|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Fortinet’s FTNT valuation may be a concern for some investors. The stock is trading at a significant premium compared to the broader Zacks Security industry. As of the latest data, FTNT’s Price/Book ratio hovers around 53.65, well above the industry’s 25.04, reflecting investors' high growth expectations. The Value Score of F further reinforces a stretched valuation for Fortinet at this moment.

With Fortinet stock trading at a premium, investors may be wondering how to approach it. While the company faces short-term pressures, such as macroeconomic uncertainties and increased competition, it also presents strong long-term growth drivers in areas like SASE. Let’s take a closer look at the key factors influencing the company to help determine the best course of action.

The cybersecurity market is extremely competitive and characterized by rapid technological change. Among others, Fortinet’s competitors include Palo Alto Networks PANW, Zscaler ZS and CrowdStrike CRWD.

Palo Alto Networks is growing rapidly in the cybersecurity space on the back of its innovative next-generation security platforms. The company’s security platforms have an innovative traffic classification engine that helps it in identifying network traffic by application, user and content. Zscaler, meanwhile, has made strategic acquisitions to boost growth. Since its inception, the company has acquired 10 businesses, with eight in the cybersecurity space and two in the cloud infrastructure space. CrowdStrike’s strong product innovation pipeline continues to enhance its market position. In the fourth quarter of fiscal 2025, the company introduced Falcon Data Protection, a new solution aimed at preventing data loss and ensuring compliance, which addresses rising concerns around data security.

These competitors are rapidly doubling down on innovation and strategic acquisitions. If Fortinet fails to keep up with the accelerating pace of change in the cybersecurity space, it risks falling behind in both market share and technological relevance.

Fortinet is dealing with growing uncertainty as trade tensions and economic instability affect key markets like Latin America, Mexico, and Canada. The company had to quickly assess the impact of new tariffs. At the same time, possible disruptions in the U.S. federal market due to staffing issues could hurt sales in the federal sector. These pressures are adding to an already challenging environment for the company.

Adding to Fortinet’s troubles is the broader weakness in the stock market. Investor fears around the escalating tariff war and a possible global economic slowdown have triggered a tech-sector sell-off, especially hurting high-growth names like Fortinet. Stubbornly high interest rates are also dragging down the tech industry, and with FTNT trading at elevated valuations, the stock is more exposed to risk as market conditions continue to worsen.

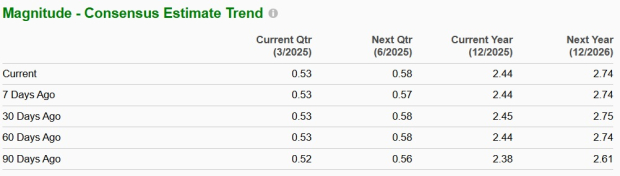

The Zacks Consensus Estimate for first-quarter 2025 earnings is pegged at 53 cents per share, which has remained unchanged over the past 60 days, indicating 23.26% year-over-year growth.

The consensus mark for first-quarter 2025 revenues is pegged at $1.54 billion, suggesting 13.54% year-over-year growth.

Fortinet’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 24.76%.

See the Zacks Earnings Calendar to stay ahead of market-making news.

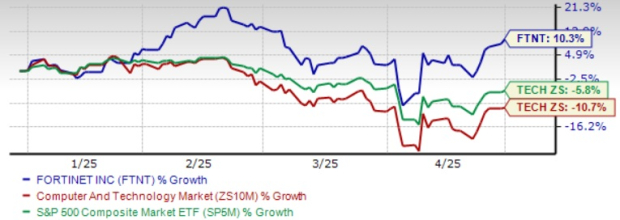

Fortinet shares have gained 10.3% in the year-to-date period, outperforming the Zacks Computer and Technology sector and the S&P 500 index’s decline of 10.7% and 5.8%, respectively. Palo Alto Networks, CrowdStrike and Zscaler have returned 2.6%, 26% and 24.1%, respectively in the same time frame.

The company’s outperformance can be attributed to its establishment as a leading provider of SASE solutions. SASE adoption is accelerating across enterprises and to keep pace, Fortinet continuously enhances FortiOS, integrating advanced networking and security into a unified platform

Fortinet’s growth is fueled by its Unified SASE strategy, built into a single FortiOS operating system. This integration delivers seamless networking and security. Customers benefit from easy upgrades, enhanced performance, and quicker deployments, making FortiSASE a compelling choice across cloud and on-premises environments.

The strategy is clearly resonating, with SASE ARR growing 96% and FortiSASE deals jumping 60% in 2024. Large enterprises already using Fortinet’s SD-WAN are expanding to FortiSASE, pushing enterprise penetration to 10%. Fortinet’s customers appreciate the simplicity of a single-vendor solution, leading to shorter sales cycles and stronger adoption. With rapid growth and high customer interest, SASE is emerging as a key revenue driver for Fortinet.

Recently, Vodafone Business and Fortinet announced an expanded global partnership through which large and medium-sized businesses in Germany and other European markets, along with MNCs who get served through Vodafone Business International, can now benefit from Fortinet’s FortiSASE cloud-based security solutions.

Current valuations of FTNT stock suggest that investors might benefit from waiting for a better entry point. The company’s product portfolio and market position are undeniable strengths, but challenges due to increased competition and macroeconomic uncertainties pose a threat to its near-term prospects.

The company recently advanced its OT Security Platform to further support the protection of its customers’ infrastructure and sites from evolving cyber threats. Ongoing innovations and improvements are favoring Fortinet, however, the near-term outlook is uncertain as more customers are spreading out their cybersecurity spending over time instead of making big investments all at once. This uncertain economic environment should caution investors.

Fortinet currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Cybersecurity Stocks Hit By Anthropic 'Claude Code Security.' JFrog Plunges.

ZS -5.47% PANW

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Stock Market Mixed With Walmart, Iran, Trump Tariff Ruling In Focus: Weekly Review

PANW

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite