|

|

|

|

|||||

|

|

Sterling Infrastructure, Inc. STRL is scheduled to report first-quarter 2025 results on May 5, after the closing bell.

In the last reported quarter, Sterling delivered adjusted earnings per share (EPS) of $1.46, beating the Zacks Consensus Estimate by 9% and growing 13.2% year over year. Revenues grew 3% year over year to $498.8 million. Despite falling slightly short of guided revenue, the company managed to outperform in key profitability metrics, demonstrating its ongoing commitment to margin expansion. Gross margin for the quarter surpassed 21%, while adjusted EBITDA and operating income also expanded meaningfully, reinforcing the company's focus on execution and disciplined cost control.

Sterling, a premier U.S. service provider specializing in transportation, civil construction, and e-infrastructure solutions, has an impressive track record of surpassing earnings expectations, exceeding the consensus mark in each of the last four quarters. The average surprise over this period is 16.2%, as shown in the chart below.

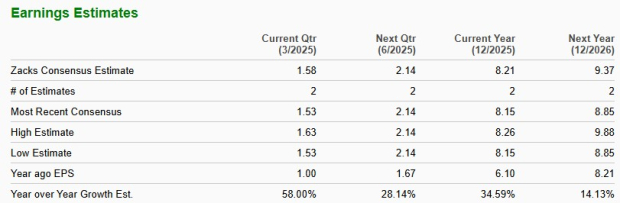

The Zacks Consensus Estimate for the third-quarter EPS has remained unchanged at $1.58 over the past 60 days. The estimated figure indicates a whopping 58% growth from the year-ago reported figure. The consensus mark for revenues is $415.6 million, indicating a 5.6% year-over-year decline.

For 2025, STRL is expected to register 34.6% EPS growth from a year ago. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Our proven model does not predict an earnings beat for Sterling for the quarter to be reported. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) for this to happen. This is not the case here, as you will see below.

Earnings ESP: STRL has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sterling has established itself as a major player in the booming e-infrastructure and transportation markets. The company’s strategic focus on high-margin projects, coupled with strong execution, has led to record earnings growth so far. With a robust backlog, ongoing federal infrastructure spending, and rising demand for data centers, Sterling appears well-positioned for another strong quarter.

However, as is typical for Sterling, the first quarter is expected to be the company’s lowest revenue quarter of the year due to seasonal trends.

Segment-wise, E-Infrastructure Solutions, STRL's largest and fastest-growing segment, accounted for 47% of fourth-quarter 2024 revenues. Its customers include Amazon.com, Inc. AMZN, Meta Platforms, Inc. META, Walmart Inc. WMT and Hyundai Motor Group. It is set to benefit from multi-year capital deployment in data centers, advanced manufacturing, and industrial sectors. Enhanced supply chain dynamics and a focus on large-scale, mission-critical projects will boost sales and margins. Data centers, now 50% of STRL’s E-Infrastructure backlog, play a crucial role in future growth, driven by the demand for AI technology advancements.

Transportation Solutions segment (which accounted for 35% of total fourth-quarter 2024 revenues) is expected to benefit from strong broad-based demand and margin growth across its entire geographic footprint. The segment is expected to have benefited from robust state and local funding, the Infrastructure Bill's allocation of $643 billion for transportation programs (including $284 billion in incremental funding), and a $25 billion investment in airports over five years.

Sterling’s Building Solutions segment (which accounted for 18% of total fourth-quarter 2024 revenues) is focusing on concrete foundations for residential and commercial projects. While Sterling’s overall outlook is strong, challenges persist in the residential construction market. Affordability concerns and high interest rates have kept potential homebuyers on the sidelines, limiting demand. Also, weather disruptions in Dallas and Fort Worth significantly hampered operations early in the quarter.

Acquisitions have significantly contributed to STRL's growth by expanding its operations and boosting revenues. Strategic investments for profitability and efficient service execution, along with accretive buyouts, are anticipated to have driven substantial fourth-quarter growth.

STRL stock has exhibited an upward movement in the past month and outperformed the Zacks Engineering - R and D Services industry and the broader Construction sector, as you can see below.

Sterling’s 1-Month Price Performance

Sterling’s stock is trading above its 50-day and 200-day simple moving averages (SMAs). This suggests the stock has positive price momentum over both the short-to-medium term (50-day SMA) and long term (200-day SMA).

Let's assess the value STRL offers to investors at its current levels. Despite the solid rally, STRL is trading slightly at a discount compared to the industry average, as shown in the chart below. The stock is trading at a forward 12-month P/E ratio of 17.4—lower than the Zacks Engineering - R&D Services industry average of 17.73 but well above its five-year median of 11.33.

Sterling’s P/E Ratio (Forward 12-Month) vs. Industry

As the infrastructure sector continues to grow, Sterling stands to benefit significantly due to its strong industry reputation and extensive experience with top-tier clients. The current capacity for data centers falls far short of meeting the rising demand driven by artificial intelligence and other emerging technologies.

Sterling remains well-positioned due to its consistent earnings outperformance, strong margin execution, and exposure to growth drivers like data centers and infrastructure spending. Despite expected seasonal softness in the first quarter, full-year EPS is projected to grow more than 34% in 2025, backed by a robust backlog and strategic acquisitions.

The stock’s upward momentum, trading above its 50- and 200-day moving averages, reinforces investor confidence. With a forward P/E of 17.4—slightly below the industry average—valuation remains reasonable. STRL reflects a balanced risk-reward profile at current levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 min | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 6 hours |

Stock Market Today: Dow Sinks As EU Makes Trump Tariff Move; IBM Dives On This AI Threat (Live Coverage)

WMT

Investor's Business Daily

|

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite