|

|

|

|

|||||

|

|

San Francisco-basedUber Technologies (UBER) is the dominant ride-sharing company in North America and internationally. Uber has expanded its business into Canada, Latin America, Europe, the Middle East, and Asia (ex-China). Through its mobile application and vast network of drivers, Uber offers various services to customers based on details like the number of riders, vehicle style, and pets. In addition, Uber has diversified into the delivery business. The company faces some bad news and goods news ahead of reporting earnings on May 7:

Last week, the U.S. Federal Trade Commission (FTC) sued Uber, alleging deceptive billing practices for the company’s “Uber One” subscription. The FTC lawsuit claims that customers were promised savings when they signed up but were not granted it. In addition, Trump’s FTC alleges that the company makes it too difficult for customers to cancel subscriptions.

Though the news was undoubtedly bearish, I am reminded of legendary billionaire Stanley Druckenmiller’s “price action versus news” mentality. Druckenmiller teaches us that how a stock reacts to a headline supersedes the headline itself. In Uber’s case, the stock pared losses on the day of the FTC news, held the 200-day moving average, and only fell about 3% - exhibiting resilience.

Last week’s FTC news was quickly negated by a new partnership announcement with German car manufacturer Volkswagen (VWAGY). Next year, Volkswagen will begin testing autonomous robotaxi vans in Los Angeles, leveraging the UBER app to onboard customers and manage the fleet. Having managed a ride-hailing service for years in Hamburg, Germany, the automaker can work with Uber to leverage its experience.

With more than 250,000 paid weekly rides, Alphabet’s (GOOGL) Waymo is by far the current undisputed leader in the autonomous ride-hailing market. In the past, UBER partnered with Waymo to allow customers to book through the Uber app, maintaining the familiar Uber experience. Recently, the two companies announced an expanded partnership where ride-hailing customers will be able to book rides in Austin and Atlanta. In reaction to the news, the UBER CEO said, “We’re thrilled to build on our successful partnership with Waymo, which has already powered fully autonomous trips for tens of thousands of riders in Phoenix.”

Last week, a deep-pocketed options player bought over $70,000 worth of far out-of-the-money July $110 UBER call options. The bet is aggressive because the stock is trading ~$78. My guess is that the buyer of these calls is betting on an even more expanded partnership with Alphabet’s Waymo or potentially a buyout. While speculation on my part, a buyout would make sense for Google. Google is flush with cash, and buying Uber would allow the company to vertically integrate, cut costs, and gain access to millions of international ride-share customers.

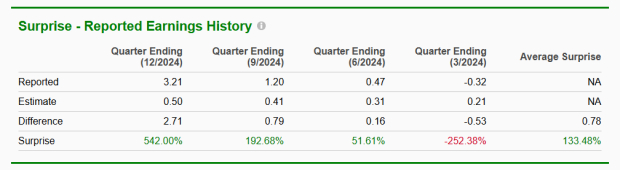

Wall Street is a game of expectations, and lately, UBER has crushed expectations. Over the past four quarters, Uber has beat Zacks Consensus Analyst Estimates by an average of 133.48%. Last quarter, the ride-hailing giant clobbered estimates by 542%!

Uber shares hold up exceptionally well compared to the general market and its main competitor, Lyft (LYFT). Over the past two years, UBER shares have been up 138% while LYFT shares are only up 17%. In addition, UBER is up a robust 29% year-to-date while the S&P 500 Index is still stuck in the red – an obvious sign of relative price strength. Typically, resilient stocks during bear phases tend to lead when themarket regains its footing.

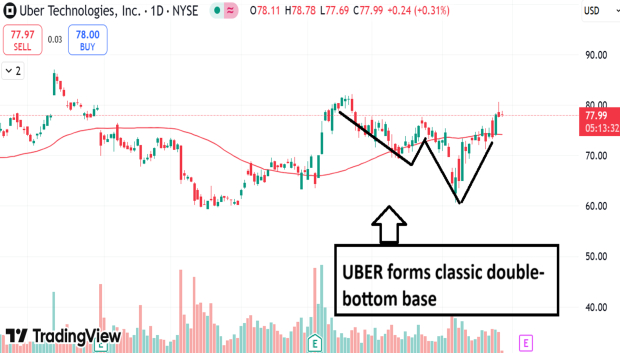

Technical analysts can gain an edge by observing multiple time frames. In the case of Uber, the monthly and daily charts are each signaling higher prices. From a daily perspective, the stock is carving out a picture-perfect double-bottom base structure. Remember, sound double-bottom bases tend to undercut the left trough, shaking out “weak hands.”

The UBER monthly chart shows a bullish long-term change. Old UBER price resistance (supply) has morphed into support (demand). The current UBER breakout and subsequent consolidation on the long-term chart suggest much higher prices.

In 2023, UBER finally scaled to the point where it is a consistently profitable business. With improved cash flows, UBER management has wasted no time rewarding shareholders.

Last year, the company announced a massive $7 billion buyback program – the first in company history. The sizable buyback is bullish for UBER because it decreases the supply of shares outstanding, improving the stock’s supply and demand dynamics.

The COVID-19 pandemic led to an explosion in Uber’s food delivery business, Uber Eats. While the coronavirus is no longer a concern, the habit of placing online orders has become “sticky” with customers. Uber Eats has grown to more than 10,000 international cities, and the company has forged a plethora of partnerships with companies like Costco (COST), Domino’s (DPZ), and MapleBear (CART.)

Bottom Line

Strategic partnerships, relative price action, share buybacks, food delivery growth, and improving profitability and cash flow are all reasons to own Uber into earnings on May 7.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 51 min | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 5 hours | |

| 7 hours | |

| 8 hours | |

| 11 hours | |

| 14 hours | |

| 14 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Retail customers file lawsuits over tariffs against FedEx and Ray-Bans maker

COST

Associated Press Finance

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite