|

|

|

|

|||||

|

|

Columbia Sportswear Company COLM reported impressive first-quarter 2025 results, wherein both the top and bottom lines increased year over year. Also, both sales and earnings beat the Zacks Consensus Estimate.

The company exceeded first-quarter expectations with strong international growth, especially in Asia, while U.S. sales declined slightly. It is navigating significant uncertainty due to the newly imposed U.S. tariffs, prompting a withdrawal of full-year guidance. As a result, shares of this company declined 2.1% in the after-hours trading session yesterday. Despite headwinds, COLM plans to boost marketing and sees opportunities to gain market share, leveraging its strong brand, diverse supply chain and financial stability.

Columbia Sportswear Company price-consensus-eps-surprise-chart | Columbia Sportswear Company Quote

This designer, marketer and distributor of outdoor and active lifestyle apparel, footwear and accessories reported earnings of 75 cents per share, surpassing the Zacks Consensus Estimate of 68 cents. Also, the bottom line increased 5.6% from 71 cents reported in the prior year period. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

The company generated net sales of $778.5 million, which exceeded the Zacks Consensus Estimate of $760 million. The metric also rose 1.1% from the year-ago period, fueled by strong performance in the Latin America, Asia Pacific (LAAP), and Europe, Middle East, and Africa (EMEA) regions, partially offset by declines in Canada and the United States. Net sales rose 3% at constant currency.

Gross profit increased 1.7% year over year to $396.1 million. The gross margin increased 30 basis points (bps) to 50.9%, which fared better than our estimate of 49.7%, mainly driven by factors such as reduced outbound shipping costs, improved closeout margins and favorable Spring 2025 product input costs, partially offset by unfavorable foreign exchange hedging rates.

SG&A expenses were up 1.5% to $354.5 million from $349.3 million reported in the year-ago quarter. As a percentage of sales, the same increased 10 bps to 45.5%. The increase was primarily driven by higher direct-to-consumer (DTC) and demand creation costs, partially offset by reduced supply-chain expenses.

Columbia Sportswear reported an operating income of $46.5 million, up 4.1% from the year-ago quarter. Operating margin increased 20 bps to 6%.

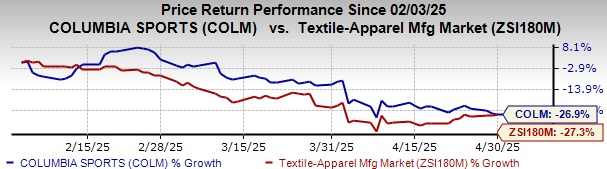

COLM Stock Past Three-Month Performance

In the United States, net sales declined 1% year over year to $471.2 million, which slightly missed our estimate of $471.6 million. Net sales surged 3% to $107.5 million in Europe, Middle East and Africa, surpassing our estimate of $103.4 million. Latin America and Asia Pacific net sales grew 10% to $152.2 million, surpassing our estimate of $137.2 million. In Canada, net sales tumbled 9% to $47.6 million, which lagged our estimate of $49.2 million.

During the quarter, DTC sales remained flat at $378.7 million. Our model expected total DTC sales of $358.2 million for the quarter. Wholesale channel sales went up 2% to $399.8 million, which missed our estimate of $403.2 million.

Net sales in the Apparel, Accessories and Equipment category inched up 2% to $628.8 million, which beat our estimate of $599.6 million. Footwear's net sales fell 1% to $149.6 million, which lagged our estimate of $161.9 million.

SOREL, Mountain Hardwear and prAna brands registered sales declines of 8%, 14% and 10%, respectively. Sales for the Columbia brand increased 3% year over year.

The company ended the quarter with cash and cash equivalents of $323.3 million, short-term investments of $335.1 million and shareholders’ equity of almost $1,709.8 million. It had no debt on its balance sheet as of March 31, 2025. Inventories increased 2.7% to $623.7 million as of the same date.

For the three months ended March 31, 2025, Columbia Sportswear’s cash used in operating activities was $32 million and capital expenditures were $15.6 million.

For the three months ended March 31, 2025, the company repurchased 1,251,784 shares of common stock for a total of $101.4 million, representing an average price of $81.03 per share. As of March 31, 2025, $526.1 million remained available under its stock repurchase authorization. Management announced a regular quarterly cash dividend of 30 cents per share, payable on June 5, 2025, to shareholders of record as of May 22.

The company has withdrawn its full-year 2025 financial outlook, originally provided on Feb. 4, 2025, due to ongoing macroeconomic uncertainty related to global trade policies. As a result, it is not providing an updated full-year 2025 financial outlook at this time.

Net sales for the second quarter of 2025 are expected to be in the range of $575- $600 million, representing year-over-year growth of 1-5%, compared with $570.2 million in the second quarter of 2024.

Shares of this Zacks Rank #3 (Hold) company have lost 26.9% in the past three months compared with the industry’s 27.3% decline.

Some better-ranked stocks are The Gap, Inc. GAP, Canada Goose GOOS and G-III Apparel Group, Ltd. GIII.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for The Gap’s fiscal 2025 earnings and revenues indicates growth of 7.7% and 1.5%, respectively, from fiscal 2024 reported levels. GAP delivered a trailing four-quarter average earnings surprise of 77.5%.

Canada Goose is a global outerwear brand. GOOS is a designer, manufacturer, distributor and retailer of premium outerwear for men, women and children. It carries a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for Canada Goose’s current fiscal year’s earnings and revenues implies a decline of 1.4% and 4.9%, respectively, from the year-ago actuals. Canada Goose delivered a trailing four-quarter average earnings surprise of 71.3%.

G-III Apparel is a manufacturer, designer and distributor of apparel and accessories under three types of brands, licensed, owned and private label. It currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for GIII’s fiscal 2025 earnings and revenues implies a decline of 4.5% and 1.2%, respectively, from the year-ago actuals. GIII delivered a trailing four-quarter average earnings surprise of 117.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite