTec’s 2025 EPS, has increased, as you can see below, reflecting a positive shift in sentiment. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

For EMCOR Stock

For MasTec Stock

After its steep rally last year, the EME stock trades at about 16X forward 12-month price-to-earnings (P/E) ratio, roughly in line with the industry average, and cheaper than many peers. (MasTec’s forward 12-month P/E is closer to 20X, which suggests EMCOR offers better value on an earnings basis.)

In fact, MasTec looks overvalued compared to direct peers like AECOM ACM, Fluor Corporation FLR, all of which are lower than MasTec. AECOM and Fluor have forward P/E ratios of 17.6 and 13.1, respectively.

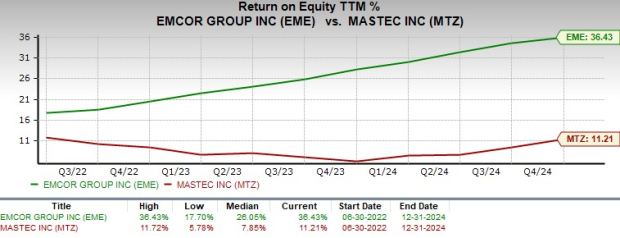

EMCOR’s trailing 12-month ROE of 36.4% far exceeds the industry average of 15.5% and MasTec’s 11.2%, underscoring its efficiency in generating shareholder returns.

EMCOR appears to have the edge as the better short-term investment right now. Both companies are riding powerful infrastructure trends and boast solid growth prospects, but EMCOR — a Zacks Rank #1 (Strong Buy) company — offers a more balanced fundamental profile with superior near-term execution and returns. You can see the complete list of today’s Zacks #1 Rank stocks here.

By contrast, MasTec, while certainly poised for high growth, comes with a higher risk/reward tilt – its stock valuation is elevated. This elevated valuation means a lot of the anticipated growth may already be priced in, and it could cap short-term upside unless MasTec delivers further earnings beats or raises its outlook. MasTec currently carries a Zacks Rank #3 (Hold).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Construction Firm Misses Views But Gains $1.35 Billion From This Sale

FLR +6.79%

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite