|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Teck Resources Limited TECK reported first-quarter 2025 adjusted earnings per share (EPS) of 42 cents, beating the Zacks Consensus Estimate of 24 cents. It marked a substantial improvement from the loss of one cent per share in the year-ago quarter. This was attributed to higher base metal prices and increased sales volume of copper and zinc in concentrate.

The prior-year quarter’s earnings have been adjusted by Teck Resources to reflect the sale of the steelmaking coal business or Elk Valley Resources (“EVR”) in the third quarter of 2024. Including the business, earnings in the first quarter of 2024 were previously 56 cents per share.

Including one-time items, the company reported EPS of 51 cents in the quarter against the year-ago quarter’s loss of 18 cents per share.

Teck Resources Ltd price-consensus-eps-surprise-chart | Teck Resources Ltd Quote

(Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Net sales amounted to $1.595 billion, surpassing the Zacks Consensus Estimate of $1.578 billion. The figure reflects a 33% year-over-year improvement over the prior year-quarter’s adjusted figure of $1.119 billion, aided by higher sales in both the copper and zinc segments.

Including EVR, the company’s sales in the year-ago quarter were around $2.96 billion.

The gross profit was CAD$536 million ($372 million), skyrocketing 217% from the year-ago quarter. The gross margin was 23.4% compared with the year-ago quarter’s 10.4%.

The adjusted EBITDA was CAD$927 million ($644 million), which soared 127% from the year-earlier period. The EBITDA margin was 40.5% in the quarter under review compared with the year-ago quarter’s 25.3%.

The Copper segment’s net sales improved 40% year over year to CAD1.51 billion ($1.05 billion), attributed to higher production and copper prices.

Total copper production was 106,100 tons, 7% higher than the first quarter of 2024. Copper in concentrate production from QB was 42,300 tons in the quarter, impacted by an extended shutdown in January, a national power outage in Chile and challenging weather, which reduced material movement needed to complete planned tailings lifts, ultimately reducing asset utilization. Copper sales in the quarter were 106,200 tons, up 11% year over year.

The segment’s gross profit skyrocketed 224% year over year to CAD$343 million ($238 million), attributed to higher copper prices and sales volume, and higher by-product and co-product revenues from molybdenum and zinc. These gains were partly offset by increased depreciation of QB assets and higher depreciation of capitalized stripping at Highland Valley Copper.

The Zinc segment’s net sales jumped 44% year over year to CAD$0.78 billion ($0.54 billion) on improved zinc prices and higher zinc concentrate sales volumes.

The segment’s gross profit marked a year-over-year surge of 206% to CAD$193 million ($134 million). This was attributed to increased zinc prices, lower zinc treatment charges and higher by-product revenues.

Teck Resources used CAD$515 million ($358 million) of cash in operating activities in the first quarter of 2025 against an inflow of CAD$42 million in the year-ago quarter.

The company had cash and cash equivalents of CAD$6.2 billion ($5.12 billion) at the end of the first quarter of 2025 compared with CAD$7.6 billion at the end of 2024.

So far this year, Teck Resources returned $505 million to shareholders through share buybacks. The company has completed $1.75 billion of its authorized share buyback program of $3.25 billion

The company’s copper production is anticipated to be 490,000-565,000 tons. The zinc production is projected between 525,000 tons and 575,000 tons. Refined zinc output is estimated between 190,000 tons and 230,000 tons.

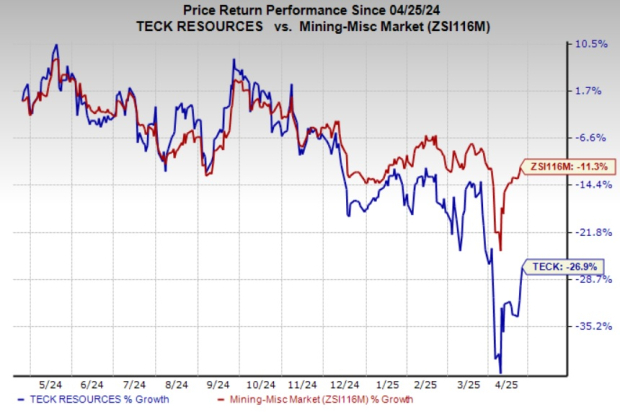

The company’s shares have lost 26.9% in the past year compared with the industry’s 11.3% decline.

Freeport-McMoRan Inc. FCX recorded earnings of 24 cents per share for first-quarter 2025, down around 25% from 32 cents in the year-ago quarter. EPS was in line with the Zacks Consensus Estimate.

Freeport-McMoRan’s revenues declined roughly 9.4% year over year to $5,728 million. The figure surpassed the consensus estimate of $5,307.6 million.

Copper production declined around 20% year over year to 868 million pounds in the reported quarter. Sales declined around 21.2% year over year to 872 million pounds of copper. The company sold 128,000 ounces of gold, down around 77.5% year over year. FCX also sold 20 million pounds of molybdenum, stable year over year, in the reported quarter.

Southern Copper Corporation SCCO reported first-quarter EPS of $1.19, surpassing the Zacks Consensus Estimate of $1.13. The bottom line came in 25% higher than the year-ago quarter’s earnings of 95 cents per share.

Southern Copper’s net sales in the quarter were $3.122 billion, marking a 20.1% increase from the year-ago quarter. The improvement was attributed to higher sales volumes of copper (up 3.6%), molybdenum (9.9%), zinc (42.4%) and silver (14.1%) and an uptick in metal prices for all its products.

Southern Copper mined 240,226 tons of copper in the reported quarter, flat year over year. Copper sales improved 3.6% year over year to 243,601 tons.

Teck Resources currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A better-ranked stock from the basic materials space is Equinox Gold Corp. EQX, which sports a Zacks Rank of 1 at present.

Equinox Gold has an average trailing four-quarter earnings surprise of 1.07%. The Zacks Consensus Estimate for the company’s fiscal 2025 earnings is pegged at 82 cents per share, implying 310% year-over-year growth. Its shares have gained 29.6% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours |

Anglo American Writes Down De Beers Diamond Unit Value by Another $2.3 Billion

TECK

The Wall Street Journal

|

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite