|

|

|

|

|||||

|

|

The space economy is experiencing a transformative surge, propelled by rapid technological advancements and substantial investments from both government and private sectors. This momentum has created promising opportunities for space companies like Rocket Lab USA Inc. RKLB and Planet Labs PBC PL, each carving out distinct niches within the industry.

While Rocket Lab specializes in providing end-to-end space solutions, including reliable launch services, spacecraft, satellite components and on-orbit management, Planet Labs, on the other hand, focuses on Earth imaging and analytics. As the demand for satellite deployment and Earth observation data continues to grow, both Rocket Lab and Planet Labs are well-positioned to capitalize on the expanding space economy. This article will delve into their respective achievements, financial health and challenges to assess which stock presents a more compelling investment opportunity in 2025.

Recent Achievements: Rocket Lab ended 2024 with a record-setting performance, wherein the company generated its highest annual revenues (ever recorded) worth $436.2 million (up 78% year over year). Moreover, its Electron registered a record number of 16 launches in 2024, reflecting a 60% increase in launch cadence compared to 2023. RKLB was successful in bagging more than $450 million in newly secured launch and space systems contracts.

Among RKLB’s more recent achievements, worth mentioning is its selection in April 2025 by Kratos Defense to launch a full-scale hypersonic test flight for the Department of Defense (“DOD”) under the Multi-Service Advanced Capability Hypersonic Test Bed (MACH-TB) 2.0 program, which is worth $1.45 billion. In March, Rocket Lab announced that its third Pioneer spacecraft for Varda Space Industries is successfully operating on orbit.

In the same month, RKLB clinched a contract worth $5.6 billion from the U.S. Space Force to compete for the DOD’s highest-priority national security missions for its National Security Space Launch (“NSSL”) Phase 3 Lane 1 program. Such contract wins bolster RKLB’s revenue growth prospects.

Financial Stability: Rocket Lab ended 2024 with a cash and cash equivalent of $419 million. Its current debt was $12 million, while its long-term debt totaled $404 million. So, we may safely conclude that the company holds a moderate solvency position, which should allow it to continue investing in innovative space technologies to support the manufacturing of components, sub-systems, and assemblies across the full range of its launch vehicles and spacecraft family.

Challenges to Note: A key risk of investing in Rocket Lab lies in its high operating expenses, caused by investments in innovations like the Neutron launch vehicle, Electron’s first-stage recovery, advanced spacecraft capabilities and an expanded portfolio of components. These expenses often offset revenue gains, leading to losses, as evident from its recent quarterly reports.

Additionally, Rocket Lab is currently facing legal challenges, including a securities class action lawsuit alleging that the company misled its investors regarding the development timeline of its Neutron rocket, suggesting potential delays and financial concerns. These issues might impact investor confidence in this stock and the company's ability to secure future government contracts.

Recent Achievements: Planet Labs ended 2024 with a solid year-over-year revenue improvement of 11%. Its net loss also improved from the 2023 reported figure. The company launched more than 70 satellites last year, including its first Tanager hyperspectral satellite and second Pelican high-resolution satellite.

Among its more recent achievements, worth mentioning is the company’s signing of a multi-year contract in April 2025 with EMDYN, a European-based agile intelligence-led solutions and security services provider. Per the terms of this agreement, EMDYN will use Planet’s high resolution SkySat satellites to monitor subtle activity across large geographical regions.

In February, PL signed a $230 million multi-year commercial agreement with the US-subsidiary of JSAT Sky Perfect, Asia's largest geostationary satellite operator. Under the contract, Planet will build and operate a constellation of 10 low-Earth-orbit Pelican satellites for JSAT. These contracts should duly boost PL’s top-line performance in the next few years.

Financial Stability: Planet Labs ended 2024 with cash and cash equivalents of $229 million. Both its current and long-term debts, as of Dec. 31, 2024, were nil. So, we may safely conclude that the company holds a solid solvency position, which should allow it to continue investing in its agile space missions, including advancing core spacecraft technologies, automated mission operations for PL’s satellite fleet and ground stations, payload prototypes and development, as well as engineering operations to drive potential scale efficiencies.

Challenges to Note: Planet Labs’ limited experience in managing international operations presents notable challenges. Expanding beyond the U.S. exposes the company to a range of risks, such as political and economic instability, fluctuating foreign exchange rates, and evolving regulatory landscapes, any of which could adversely affect its financial performance and operational stability.

Moreover, the company has faced internal pressures, as reflected by substantial workforce reductions — a 10% layoff in August 2023, followed by a further 17% cut in June 2024. The cost-cutting measures may point to underlying organizational or strategic hurdles. These might also affect PL’s operational efficiency and cause disruption of ongoing projects.

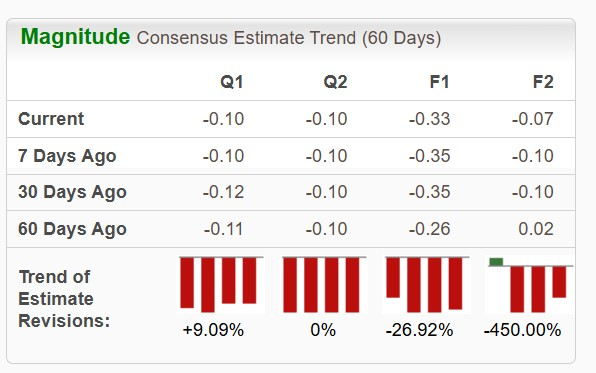

The Zacks Consensus Estimate for Rocket Lab’s 2025 sales suggests a surge of 32.1% from the year-ago quarter’s reported figure, while that for its loss per share estimate implies an improvement. The bottom-line estimates for 2025 and 2026 have, however, been trending downward over the past 60 days.

The Zacks Consensus Estimate for Planet Lab’s 2025 sales implies a year-over-year improvement of 10.3%, while that for its loss suggests no change. The stock’s near-term bottom-line estimates have been trending southward over the past 60 days.

RKLB (down 20.5%) has outperformed PL (down 41.4%) over the past three months and has done the same in the past year. Shares of RKLB and PL have surged 502.9% and 101.8%, respectively.

PL is trading at a forward sales multiple of 3.64X, below RKLB’s forward sales multiple of 15.38X.

The image below, reflecting a negative Return on Equity (ROE) for RKLB and PL, suggests that neither space company is very efficiently generating profits from its equity base.

While both Rocket Lab and Planet Labs are well-positioned to benefit from the long-term growth of the space economy, near-term investment risks remain significant. Rocket Lab’s expanding launch cadence and high-profile government contracts are promising, but ongoing losses, high operating expenses and pending legal issues introduce financial uncertainty. On the other hand, Planet Labs’ debt-free position and strong commercial partnerships offer a solid foundation, yet recent workforce reductions and global expansion risks could weigh on execution.

Despite their strategic progress, their downward earnings revisions imply a bearish outlook. Moreover, their negative return on equity highlights ongoing profitability challenges. In this context, investors may be wise to adopt a wait-and-watch approach, looking for clearer signals of financial stability and earnings visibility before committing capital to either stock.

Both RKLB and PL carry a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

AXA DCP partners with Planet Labs for near-real-time disaster monitoring

PL +5.26%

Life Insurance International

|

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite