|

|

|

|

|||||

|

|

Industrial equipment manufacturer Kadant (NYSE:KAI) met Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 3.9% year on year to $239.2 million. On the other hand, next quarter’s revenue guidance of $246.5 million was less impressive, coming in 6.5% below analysts’ estimates. Its non-GAAP profit of $2.10 per share was 6.9% above analysts’ consensus estimates.

Is now the time to buy Kadant? Find out by accessing our full research report, it’s free.

Management Commentary“Our first quarter results were in line with expectations across most financial metrics despite the increasing geopolitical and trade uncertainties,” said Jeffrey L. Powell, president and chief executive officer of Kadant Inc.

Headquartered in Massachusetts, Kadant (NYSE:KAI) is a global supplier of high-value, critical components and engineered systems used in process industries worldwide.

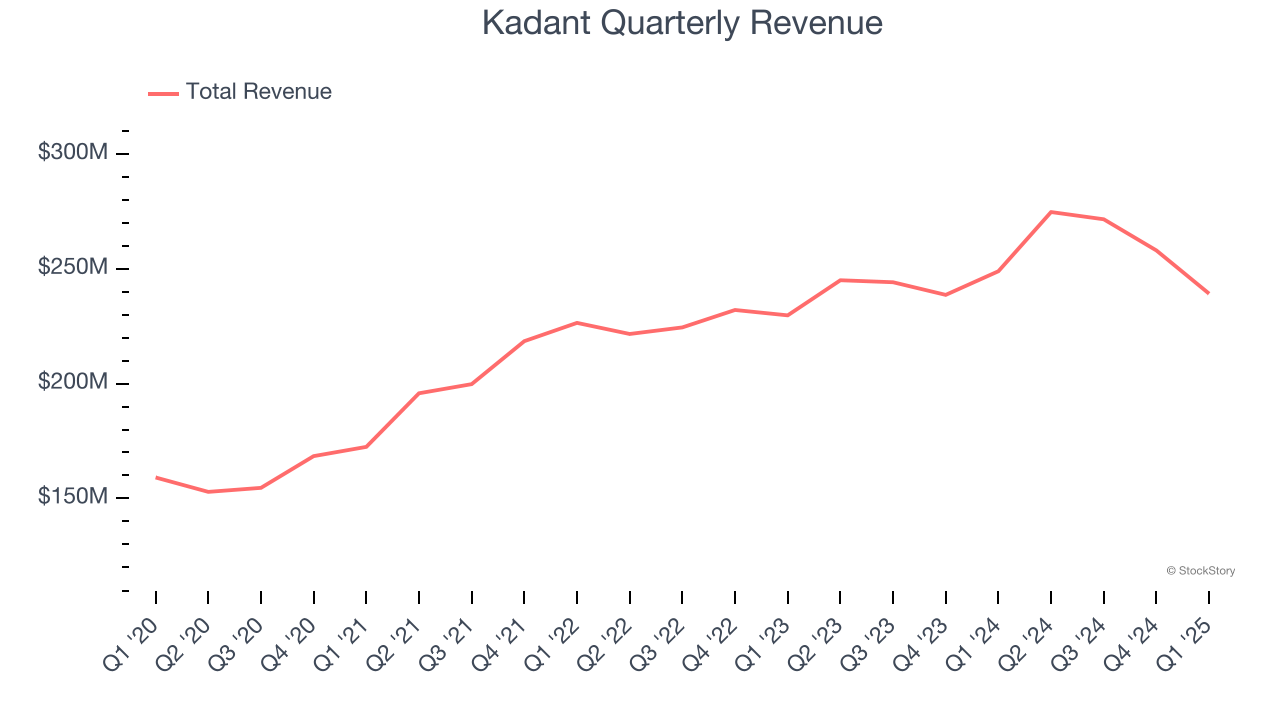

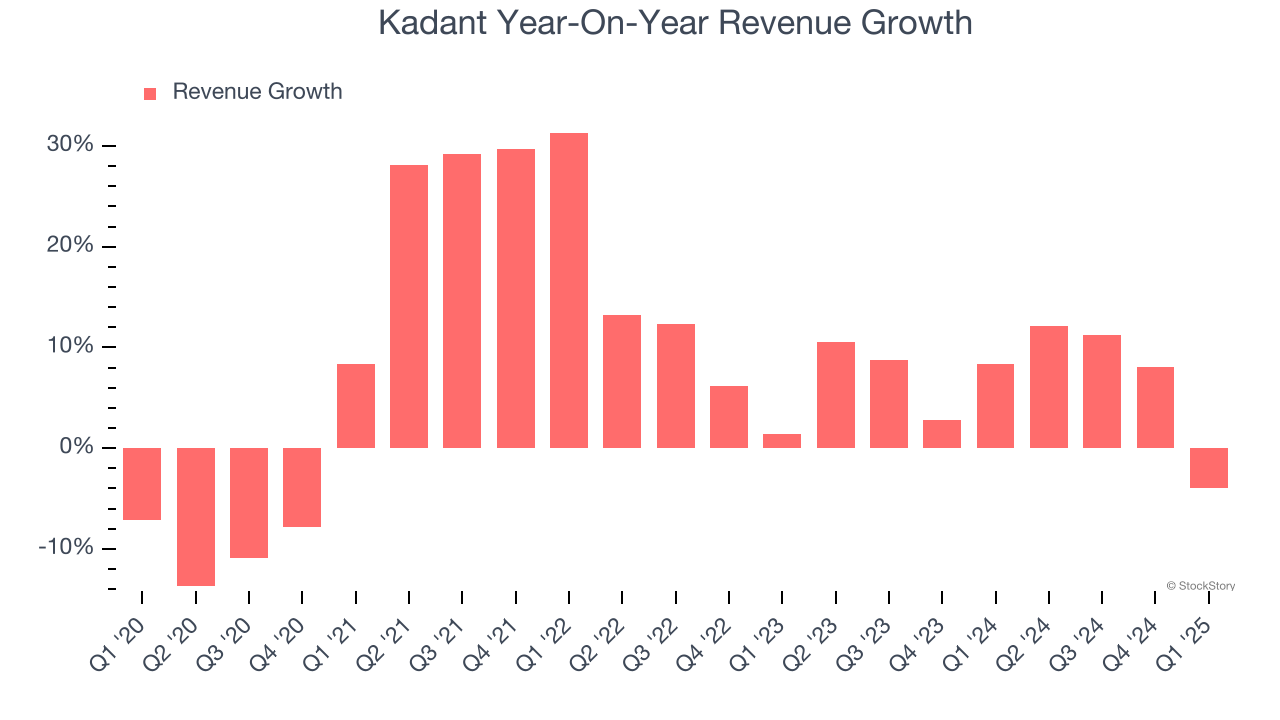

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Kadant’s sales grew at a decent 8.6% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Kadant’s recent performance shows its demand has slowed as its annualized revenue growth of 7.2% over the last two years was below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Fluid Handling, Industrial Processing, and Material Handling, which are 38.6%, 37.4%, and 23.9% of revenue. Over the last two years, Kadant’s revenues in all three segments increased. Its Fluid Handling revenue (piping, cleaning, and filtration) averaged year-on-year growth of 3.5% while its Industrial Processing (paper and timber processing equipment) and Material Handling (wood production equipment) revenues averaged 10.7% and 9.2%.

This quarter, Kadant reported a rather uninspiring 3.9% year-on-year revenue decline to $239.2 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 10.3% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

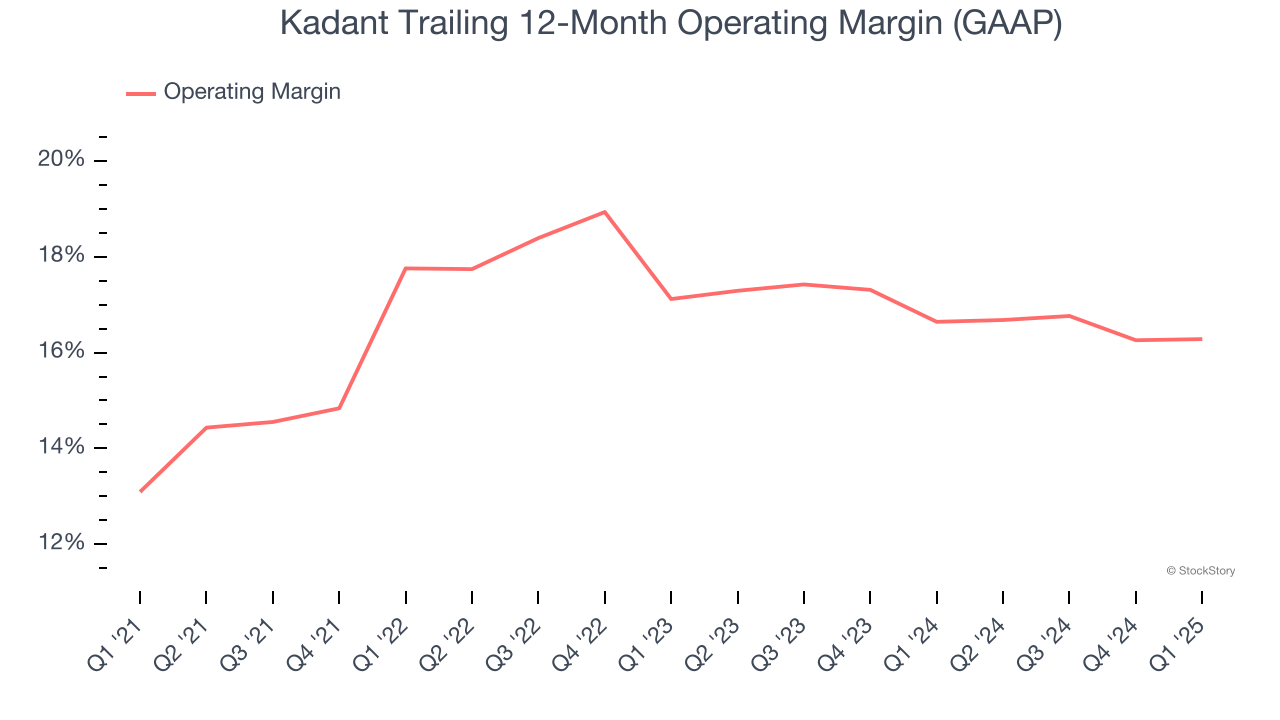

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Kadant has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Kadant’s operating margin rose by 3.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Kadant generated an operating profit margin of 14.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

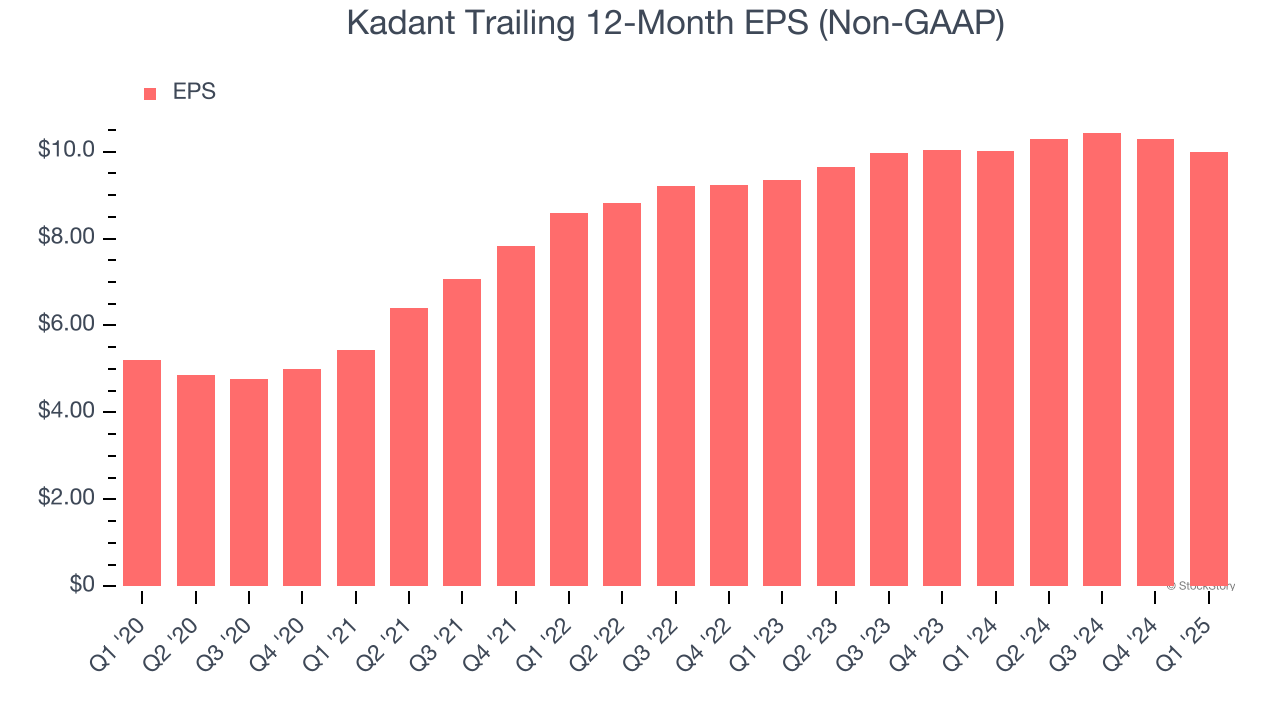

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Kadant’s EPS grew at a remarkable 13.9% compounded annual growth rate over the last five years, higher than its 8.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Kadant’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Kadant’s operating margin was flat this quarter but expanded by 3.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Kadant, its two-year annual EPS growth of 3.4% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q1, Kadant reported EPS at $2.10, down from $2.38 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 6.9%. Over the next 12 months, Wall Street expects Kadant’s full-year EPS of $9.99 to grow 1.6%.

It was good to see Kadant beat analysts’ Material Handling revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed significantly and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1.4% to $310.50 immediately after reporting.

Kadant underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-23 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-10 | |

| Feb-04 | |

| Jan-29 | |

| Jan-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite