|

|

|

|

|||||

|

|

New: Instantly spot drawdowns, dips, insider moves, and breakout themes across Maps and Screener.

Uber Technologies UBER and Lyft LYFT are two well-known names in the ride-hailing space. The companies have played a big part in revolutionizing the transportation industry with their innovative business models centered around ride-sharing.

Uber, based in San Francisco, is highly active on the diversification front, operating globally. Even though Uber’s primary business is ride-sharing, it has diversified into food delivery and freight over time. The goal seems to be to expand rapidly on a number of fronts. Lyft, also headquartered in San Francisco, has a more focused strategy, operating primarily in the United States and concentrating mainly on ride-sharing.

Given the two ride-hailing companies' different approaches, let’s examine them closely to find out which one currently holds an edge and, more importantly, might be the smarter investment now.

Uber is the dominant player in the North American ride-sharing business. Beyond the United States, Uber has expanded its business into multiple areas across the globe, including Canada, Latin America, Europe, the Middle East and Asia (excluding China).

Diversification is imperative for big companies to reduce risks, and Uber has excelled in this area. The company has engaged in numerous acquisitions, geographic and product diversifications, and innovations. Uber’s endeavors to expand into international markets are commendable and provide it with the benefits of geographical diversification. Prudent investments enable Uber to extend services and solidify its comprehensive offerings. As already stated, Uber has diversified its business into the areas of food delivery services (Uber Eats) and freight.

Uber’s ridesharing and delivery platforms are growing in popularity. This is generating strong demand, which, along with the latest growth initiatives and continued cost discipline, is driving the company’s results. We expect gross bookings from the Mobility segment in the March-end quarter to grow 15.6% on a year-over-year basis. We expect gross bookings from the Delivery segment in the March quarter to grow 15.1% on a year-over-year basis. Total trips are expected to increase 19.4% year over year in the March-end quarter, per our model.

Another area of confidence is Uber’s buyback strategy. In 2024, Uber generated a record $6.9 billion in free cash flow, with an adjusted EBITDA of $6.5 billion. Uber’s announcement to start an accelerated $1.5 billion stock buyback program highlights not only its shareholder-friendly strategy but also signals confidence in its ongoing business strategy. The $1.5 billion plan is part of the company's $7 billion buyback program announced last year.

Uber aims to gain a stronghold in the highly promising robotaxi market through strategic partnerships. To this end, the company has partnerships with many companies. By adopting this approach, Uber has avoided the massive R&D costs associated with developing autonomous systems independently.

Lyft, too, has ambitions to be a key player the lucrative and emerging autonomous vehicle (AV) market. To this end, Lyft has partnerships with players including startup May Mobility, automated driving company Mobileye Global MBLY and Nexar.

The deal with May Mobility aims to launch AVs on the Lyft app later this year, starting in Atlanta. The data-sharing agreement with Nexar is designed to give operators better insights into how to train autonomous driving systems. The deal with Mobileye aims to facilitate the widespread commercialization of AV services by industry-leading fleet operators.

Previously, Lyft partnered with Motional to launch a driverless ride-hailing service in Los Angeles. However, the partnership ended. Lyft’s recent deals pertaining to AV highlight that it does not aim to be left behind, as rival Uber has signed many AV-related deals.

Lyft’s Price Lock feature is also doing well. With the return-to-office mode gaining steam, there is a surge in weekday demand for ride-hailing services. To compete more effectively with rivals in the ride-hailing arena, Lyft has introduced a Price Lock feature. This feature allows users to bypass surge pricing during peak commuting hours. Lyft riders can limit the cost of rides by paying just $2.99 per month.

By locking in a commute price, they can also save money through the feature. If the price of the ride is lower than a rider’s locked-in price, the person pays the lower rate. Management stated that the Price Lock feature was performing better than expected. Management also noted that riders availing Price Lock take four more rides per month on average than they did prior to buying the pass. Apart from commuters, this feature is helping drivers by creating more predictability on when and where to drive.

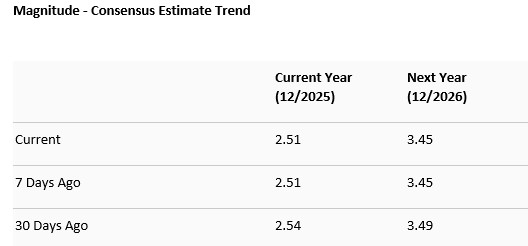

The Zacks Consensus Estimate for Uber’s 2025 and 2026 sales implies a year-over-year increase of 14.6% and 15.3%, respectively. The consensus mark for Uber’s 2025 EPS projects a 45% year-over-year drop. The consensus estimate for 2026 indicates a 37.8% year-over-year increase. Moreover, EPS estimates for 2025 and 2026 have been trending southward over the past 30 days.

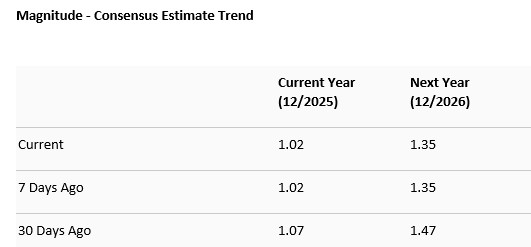

The Zacks Consensus Estimate for Lyft’s 2025 and 2026 sales implies a year-over-year increase of 12.6% and 12.2%, respectively. The consensus mark for Lyft’s 2025 and 2026 EPS indicates a 7.4% and 32.1% year-over-year increase, respectively. However, EPS estimates for 2025 and 2026 have been trending southward over the past 30 days, like Uber.

Uber has navigated the recent tariff-induced stock market volatility well, registering a 29.9% year-to-date gain, while the Zacks Internet-Services industry is down in double digits. Lyft, too, has suffered a decline of 4.9% in the same timeframe.

Lyft is trading at a forward sales multiple of 0.76, below its median of 1.22 over the last five years. UBER’s forward sales multiple is 3.10X, above its median of 3.01X over the last five years.

Uber’s more expensive valuation seems to suggest that investors are to pay a premium for this dominant player in the ride-hailing industry. The company’s diversification efforts and shareholder-friendly approach reflect its financial strength. Uber’s large size (market capitalization of $163.85 billion) positions it well to overcome turbulent times, such as the current one.

Lyft, on the other hand, is focused mainly on one area, i.e., ride-sharing, which is highly susceptible to economic downturns like the current scenario. Lyft’s disappointing price performance reflects its vulnerability to the current tariff-induced uncertain scenario. The much smaller Lyft, with a market capitalization of $5.12 billion, is not as shareholder-friendly as its larger rival.

On the basis of our analysis, Uber emerges as a clear winner compared with Lyft, despite both carrying a Zacks Rank #3 (Hold) currently. As a result, Uber is a better pick than Lyft now.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour |

Why legendary tech investor Bill Gurley says AI stocks are becoming crowded

UBER

Yahoo Finance Video

|

| 2 hours | |

| Jan-25 | |

| Jan-25 | |

| Jan-24 | |

| Jan-24 | |

| Jan-24 | |

| Jan-24 | |

| Jan-23 | |

| Jan-23 | |

| Jan-23 |

Amazon Grocery Push Seen Gaining Momentum. What That Means For Instacart, DoorDash.

UBER

Investor's Business Daily

|

| Jan-23 | |

| Jan-23 | |

| Jan-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite