|

|

|

|

|||||

|

|

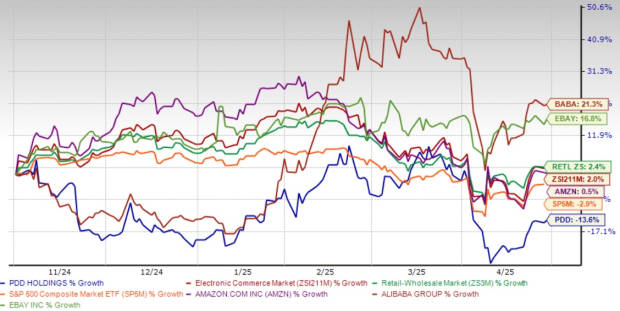

PDD Holdings Inc. PDD, the parent company of e-commerce platforms Pinduoduo and Temu, has experienced a troubling start to 2025, with shares plummeting 13.6% in the past six months. This performance has raised concerns among investors about the company's near-term prospects, despite its impressive growth trajectory in previous years. As the stock continues to face downward pressure, investors are questioning whether current price levels represent a buying opportunity or a signal to remain cautious.

PDD Holdings has established itself as a formidable player in the global e-commerce space, gaining significant market share through its innovative social commerce model and aggressive pricing strategies. According to the company's recent 20-F filing, PDD has continued expanding its user base both domestically and internationally, with Temu making substantial inroads into international markets, particularly in North America and Europe.

However, the competitive landscape has intensified considerably. Established giants like Amazon AMZN, eBay EBAY, and Alibaba BABA have responded to PDD's expansion with their strategic initiatives. Domestically, the Chinese e-commerce market has become increasingly saturated, forcing players to compete more aggressively on price and promotions, which has pressured margins across the sector. Shares of Amazon, eBay and Alibaba have returned 0.5%, 16.8% and 21.3%, respectively, in the same time frame.

Despite market headwinds, PDD's financial fundamentals remain relatively strong. The company maintains a robust cash position of RMB331.6 billion (approximately $45.4 billion) in cash, cash equivalents, and short-term investments as of Dec. 31, 2024. This substantial war chest provides PDD with significant flexibility to weather market turbulence and continue investing in growth initiatives.

For 2025, the Zacks Consensus Estimate for revenues is pegged at $64.94 billion, indicating growth of 18.74% from the year-ago quarter’s reported figure. The consensus mark for earnings is pinned at $11.99 per share, suggesting 5.92% growth from 2024.

See the Zacks Earnings Calendar to stay ahead of market-making news.

However, concerning signals have emerged. Cash generated from operating activities declined to RMB29.5 billion in fourth-quarter 2024 from RMB36.9 billion in the same period of 2023, potentially indicating efficiency challenges or increased competitive pressure. Management has explicitly prioritized long-term ecosystem investments over short-term financial optimization, a strategy that may continue to pressure near-term results.

The company's international expansion through Temu has required substantial investments in marketing, logistics, and customer acquisition. While this strategy has successfully driven user growth, it has come at the expense of profitability in the short term. According to the 20-F filing, PDD has increased its research and development expenses significantly, reflecting its commitment to technological advancement but further pressuring margins.

At current levels, PDD stock trades at a forward P/E of 8.33x, substantially below the Zacks Internet - Commerce industry average of 20.95x. This significant discount might appear to present a compelling opportunity for value investors.

However, this valuation gap likely reflects legitimate market concerns rather than simply an overlooked opportunity. The discount appears to price in several risk factors, including the intensifying competition previously noted, regulatory uncertainties in both China and international markets, and management's explicit focus on long-term growth over short-term profitability.

Regulatory developments remain a particular concern for Chinese technology companies like PDD. Recent government actions targeting various sectors of the Chinese economy have created an unpredictable operating environment. While PDD has thus far navigated these challenges relatively successfully, regulatory risk remains a significant factor in the stock's discounted valuation.

For current shareholders, maintaining existing positions may be prudent given PDD's strong market position, substantial cash reserves, and long-term growth potential. The company's commitment to innovation and international expansion could eventually yield significant returns, particularly if its investments in logistics and technology create sustainable competitive advantages.

However, investors considering new positions might benefit from patience. The current valuation discount, while attractive at first glance, appropriately reflects real challenges facing the company. A more favorable entry point may emerge if PDD demonstrates improved operating efficiency, clearer regulatory visibility, or signs that its international expansion is approaching profitability.

Until such catalysts materialize, potential investors should closely monitor quarterly results for indications that PDD's long-term investments are beginning to translate into sustainable competitive advantages and improved financial metrics. The stock's current technical weakness suggests market sentiment remains negative, and patience may be rewarded with more attractive entry points in the coming quarters. PDD currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 32 min | |

| 2 hours | |

| 4 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite