|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

About the Industry

The companies grouped under the Semiconductor – General category produce a broad range of semiconductor devices, both integrated and discrete, like microprocessors, graphics processors, embedded processors, chipsets, motherboards, wireless and wired connectivity products, DLPs and analog, serving multiple end markets. It includes companies like NVIDIA, Texas Instruments, Intel and STMicroelectronics.

Major Themes Shaping the Industry

Zacks Industry Rank Indicates Good Prospects

The Zacks Semiconductor-General Industry is a stock group within the broader Zacks Computer and Technology Sector. It carries a Zacks Industry Rank of #92, which places it in the top 37% of nearly 250 Zacks-classified industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates that near-term prospects are improving. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of 2 to 1.

An industry’s positioning in the top 50% of Zacks-ranked industries is normally because the earnings outlook for the constituent companies in aggregate is relatively strong. The opposite is true for stocks in the bottom 50% of industries. In this case, the aggregate earnings estimate for 2026 is up 35.1% from the year-ago level while the aggregate earnings estimate for 2027 is up 55.5% from last year.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Stock Market Performance Remains Strong

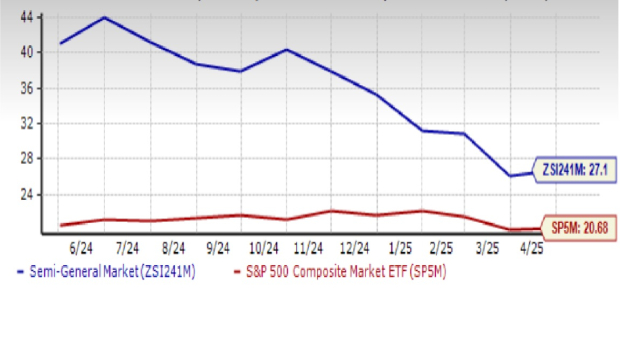

Tracking the performance of the Zacks Semiconductor – General Industry over the past year shows that the industry has traded at a premium to both the broader Zacks Computer and Technology Sector and the S&P 500 index throughout the year.

The industry has gained 22.5% over the past year. The broader technology sector gained 8.1% while the S&P 500 index gained 10%.

One-Year Price Performance

Current Valuation: Rich

On the basis of forward 12-month price-to-earnings (P/E) ratio, we see that the industry is currently trading at a 27.10X multiple, which is below its median value of 37.86X over the past year. However, since the S&P 500 trades at 20.68X and the sector trades at 23.70X, the industry appears significantly overvalued.

It’s worth noting that the industry has traded much closer to the sector in the last 10 years, trailing it at first then slightly beating it. But it has really pulled ahead from the middle of 2022, most likely because companies are scrambling to acquire the basic building blocks for AI, autonomous driving, defense and other mega trends driving the market today.

Forward 12 Month Price-to-Earnings (P/E) Ratio

2 Stocks to Consider

The industry continues to look good and it will benefit from further interest cuts this year, which typically drives more money into risky assets. Several of the technology heavyweights in this industry are the backbone of how computing is done these days, so we remain optimistic over the long run. The only stumbling block is the valuation. We continue to like NVIDIA and think that TXN is worth keeping an eye on:

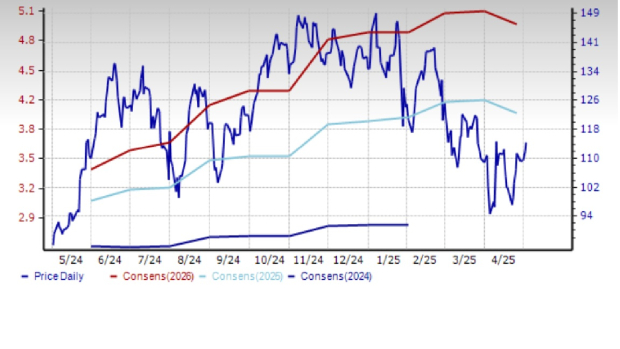

NVIDIA Corp. (NVDA): Santa Clara, CA-based NVIDIA provides graphics, and compute and networking solutions in the U.S., Taiwan, China and other markets. Its graphics processing units (GPUs) are the most popular in the gaming segment. NVIDIA is also at the leading edge of enterprise, data center, cloud and automotive deployments today.

Generative AI is driving exponential growth in compute requirements. Because NVIDIA’s accelerated computing is versatile, energy-efficient and has low total cost of ownership, companies are rapidly transitioning to its products to train and deploy AI. NVIDIA GPUs, CPUs, networking, AI foundry services and NVIDIA AI Enterprise software are all growth engines. They are opening up opportunities and leading to broad-based growth across geographies and markets.

AI and accelerated computing are quickly becoming integral to customers' innovation road maps and competitive positioning. The data center business is extremely strong, driven by demand for data processing, training and inference from large cloud-service providers and GPU-specialized ones, as well as from enterprise software and consumer Internet companies.

Some of its largest cloud customers include AWS, CoreWeave, Google Cloud Platform (GCP), Microsoft Azure and Oracle Cloud Infrastructure (OCI). Healthcare partners like IQVIA, Illumina, Mayo Clinic and Arc Institute are using its products to advance genomics, drug discovery and healthcare. NVIDIA is also seeing momentum across professional visualization and automotive (recent collaborations include Toyota, Hyundai, Mercedes-Benz, Audi). The company also gives away billions to shareholders in dividends and share repurchases.

While still up from 90 days ago, the Zacks Consensus Estimate for 2026 (ending January) has gone from $4.41 30 days ago to the current level of $4.24 (down 3.9%). There’s a similar decline of 11 cents (2.0%) in the 2027 estimate. At current levels, analyst estimates represent a 48.2% increase in revenue and 41.8% increase in earnings for 2026 and a 24.2% revenue increase and 26.7% earnings increase in 2027.The Zacks Rank #3 (Hold rated) stock is up 30.1% in the past year.

Price & Consensus: NVDA

Texas Instruments, Inc. (TXN)

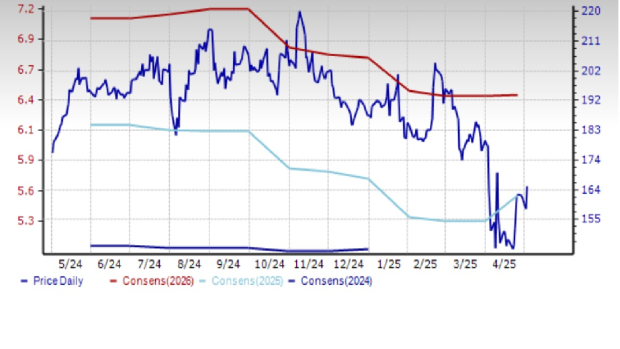

Dallas-based Texas Instruments is an original equipment manufacturer of analog and embedded processing chips for industrial, automotive, communications, enterprise and other applications.

While the US is its largest market, followed by Europe, it’s worth noting that China still accounts for nearly a fifth of its revenues, which could be at risk given the current geopolitics.

As the pandemic and geopolitics impacted the chip supply chain, and the government incentivized American companies to reshore manufacturing, TI changed its manufacturing strategy from one that opportunistically used external capacity to one on the path to source more than 95% of its wafers internally, with more than 80% on 300mm, by 2030. To this end, it expanded its internal manufacturing capacity in 2024, with tool installations continuing at two 300mm wafer fabs in Richardson, TX and Lehi, UT. Another Lehi fab and a Sherman, TX fab are currently in prep.

The company is a beneficiary of the 25% investment tax credit related to some of its investments in U.S. semiconductor manufacturing (expected to continue on qualified investments up to 2034). It also has an agreement with the Department of Commerce to receive direct funding of up to $1.6 billion for the three large-scale 300mm wafer fabs currently under construction in Sherman, Texas and Lehi, Utah.

As may be expected, capacity expansion initially has a negative impact on margins, as capacity can only be filled over time. Until then, some underutilization charges are a given.

It is encouraging to note, however, that TI has also gradually increased the share of direct sales to customers, which improves insight into their projects and timelines, thus driving sales, customer penetration and market share gains. In 2024, around 80% of business came from direct customers.

With industrial and automotive markets accounting for around 70% of revenue, the growing electronic content in these applications, as well as the demand for sustainable growth, hold promise.

In the last 30 days, analysts have raised their 2025 estimates by 20 cents (3.7%) and lowered their 2026 estimates by 12 cents (1.9%). Analysts currently expect revenue and earnings to grow a respective 11.0% and 6.7% in 2025 followed by a respective 8.8% and 13.9% in 2026.

In the past year, this Zacks Rank #3 stock has slumped 10%.

One-Year Price Performance: TXN

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 18 min |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

NVDA

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 5 hours | |

| 6 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite