|

|

|

|

|||||

|

|

RTX Corp. RTX demonstrated robust financial performance in the first quarter of 2025, surpassing analyst expectations. The company reported adjusted earnings per share (EPS) of $1.47, which exceeded the Zacks Consensus Estimate by 9%. Revenues outpaced the consensus mark by 3%. The company also registered solid growth in its sales and earnings on a year-over-year basis. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

This growth was primarily driven by sustained demand for its defense products as well as commercial OEM and aftermarket sales. Segment-wise, all its business units registered positive growth, except Raytheon. RTX reiterated its full-year financial guidance and ended the first quarter with solid cash and cash equivalents worth $5.16 billion. This might encourage some investors to add this stock to their portfolio right away.

However, a prudent investor knows that a significant decision like buying a stock should not depend on a company’s single quarterly performance alone. Instead, to make a more informed decision, one should be mindful of the stock’s performance over the past year in terms of share price return, long-term prospects as well as risks (if any) to investing in the same. Below, we have provided a detailed discussion on this.

RTX’s shares have surged an impressive 22.2% in the past year, outperforming the Zacks Aerospace-Defense industry’s rise of 3.4% and the broader Zacks Aerospace sector’s growth of 7.8%. RTX has also outpaced the S&P 500’s return of 8.2% in the same period.

Other defense players, such as Rocket Lab USA RKLB and Leidos Holdings LDOS, have put up similar stellar performances. Shares of RKLB and LDOS have surged 488.9% and 10.7%, respectively, over the past year.

Steadily improving commercial air traffic has been boosting commercial OEM as well as commercial aftermarket sales for RTX in recent times. This must have encouraged stakeholders to stay invested in this stock, further corroborated by the solid share price return offered over the past year.

Keeping up with this trend, RTX’s Collins Aerospace unit registered an 8% year-over-year improvement in its first-quarter 2025 top-line figures, partially driven by a 13% increase in commercial aftermarket sales.

On the other hand, a 3% rise in commercial OEM and a 28% improvement in commercial aftermarket sales resulted in a 14% rise in adjusted sales for RTX’s Pratt & Whitney unit. Continued growth in commercial air traffic, including higher flight hours and a favorable OEM mix in large commercial engines, primarily boosted the improvement in commercial aftermarket and OEM sales.

Looking ahead, growth prospects for the commercial aerospace market and, in turn, RTX’s commercial business remain bright. As per the International Air Transport Association’s (“IATA”) latest report published in December 2024, the number of global passengers is projected to increase at an average annual rate of 3.8% over the next two decades, leading to a net addition of over 4.1 billion passenger journeys by 2043 compared to 2023. This should boost the demand for new aircraft, strengthening commercial OEM as well as commercial aerospace aftermarket sales for RTX in the coming days.

Moreover, as geopolitical tensions and hostilities prevail across various parts of the world, growth opportunities for RTX from its military business remain immense, with the company being a prominent U.S. defense contractor. This can be further gauged from the solid backlog of $92 billion that its defense business unit generated as of March 31, 2025.

In line with this, the Zacks Consensus Estimate for RTX’s long-term earnings growth rate is pegged at a solid 9.3%.

A quick sneak peek at its near-term earnings and sales estimates mirrors a similar picture.

The Zacks Consensus Estimate for second-quarter and full-year 2025 revenues suggests a solid improvement of 5.3% and 4.1%, respectively, from the prior-year levels. The earnings estimate figures also indicate a similar picture.

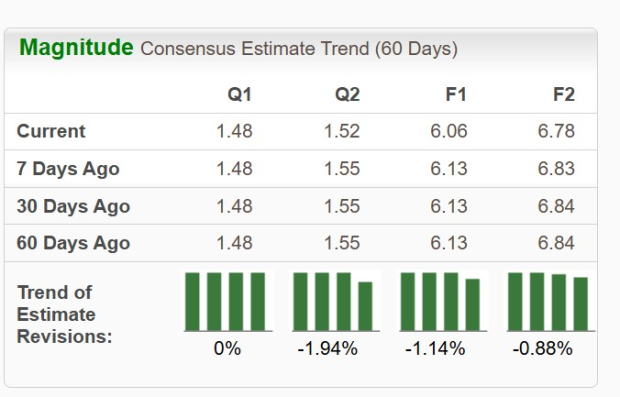

However, the downward revision witnessed in the company’s 2025 and 2026 earnings estimates over the past 60 days indicates declining investors’ confidence in the stock.

Despite the aforementioned growth opportunities, there are certain risks to investing in RTX. One notable headwind plaguing stocks like RTX that operate in commercial aerospace is the supply-chain issue.

Notably, the global supply-chain disruption that was exacerbated during the COVID period remains a major challenge affecting global trade and, thereby, the aerospace sector. In its December 2024 report, IATA announced that it expects severe supply-chain issues to continue to affect the aviation industry into 2025. This, in turn, might cause RTX to default on its delivery of finished products within the stipulated time. Since its Pratt & Whitney is a major supplier of commercial jet engines, the failure can adversely impact its revenue generation prospects.

In terms of valuation, RTX’s forward 12-month price-to-earnings (P/E) is 19.91X, a premium to its industry average of 18.35X. This suggests that investors will be paying a lower price than the company's expected earnings growth compared to that of its industry. The stock’s forward 12-month P/E is also stretched when compared to its five-year median.

Its industry peer, LDOS, however, is trading at a discount with its forward 12-month P/E being 13.5X. RKLB, on the other hand, is trading at a negative forward 12-month P/E.

Investors interested in defense stocks should refrain from adding RTX to their portfolio, considering its premium valuation and downward revision in its near-term earnings estimate. However, those who already own this Zacks Rank #3 (Hold) stock may continue to do so, considering its solid performance at the bourses and long-term growth opportunities. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 12 hours | |

| 19 hours | |

| 20 hours | |

| 22 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite