|

|

|

|

|||||

|

|

Alamos Gold AGI is expected to report an improvement in its bottom line when it reports first-quarter 2025 results on April 30, 2025, after market close.

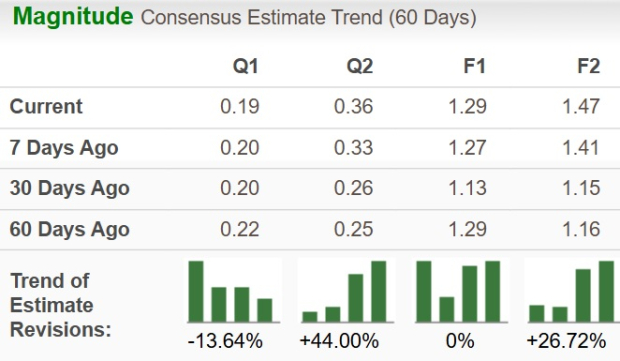

The Zacks Consensus Estimate for Alamos Gold’s earnings has moved down 13.6% over the past 60 days to 19 cents per share. The figure indicates 46% growth from the year-ago quarter.

In the trailing four quarters, Alamos Gold’s earnings matched the Zacks Consensus Estimate in one quarter, beat the mark in two quarters and missed in one quarter.

The company has an average earnings surprise of 7.93%. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Alamos Gold’s production grew 7% to 567,000 ounces in 2024, marking a record for the second consecutive year. This growth was attributed to strong performances across its operations and reflected the inclusion of the Magino mine after the acquisition of Argonaut Gold Inc.

For 2025, gold production is projected to range between 580,000 and 630,000 ounces, representing a 7% year-over-year increase at the midpoint. This will be aided by the ramp-up of production at Island Gold and a full year of operations at Magino.

Several optimization initiatives were implemented at the Magino mill, which required downtime during the second half of 2024. This included replacing the secondary crusher during the third quarter of 2024 and replacing the primary crusher in the fourth quarter. These improvements are expected to have supported higher throughput rates going forward.

Mill throughput is expected to reach approximately 11,200 tons per day by the end of the first quarter of 2025. Once this is achieved, the Island Gold mill will be shut down and ore from the mine will be trucked and processed through the larger and more cost-effective Magino mill. We expect the company to provide the details in the first-quarter 2025 results.

For the first quarter, AGI projected production to be between 125,000 and 140,000 ounces. In the year-ago quarter, the company had produced 135,700 ounces of gold and sold 132,849 ounces (at an average realized gold price of $2,069 per ounce).

We expect the company’s production and sales volumes in the first quarter of 2025 to be higher than first-quarter 2024 figures.

In the January-March 2025 period, gold prices averaged around $2,883.40 per ounce, marking a 39% increase from the prior-year quarter. Geopolitical tension, tensions over the escalating trade war and solid demand from central banks have boosted gold prices. Prices had crossed the $3,000 per ounce threshold during the quarter.

For the first quarter of 2025, the company expects total cash costs and all-in sustaining costs (AISC) costs to be higher compared with the year-ago quarter, and decline thereafter. Alamos Gold reported total cash costs of $910 per ounce, AISC of $1,265 per ounce and cost of sales of $1,307 per ounce.

Overall, Alamos Gold’s earnings in the first quarter are expected to have benefited from increased sales volumes and higher gold prices, partially offset by elevated costs.

Subsequent to the end of the first quarter, Alamos Gold announced that it had entered into a binding agreement to sell its non-core Quartz Mountain Gold Project located in Lake County, OR, to Q-Gold Resources Ltd. for total consideration of up to $21 million and a 9.9% equity interest in the latter.

The transaction, expected to close in the second quarter of 2025, is in sync with Alamos Gold’s strategy of monetizing non-core assets as it focuses on portfolio of high-return growth projects, including the Phase 3+ Expansion at Island Gold, Lynn Lake and PDA.

Our proven model does not conclusively predict an earnings beat for Alamos Gold this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat but that is not the case here.

Earnings ESP: The Earnings ESP for AGI is 0.00%. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Zacks Rank: Alamos Gold currently has a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

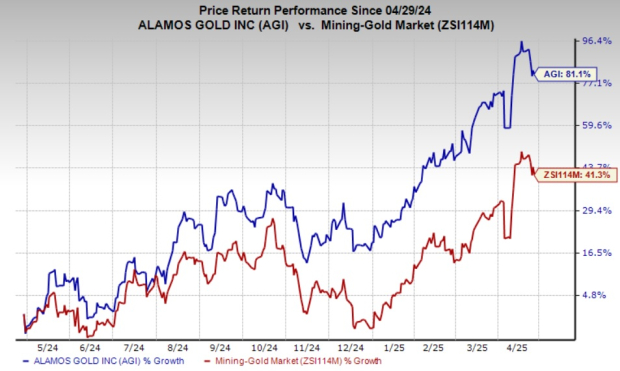

Shares of Alamos Gold have appreciated 81.1% in a year compared with the industry’s 41.3% growth.

Here are some basic material companies, which according to our model, have the right combination of elements to post an earnings beat this quarter:

CF Industries Holdings, Inc. CF, scheduled to release earnings on May 7, has an Earnings ESP of +3.67% and a Zacks Rank of 3.

The consensus estimate for CF Industries’ earnings for the first quarter of 2025 is pegged at $1.47 per share, indicating year-over-year growth of 42.7%. CF Industries has a trailing four-quarter average earnings surprise of 18.1%.

Kinross Gold Corporation KGC, scheduled to release first-quarter earnings on May 6, has an Earnings ESP of +11.07% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Kinross Gold's earnings for the first quarter of 2025 is pegged at 22 cents per share, indicating a surge of 120% from the year-ago quarter’s actual. Kinross Gold has a trailing four-quarter average earnings surprise of 23.7%.

Methanex Corporation MEOH, scheduled to release first-quarter earnings on April 30, has an Earnings ESP of +4.74%.

The Zacks Consensus Estimate for Methanex's earnings for the first quarter of 2025 is pegged at $1.25 per share, indicating a surge of 92.3% from the year-ago quarter’s reported figure. MEOH currently has a Zacks Rank of 3. Methanex has a trailing four-quarter average earnings surprise of 85.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 |

Trump's Tariffs Lift Gold Prices. These Mining Stocks Are Basing.

KGC +6.22%

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite