|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

J&J’s JNJ stock has declined 6.4% in the past three months. J&J faces several challenges, including slowing sales in the MedTech segment, loss of exclusivity of its blockbuster drug, Stelara, and uncertainty around the talc lawsuits, among others.

In addition to that, broader market uncertainties and a volatile macroeconomic environment continue to hurt the stock.

The sky-high tariffs imposed by the United States and retaliatory tariffs by China and some other countries have been affecting global stock markets. Though the massive tariffs imposed by the United States and China are now on a pause, it is only a temporary suspension, and no one knows what will happen after the 90-day tariff suspension ends. The uncertainty around tariffs and trade production measures remains, slowing down economic growth.

However, J&J also has some unique strengths. Let’s understand the company’s strengths and weaknesses to better analyze how to play J&J stock amid the recent price decline.

Johnson & Johnson’s biggest strength lies in its diversified business model. It operates through pharmaceuticals and medical devices divisions. It has more than 275 subsidiaries, indicating that the business is extremely well-diversified. This diversification helps it withstand economic cycles more effectively. J&J has 26 platforms with annual sales exceeding $1 billion. Meanwhile, it has one of the largest R&D budgets among pharma companies.

J&J separated its Consumer Health business into a newly listed company called Kenvue KVUE in 2023. The separation of Kenvue has allowed J&J to focus on its core pharmaceutical and medical device business.

J&J’s Innovative Medicine unit is showing a growth trend. The segment’s sales rose 4.4% in the first quarter of 2025 on an organic basis despite the loss of exclusivity (LOE) for its multi-billion-dollar product, Stelara, and the negative impact of the Part D redesign. In 2025, J&J expects growth in the Innovative Medicine segment in the face of Stelara biosimilar entrants to be driven by its key products such as Darzalex, Tremfya, Spravato and Erleada as well as new drugs like Carvykti, Tecvayli and Talvey, and new indications for Tremfya and Rybrevant.

J&J expects to generate more than $57 billion in sales in the Innovative Medicines segment in 2025. It expects the Innovative Medicine business to grow 5-7% from 2025 to 2030.

Moreover, J&J believes 10 of its new Innovative Medicine products, including new cancer drugs like Talvey and Tecvayli, and pipeline candidates, like nipocalimab and icotrokinra (JNJ-2113), have the potential to deliver peak non-risk-adjusted operational sales of $5 billion. Nipocalimab was approved by the name of Imaavy last month for treating generalized myasthenia gravis. Nipocalimab is in mid- and late-stage development for several rare autoantibody-driven diseases. J&J believes nipocalimab has the potential to create a pipeline in a product.

J&J lost U.S. patent exclusivity of Stelara in 2025. The drug generated sales of $10.36 billion in 2024. The launch of generics is expected to significantly erode the drug’s sales and hurt J&J’s sales and profits in 2025. Stelara sales declined 33.7% in the first quarter of 2025.

A biosimilar version of Stelara was launched in certain European markets for some indications in July 2024. Several biosimilar versions of Stelara are expected to be launched in the United States in 2025. Amgen AMGN launched the first Stelara biosimilar, Wezlana, in January 2025, while Teva Pharmaceutical Industries TEVA launched Selarsdi in February 2025.

Both Amgen and Teva had entered into settlement agreements with J&J for their respective biosimilar launches. Stelara biosimilar competition is expected to accelerate throughout 2025 as the number of biosimilar entrants increases.

In addition, sales in 2025 are likely to be hurt by the impact of the Medicare Part D redesign, mainly sales of drugs like Stelara, Tremfya, Erleada and pulmonary arterial hypertension (PAH) drugs.

Sales in J&J’s MedTech business are facing continued headwinds in the Asia Pacific, specifically in China. Sales in China are being hurt by the impact of the volume-based procurement (VBP) program and the anticorruption campaign. VBP is a government-driven cost-containment effort in China.

J&J does not expect any improvement in its business in the Asia Pacific region, specifically in China, in 2025. Competitive pressure is also hurting sales growth in some MedTech businesses, such as PFA ablation catheters in U.S. electrophysiology. It expects continued impacts from VBP issues in China in 2025 as VBP expands across provinces and products.

J&J faces more than 62,000 lawsuits for its talc-based products, primarily baby powders. The lawsuits allege that its talc products contain asbestos, which caused many women to develop ovarian cancer. J&J insists that its talc-based products are safe and do not cause cancer. The company permanently discontinued the sales of its talc-based Johnson’s Baby Powder.

In April, a bankruptcy court in Texas rejected J&J’s proposed bankruptcy plan to settle its talc lawsuits after a two-week trial in Houston. J&J will go back to the traditional tort system to fight the lawsuits individually with its bankruptcy strategy to settle the lawsuits failing for the third time.

J&J’s shares have outperformed the industry year to date. The stock has risen 6.8% in the year-to-date period against a 2.7% decline of the industry. The stock has also outperformed the sector and S&P 500 Index, as seen in the chart below.

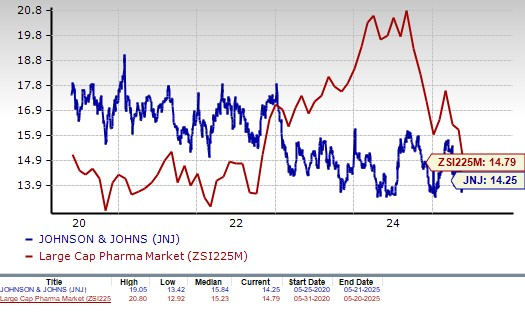

From a valuation standpoint, J&J is reasonably priced. Going by the price/earnings ratio, the company’s shares currently trade at 14.25 forward earnings, slightly lower than 14.79 for the industry. The stock is also trading below its five-year mean of 15.84.

The Zacks Consensus Estimate for 2025 earnings has risen from $10.58 per share to $10.60 over the past 60 days, while that for 2026 has declined from $11.07 to $10.98 over the same timeframe.

J&J considers 2025 to be a “catalyst year,” positioning the company for growth in the second half of the decade. J&J expects operational sales growth in both the Innovative Medicine and MedTech segments to be higher in the second half than in the first. While newly launched products should drive growth in the Innovative Medicines segment in the second half, the MedTech segment may benefit from new products and easier comps. J&J expects growth to accelerate from 2026 onward.

The company has an interesting R&D pipeline that can generate innovative products and further drive its growth. J&J has been on an acquisition spree lately, with the latest acquisition of Intra-Cellular Therapies strengthening its presence in the neurological and psychiatric drug market.

Last month, J&J's board authorized a 4.8% increase in its quarterly dividend, marking the company’s 63rd consecutive year of dividend increase.

While J&J’s Innovative Medicines segment is showing a growth trend, the MedTech unit’s slowdown is a concern. The Stelara patent cliff and the potential impact of Part D redesign will be significant headwinds in 2025. It remains to be seen how the company navigates them in 2025. The legal battle surrounding its talc lawsuits has created a bearish sentiment around the stock.

Those who already own this Zacks Rank #3 (Hold) company’s shares may stay invested for some time to see how the company achieves growth in 2025 amid the various challenges. However, investors looking for high-growth companies should refrain from investing in J&J’s stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite