|

|

|

|

|||||

|

|

SoundHound AI SOUN is scheduled to report its first-quarter 2025 results on May 8, after the closing bell.

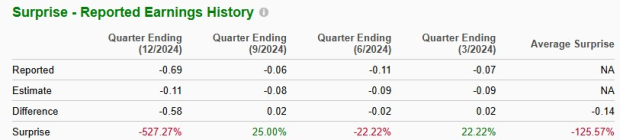

In the last reported quarter, SoundHound reported a loss of 69 cents per share, significantly wider than the 6-cent loss recorded in the same period a year earlier and notably below the Zacks Consensus Estimate by a wide margin of 527.3%. However, revenues jumped 101.5% year over year to $34.5 million, surpassing the consensus estimate by 3.1%. This revenue surge was supported by key customer additions, broader partnership networks, and continued progress in generative AI. Growth momentum was further driven by increasing adoption in quick-service restaurants, in-car voice commerce, and strategic acquisitions.

This maker of artificial intelligence (AI) tools for computer interpretation of voice commands surpassed earnings estimates in two of the trailing four quarters and missed on the other two occasions, with an average negative surprise of 125.6%. You can see the historical figures in the chart below. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

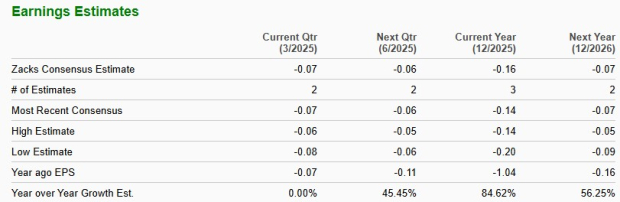

The Zacks Consensus Estimate for the first-quarter bottom line has remained unchanged at a loss of 7 cents per share over the past 60 days. This is the same as the year-ago reported loss per share. The consensus mark for revenues is $30.2 million, suggesting a 160.6% year-over-year increase. For 2025, SOUN is expected to witness a 95.7% improvement from the 2024 level.

For 2025, SOUN is expected to register a bottom-line improvement of 84.6% from a year ago.

Our proven model does not conclusively predict an earnings beat for SoundHound for the quarter to be reported. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) for this to happen. This is not the case here, as you will see below.

Earnings ESP: SoundHound has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

SoundHound’s expansive serviceable markets across its core and emerging verticals, diversified customer base and high-profile partnerships are expected to have supported its revenue growth in the first quarter.

The company continues to benefit from expanding adoption of its voice AI platform across core verticals such as restaurants, automotive, healthcare, and energy. SoundHound has become a key player in the restaurant industry, now serving more than 10,000 locations, with recent go-lives at Burger King UK and new wins across major QSR brands. The restaurant sector’s shift toward automation is amplifying recurring revenue opportunities, making it a critical growth driver in the first quarter of 2025.

Beyond its core markets, SoundHound has expanded into healthcare, energy, retail, and government sectors. Recent wins with Duke Health, Wellstar Health, and a large U.S. utility underscore the repeatability and scalability of its solutions across industries. These enterprise deals offer large-scale deployments with multi-year visibility, strengthening the company’s backlog and reducing customer concentration. The first quarter is expected to reflect early contributions from these sectors, especially from its seven-figure energy contract.

The company’s collaborations with major players such as NVIDIA NVDA, Perplexity, Lucid Group, Inc. LCID and LG, along with restaurant industry partners, are expected to contribute to growth. These partnerships underscore SoundHound’s leadership in creating transformative voice solutions. SoundHound has expanded its collaboration with NVIDIA by integrating NVIDIA AI Enterprise tools to enhance its voice AI capabilities. This partnership enables faster, low-latency processing, real-time retrieval-augmented generation, and scalable AI model optimization. The integration is already being used in automotive applications, such as Lucid Motors' voice assistant, to improve response times and user interactions. SoundHound AI plans to broaden the use of NVIDIA AI software in more modules to further advance automotive voice technology.

First-quarter results should also reflect initial contributions from enterprise and government contracts. The company’s cumulative bookings backlog surged past $1.2 billion in the last quarter—up 75% year over year—adding visibility to future revenue and reinforcing a SaaS-like revenue profile.

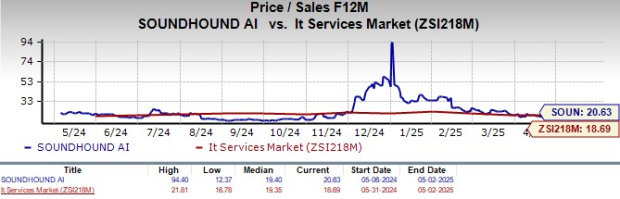

SOUN shares have gained 23.6% in the past month, outperforming the broader Zacks Computer & Technology sector’s rise of 16.9% and the Zacks Computers - IT Services industry’s increase of 15.3%.

SOUN Stock’s 1-Month Performance

SOUN shares are currently overvalued, as suggested by its Value Score of F. In terms of its forward 12-month price-to-sales (P/S) ratio, SOUN is trading at 20.63, higher than the Zacks Computers - IT Services industry’s 18.69.

Despite recent volatility and a weak earnings history, SoundHound AI continues to display compelling growth momentum that supports a hold recommendation. Revenue growth of more than 100% in the prior quarter and strong projections for both top-and-bottom-line improvements in 2025 reflect expanding adoption of its voice AI platform across high-growth sectors like quick-service restaurants, automotive, healthcare, and energy.

The company’s expanding enterprise partnerships—including with NVIDIA and Lucid—reinforce technological leadership, while a growing backlog exceeding $1.2 billion provides multi-year visibility and recurring revenue potential.

Analysts remain bullish on SOUN stock, with three out of six rating it a "Strong Buy." The stock's average price target of $13.92 implies a 48.2% upside from its latest closing price.

Although the stock appears overvalued based on traditional metrics, its recent 23.6% outperformance over both sector and industry benchmarks suggests that near-term optimism is priced in.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 53 min | |

| 2 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 8 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 16 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite