|

|

|

|

|||||

|

|

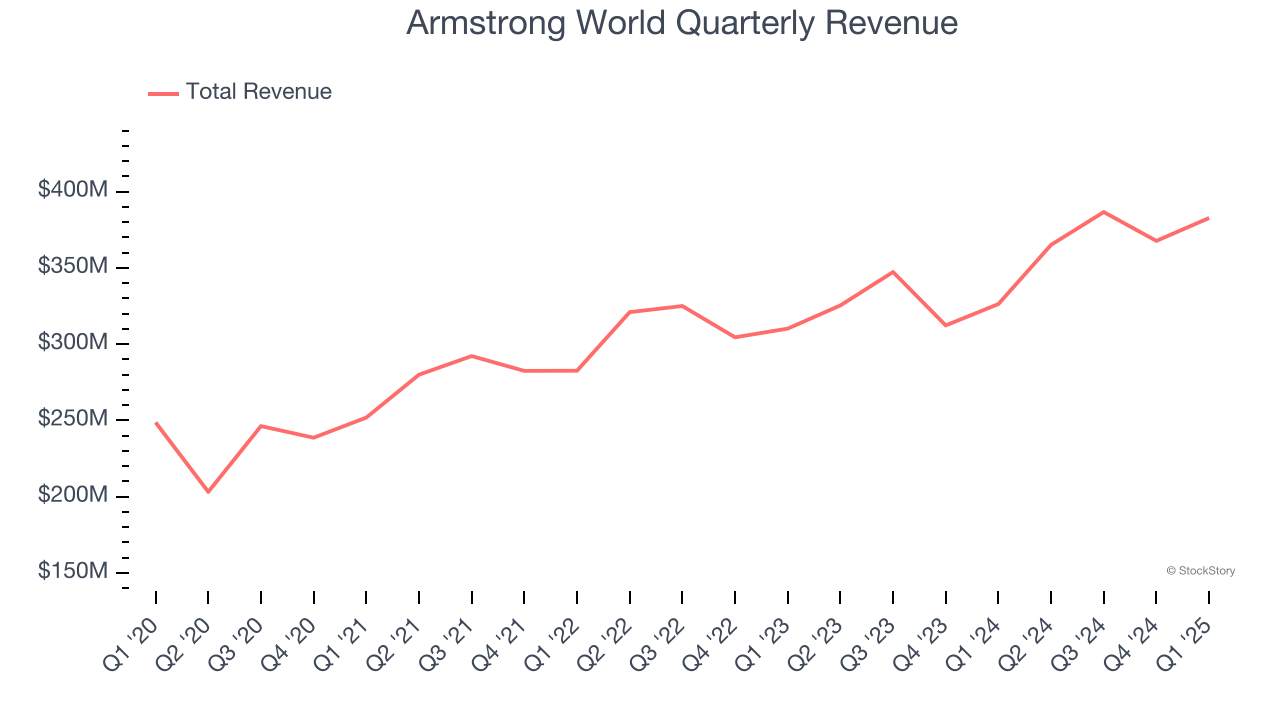

Ceiling and wall solutions company Armstrong World Industries (NYSE:AWI) announced better-than-expected revenue in Q1 CY2025, with sales up 17.3% year on year to $382.7 million. The company expects the full year’s revenue to be around $1.59 billion, close to analysts’ estimates. Its non-GAAP profit of $1.66 per share was 8.7% above analysts’ consensus estimates.

Is now the time to buy Armstrong World? Find out by accessing our full research report, it’s free.

"We delivered a solid start to 2025 with double-digit net sales and earnings growth featuring strong Mineral Fiber AUV performance, manufacturing productivity and the benefits of both organic Architectural Specialties growth and sizable contributions from our 2024 acquisitions," said AWI President and CEO, Vic Grizzle.

Started as a two-man shop dating back to the 1860s, Armstrong (NYSE:AWI) provides ceiling and wall products to commercial and residential spaces.

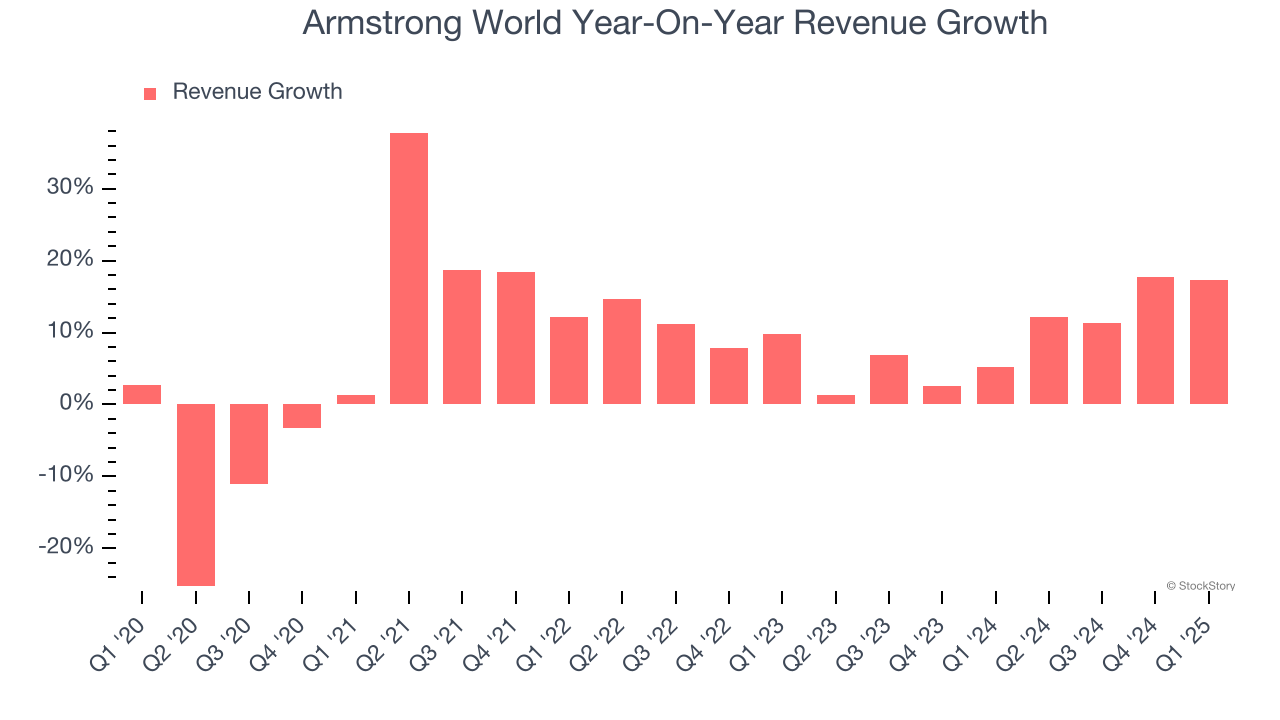

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Armstrong World grew its sales at a decent 7.5% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Armstrong World’s annualized revenue growth of 9.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Armstrong World recent performance stands out, especially when considering many similar Building Materials businesses faced declining sales because of cyclical headwinds.

This quarter, Armstrong World reported year-on-year revenue growth of 17.3%, and its $382.7 million of revenue exceeded Wall Street’s estimates by 3.4%.

Looking ahead, sell-side analysts expect revenue to grow 7.1% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

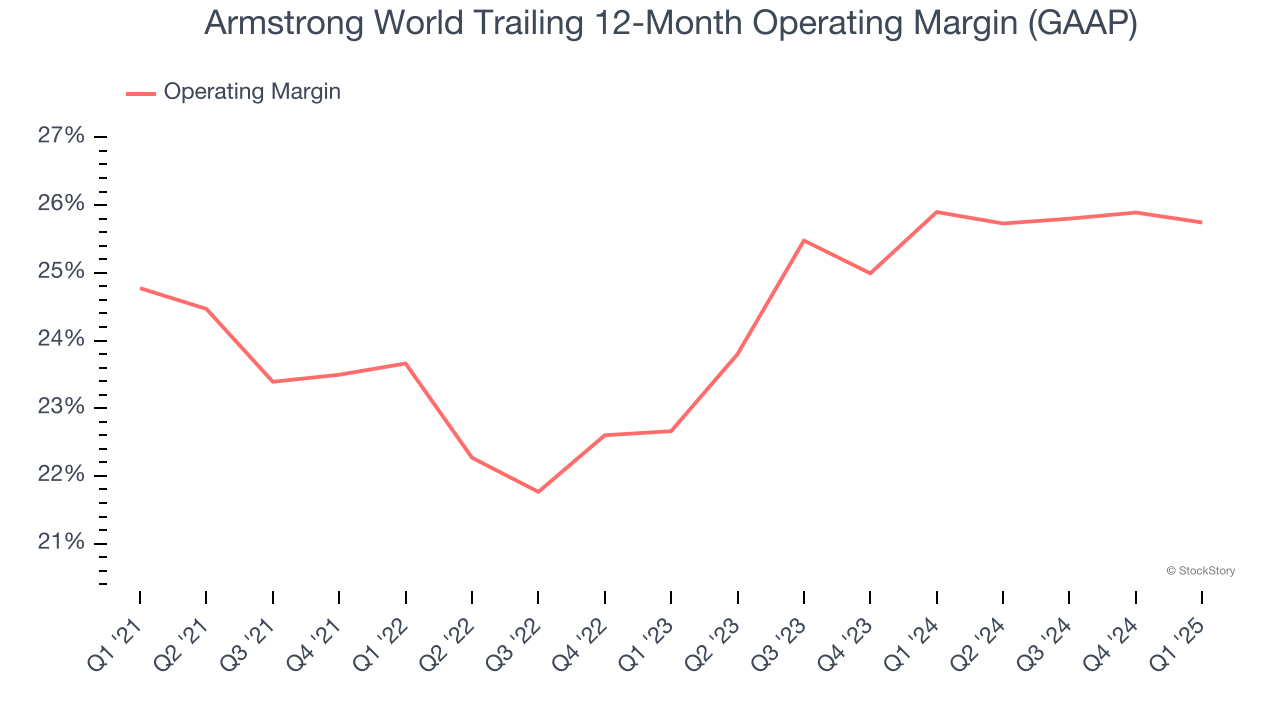

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Armstrong World has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 24.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Armstrong World’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Armstrong World generated an operating profit margin of 25.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

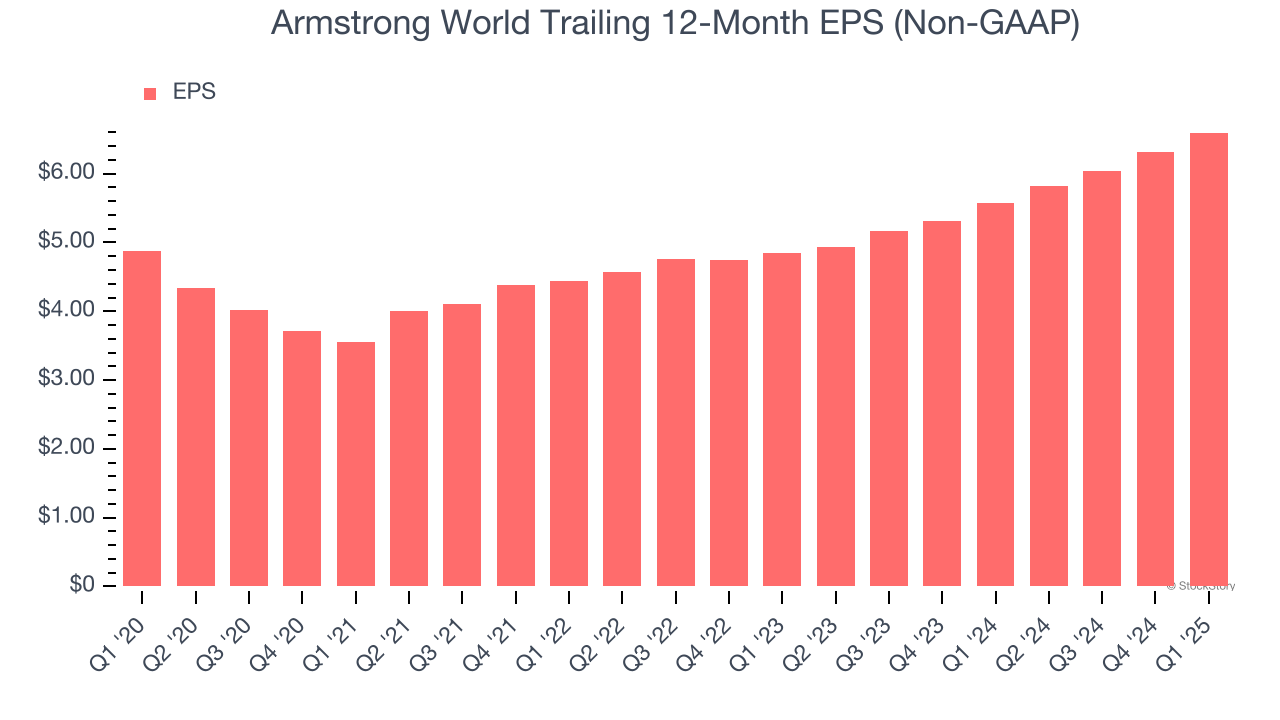

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Armstrong World’s EPS grew at an unimpressive 6.2% compounded annual growth rate over the last five years, lower than its 7.5% annualized revenue growth. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Armstrong World, its two-year annual EPS growth of 16.6% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q1, Armstrong World reported EPS at $1.66, up from $1.38 in the same quarter last year. This print beat analysts’ estimates by 8.7%. Over the next 12 months, Wall Street expects Armstrong World’s full-year EPS of $6.60 to grow 8.7%.

We enjoyed seeing Armstrong World beat analysts’ revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance slightly missed. Overall, this quarter had some key positives. The stock remained flat at $139 immediately after reporting.

Sure, Armstrong World had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-08 | |

| Feb-05 | |

| Feb-05 | |

| Jan-27 | |

| Jan-14 | |

| Jan-12 | |

| Jan-08 | |

| Dec-17 | |

| Dec-09 | |

| Dec-09 | |

| Dec-08 | |

| Dec-01 | |

| Dec-01 | |

| Nov-27 | |

| Nov-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite