|

|

|

|

|||||

|

|

AstraZeneca’s AZN first-quarter 2025 core earnings of $1.24 per American depositary share (ADS) beat the Zacks Consensus Estimate of $1.10. Core earnings of $2.49 per share rose 21% year over year on a reported basis as well as at constant exchange rates (CER).

Total revenues of $13.59 billion rose 7% on a reported basis and 10% at CER, driven by higher product sales and alliance revenues from partnered medicines. However, the metric missed the Zacks Consensus Estimate of $13.68 billion. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar)

All growth rates mentioned below are on a year-over-year basis and at CER.

Product sales rose 9% to $12.88 billion, driven by strong underlying demand trends for its marketed products.

Among AstraZeneca’s various therapeutic areas, Oncology product sales were up 13%, while Cardiovascular, Renal and Metabolism (“CVRM”) product sales rose 12%. The Respiratory & Immunology (R&I) segment’s sales rose 11%. While Rare disease product sales remained flat, sales of Vaccines & Immune (V&I) Therapies declined 30%. Sales of other medicines were down 5%.

Collaboration revenues totaled $74 million, up 64%, all attributed to the triggering of a sales milestone for Farxiga from AZN’s partner in Japan. Alliance revenues rose 42% to $639 million, driven by continued revenue growth from partnered medicines.

Alliance revenues included $398 million from Daiichi Sankyo for Enhertu and $130 million of AstraZeneca’s share of gross profits in the United States from partner Amgen AMGN for Tezspire.

Alliance revenues also included $82 million for Beyfortus. AZN records a 50% share of gross profits from this drug’s sales in major ex-U.S. markets and 25% of brand revenues from the rest of the world markets via partner Sanofi SNY. The company also records Beyfortus product sales from products supplied to partner Sanofi under the V&I Therapies segment.

In Oncology, Tagrisso recorded sales of $1.68 billion, up 8%, on strong demand across all approved indications. Tagrisso sales beat the Zacks Consensus Estimate and our model estimate of $1.67 billion and $1.62 billion, respectively.

Product revenues from Lynparza rose 5% to $726 million, driven by increased market share/demand growth for all approved indications. Lynparza sales also benefited from launches in breast and prostate cancers across Europe. The drug’s sales missed the Zacks Consensus Estimate of $781 million and our estimate of $758 million, likely due to the soft sales performance of the drug across Emerging markets and U.S. headwinds from Medicare Part D redesign.

AstraZeneca markets Lynparza in partnership with Merck MRK. During the quarter, the company did not record any milestone payment from partner Merck related to the drug.

Imfinzi generated sales of $1.26 billion in the quarter, up 16%, driven by demand growth across all approved indications, partially offset by mandatory price reductions in Japan. Its sales missed the Zacks Consensus Estimate of $1.35 billion and our estimates of $1.29 billion.

Sales of Calquence rose 8% to $762 million in the quarter, benefiting from continued new patient share gains in frontline chronic lymphocytic leukemia (CLL) setting across the United States and Europe. Though this metric beat the Zacks Consensus Estimate of $759 million, it missed our model estimate of $793 million.

The new breast cancer drug Truqap, approved in November 2023, recorded $132 million in revenues in the first quarter of 2025 compared with $163 million in the previous quarter. This sequential decline was attributed to the negative impact of the Medicare Part D redesign and fourth-quarter inventory destocking.

In CVRM, Farxiga recorded product sales of $2.06 billion, up 16%, indicating accelerated volume growth. The label expansion approvals for heart failure and chronic kidney disease indications contributed to Farxiga’s sales growth in many ex-U.S. markets. In Emerging markets, Farxiga is witnessing solid growth despite generic competition in some. However, generic competition in the United States hurt sales. Farxiga sales beat the Zacks Consensus Estimate of $1.90 billion and our model estimate of $1.87 billion.

Brilinta/Brilique sales totaled $305 million in the reported quarter, down 4%.

New drug Wainua added $39 million in product sales during the quarter compared with $42 million in fourth-quarter 2024.

In R&I, Symbicort sales declined 3% to $723 million due to generic erosion in the United States and Europe. The drug’s sales missed the Zacks Consensus Estimate and our model estimate of $772 million and $767 million, respectively. Pulmicort sales declined 26% to $158 million.

Fasenra recorded sales of $418 million in the quarter, up 19% year over year, driven by strong demand growth and market share gains. The drug’s sales beat the Zacks Consensus Estimate and our model estimate of $380 million and $377 million, respectively.

Tezspire recorded total revenues of $217 million compared with $213 million in the previous quarter. Amgen records product sales in the United States and AstraZeneca records its share of U.S. gross profits as Alliance revenues. AstraZeneca books product sales in markets outside the United States.

In the Rare Disease portfolio, Soliris sales fell 38% to $444 million due to conversion to Ultomiris. The drug’s sales missed the Zacks Consensus Estimate and our model estimate of $549 million and $536 million, respectively.

Ultomiris revenues amounted to $1.05 billion, up 25%, driven by patient demand, growth in neurology indications, geographic expansions in new markets and continued conversion from Soliris.

In Other Medicines, sales of Nexium remained flat at $233 million.

In V&I Therapies, AstraZeneca recorded $112 million in revenues from Beyfortus, which included alliance revenues mentioned earlier as well as sales of manufactured Beyfortus product to Sanofi.

Core selling, general and administrative expenses increased 4% at CER to $3.46 billion due to market development for recent launches and brand support.

Core research and development expenses rose 16% to $3.09 billion due to increasing investment in the pipeline.

The core operating margin was 35% in the quarter, which remained flat year over year at CER.

AstraZeneca maintained its financial guidance for 2025. It expects total revenues to grow by a high single-digit percentage at CER.

Core EPS is expected to increase by a low double-digit percentage.

AstraZeneca also provided updates on two different cancer drugs in separate press releases.

In the first press release, the company announced its decision to discontinue the late-stage CAPItello-280 study evaluating the combination of Truqap, docetaxel and androgen-deprivation therapy (ADT) in patients with metastatic castration-resistant prostate cancer (mCRPC). This decision was taken in consultation with an independent data monitoring committee, which concluded that the Truqap combination was unlikely to meet the study’s primary endpoints.

In the second one, AZN announced that the EMA’s Committee for Medicinal Products for Human Use has recommended approving its regulatory filing seeking label expansion for a combination regimen involving Calquence in the CLL indication. This filing seeks approval for a fixed-duration regimen of Calquence in combination with Venclexta, with or without obinutuzumab, to treat adult patients with previously untreated CLL.

AstraZeneca reported mixed first-quarter results, as its earnings beat estimates but revenues missed the same. The revenue miss was largely due to soft sales performance in key oncology and rare disease drugs, including Lynparza, Imfinzi and Soliris.

Shares of AstraZeneca fell about 2% in pre-market trading today, likely reflecting investor concerns around these sales headwinds despite the strong EPS performance.

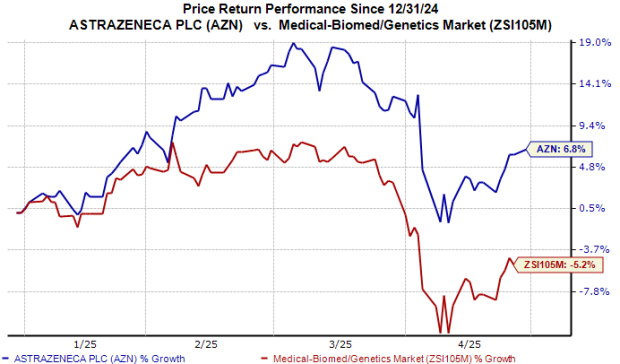

Year to date, the stock has risen 7% against the industry’s 5% decline.

AZN reaffirmed its 2025 guidance and emphasized its commitment to expanding in the U.S. market despite potential headwinds from proposed pharmaceutical tariffs.

Alongside the earnings results, AstraZeneca also mentioned that it expects to face a fine of up to $8 million in China over the suspected unpaid import taxes of $1.6 million for Enhertu, if found liable. The company had previously disclosed, during its fourth-quarter and full-year 2024 release, that it might be charged a similar fine of up to $4.5 million related to cancer drugs Imfinzi and Imjudo. AZN was also informed by Chinese authorities that they did not find any ‘illegal gain to the Company resulting from personal information infringement’ under a separate allegation.

Looking ahead, AstraZeneca remains confident in its long-term growth prospects. The company plans to launch 20 new medicines by 2030, with eight already approved. It believes that many of these new medicines will have the potential to generate more than $5 billion in peak-year revenues. It continues to target $80 billion in total annual revenues by the end of the decade.

AstraZeneca PLC price | AstraZeneca PLC Quote

Currently, AstraZeneca has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours |

These Stocks Lead Dow Jones In February. Hint: It's Not AI Companies.

MRK AMGN

Investor's Business Daily

|

| 7 hours | |

| 7 hours | |

| 9 hours | |

| 13 hours | |

| 13 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 14 hours | |

| 14 hours | |

| 15 hours | |

| 21 hours |

Novavax Stock Hits Over 1-Year High: Is Sanofis Flu-COVID Shot The Post-Pandemic Growth Driver?

SNY

New feeds test provider finance

|

| 22 hours | |

| 23 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite