|

|

|

|

|||||

|

|

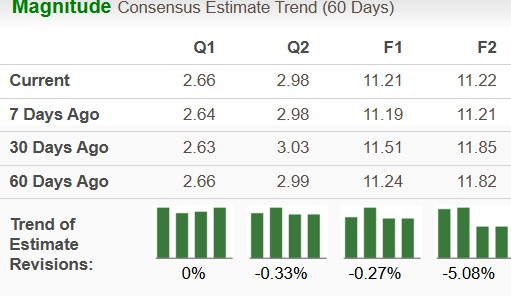

General Motors GM is slated to release first-quarter 2025 results on April 29, before the opening bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings and revenues is pegged at $2.66 per share and $42.37 billion, respectively.

The consensus estimate for the to-be-reported quarter’s earnings has moved north by 2 cents over the past seven days. The bottom-line projection indicates a modest year-over-year uptick of 1.5%. The Zacks Consensus Estimate for quarterly revenues, however, suggests a year-over-year decrease of 1.5%.

For 2025, the Zacks Consensus Estimate for GM’s revenues is pegged at $179.3 billion, implying a contraction of 4.3% year over year. The consensus mark for 2025 EPS is pegged at $11.21, implying growth of around 6% on a year-over-year basis.

In the trailing four quarters, this U.S. legacy automaker surpassed earnings estimates on all occasions, with the average earnings surprise being 15.81%.

General Motors Company price-eps-surprise | General Motors Company Quote

Our proven model predicts an earnings beat for General Motors this time around as well. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

GM has an Earnings ESP of +7.40% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

(See the Zacks Earnings Calendar to stay ahead of market-making news.)

General Motors sold 693,363 units in the first quarter of 2025, up 17% year over year. It posted double-digit gains across its key brands— Chevrolet (up 13.7%), GMC (up 17.6%), Cadillac (17.8%) and Buick (39.3%). The company dominated the U.S. auto industry for the quarter, leading in total, retail and fleet sales. Meanwhile, GM’s closest peer Ford F saw its sales drop 1.3% in the quarter ending March.

GM’s retail sales surged 15%, marking its best first-quarter since 2018. Electric vehicle (EV) sales were up 94% to 31,887 units, with General Motors being the #2 seller of EVs in the country, trailing only Tesla TSLA.

In the quarter to be reported, General Motors delivered 442,000 vehicles in China, nearly flat year over year but down 26.3% sequentially. However, its new energy vehicle sales jumped 53.2% year over year. The Buick GL8 led the premium multi-purpose vehicle segment with 24,000 units sold, while the Wuling Hong Guang MINIEV retained its popularity. LaCrosse and Envision Plus models saw strong gains. Additionally, Chevrolet Tahoe deliveries began under GM’s Durant Guild platform in March.

Our estimate for wholesale vehicle sales volumes of the GMNA (General Motors North America) segment is 807,000 units, suggesting year-over-year growth of 1.9%. We project revenues from the GMNA segment to be $36.46 billion, implying an increase of 1%. Operating income from the unit is estimated at $3.9 billion, implying growth of 2%.

On the flip side, we expect wholesale volumes from the GMI unit (excluding China JV) to be down roughly 2% in the quarter to be reported to 102,000 units. Our projections call for a contraction of 17% in revenues year over year. However, we expect operating income of $58.3 million against a loss of $10 million in the year-ago period.

Year to date, shares of General Motors have declined 12%, outperforming the auto sector. It has also performed better than Tesla, whose shares have plunged 36% so far in 2025. Meanwhile, Ford has gained 1.6% in the same timeframe.

From a valuation perspective, General Motors is trading relatively cheap. Going by its price/sales ratio, the company is trading at a forward sales multiple of 0.26, below the industry’s 2.19. The company has a Value Score of A. Meanwhile, Tesla looks too pricey at a forward sales multiple of 7.6, whereas Ford’s P/S of 0.24 is slightly lower than GM’s.

General Motors is the top-selling automaker in the United States. It is advancing well in its electrification journey.

GM exited 2024 with several wins. Its EV portfolio became “variable profit positive” in the last quarter of 2024, with 189,000 electric vehicles produced during the year and a goal to ramp up to 300,000 units in 2025. The company expects EV losses to shrink by $2 billion this year, reflecting growing operational efficiency and scale. Meanwhile, cost discipline has been another bright spot. GM met its $2 billion cost-cutting goal and is unlocking another $1 billion in annual savings after pulling back from robotaxi development.

GM’s China operations are starting to look more promising. Its restructuring efforts in the region are showing early signs of a turnaround, with the company aiming to return to profitability this year.

Financially, GM remains sturdy. The automaker ended 2024 with $35.5 billion in automotive liquidity and returned $7.6 billion to shareholders via dividends and buybacks. A 25% dividend hike and a fresh $6 billion repurchase authorization (including a $2 billion ASR) fuel confidence.

However, near-term headwinds remain. GM expects a slight dip in internal combustion engine vehicle volumes in North America and forecasts a 1-1.5% decline in vehicle pricing, which could weigh on margins. Also, macro uncertainties and tariff troubles could cloud the company’s near-term prospects.

GM looks like a solid long-term play. However, for new investors, it may be wise to stay on the sidelines until the company outlines how it plans to navigate ongoing tariff tensions and pricing pressure. So, instead of jumping to buy the stock ahead of results, it's better to exercise patience and wait for more clarity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite