|

|

|

|

|||||

|

|

The Clorox Company CLX reported third-quarter fiscal 2025 results, wherein both top and bottom lines missed the Zacks Consensus Estimate and declined on a year-over-year basis.

Clorox’s results highlight the impact of ongoing economic uncertainty, which led to shifts in consumer shopping habits, temporary slowdowns in certain product categories, and lower overall sales. Despite these headwinds, the company maintained strong fundamentals by holding market share, expanding profit margins, and continuing to invest in its trusted brands. Clorox remains focused on its long-term IGNITE strategy to drive sustainable growth.

Clorox also achieved gross margin expansion for the 10th consecutive quarter, driven by its strong cost-saving initiatives and effective margin management. The company benefited from ongoing efforts to improve efficiency across manufacturing and logistics, as well as from portfolio changes like the divestitures of the VMS and Argentina businesses, which removed lower-margin operations.

The company posted adjusted earnings of $1.45 per share, which missed the Zacks Consensus Estimate of $1.57. Also, the bottom line decreased 15% from $1.71 reported in the same quarter a year ago. The bottom-line results were impacted by reduced net sales, somewhat negated by higher gross margin. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

The Clorox Company price-consensus-eps-surprise-chart | The Clorox Company Quote

Net sales of $1.67 billion dipped 8% from the year-ago quarter, largely due to the sale of its VMS and Argentina businesses. Also, the metric missed the consensus mark of $1.71 billion. Organic sales were down 2% due to an unfavorable price mix, while organic volume remained flat as consumer demand slowed across most of the company’s product categories.

Despite the sales decline, the gross margin expanded 240 basis points (bps) year over year to 44.6% in the reported quarter, marking the company's 10th consecutive quarter of margin expansion. This growth was driven by substantial cost savings and gains from the divestitures of the VMS and Argentina businesses.

Sales of the Health and Wellness segment rose 3% year over year to $630 million. Our model predicted segment sales of $633.4 million. The increase was driven by a 7-point increase in volume, partially offset by 4 points of unfavorable price mix. The volume growth was mainly fueled by stronger consumer demand in the cleaning category, while the price mix was impacted by changes in product assortment and strong shipments to the Club channel. The segment-adjusted EBIT rose 10%, primarily fueled by lower manufacturing and logistics costs, higher sales and ongoing cost savings, though partially negated by increased advertising investments.

The Household segment’s sales declined 11% year over year to $469 million. Our model had predicted sales of $515.5 million for the segment. The segment’s sales declined mainly due to a 9-point decrease in volume and 2 2-point of unfavorable price mix. Segment adjusted EBIT fell by 18% from the year-ago quarter due to reduced sales offset by cost savings.

Sales in the Lifestyle segment fell 3% year over year to $306 million, resulting from a 2-point decrease in volume due to lower consumer demand and a 1% unfavorable price mix. We expected net sales of $315 million for the segment. Segment-adjusted EBIT declined 6% on account of reduced net sales.

In the International segment, sales declined 15% year over year to $263 million. We anticipated net sales of $238.7 million for the segment. However, excluding the impact of Argentina and a 3-point hit from foreign exchange rates, organic sales grew 2%, supported by a 1% increase in organic volume. Segment adjusted EBIT dipped 18% due to the Argentina divestiture, partially offset by cost savings.

Clorox ended the quarter with cash and cash equivalents of $226 million, long-term debt of $2.5 billion and stockholders’ equity of $27 million, excluding the non-controlling interest of $163 million.

As previously announced in August 2021, Clorox is making a significant investment to upgrade its technology and operations over five years. As part of this plan, the company expects to invest $560-$580 million in transformative technologies, including the replacement of its ERP system, a transition to a cloud-based platform, and broader digital transformation efforts. Of this total, approximately 70% will be recorded as incremental operating costs within selling and administrative expenses. Around 70% of these costs are related to the ERP implementation, with the remainder supporting other technology enhancements.

Aligning with its strategic priorities, Clorox completed the divestiture of its Better Health VMS business in the first quarter of fiscal 2025. The sale included the Natural Vitality, NeoCell, Rainbow Light, and RenewLife brands, along with related trademarks, licenses, and manufacturing and distribution facilities in Sunrise, FL. This divestiture supports the company’s goal to simplify its portfolio, reduce volatility, and drive more consistent and profitable growth by accelerating sales and structurally improving margins.

Clorox updated its FY25 outlook to reflect weaker consumer demand, tariffs, and higher expected shipments from its ERP transition. Management expects fiscal 2025 net sales to decline 1% to flat compared with 1% to 2% mentioned earlier. This includes a 2 percentage point negative impact from the divestiture of its business in Argentina and about 3 points of negative impact from the divestiture of its VMS business. Foreign exchange is expected to have a neutral effect. Organic sales are anticipated to increase 4-5% versus the previous projection of 4-7%. The organic sales guidance includes a 2- to 3-point negative impact from the ongoing ERP system transition, up from the previous estimate of 1 to 2 points.

The gross margin is expected to expand 150 bps compared with the 125-150 bps increase mentioned earlier, driven by the company’s holistic margin management efforts, partly offset by cost inflation, higher trade promotional expenses, and higher costs from newly implemented tariffs. Selling and administrative expenses are forecasted to be between 15% and 16% of net sales, indicating a 150-bps impact of strategic investments in digital capabilities and productivity enhancements.

Advertising and sales promotion spending is projected to be 11-11.5% of net sales, driven by CLX’s continued commitment to brand investment. The company expects the effective tax rate to be 26% for fiscal 2025. Excluding the impacts of the VMS sale, it expects an adjusted effective tax rate of 23%.

Clorox envisions a GAAP EPS of $5.73-$6.13 compared with the $5.52-$5.92 mentioned earlier. The raised EPS indicates a year-over-year increase of 155-172%.

The company still projects an adjusted EPS of $6.95-$7.35. The adjusted EPS suggests a 13-19% year-over-year increase. While this range remains unchanged from the previous forecast, it reflects the recent macroeconomic environment, including its impact on sales and earnings. The updated outlook also accounts for higher sales and profits expected from additional shipments tied to Clorox’s ERP system transition.

Adjusted EPS excludes an estimated 70 cents related to the long-term investment in digital capabilities and productivity enhancements, a loss of 94 cents from the VMS business divestiture in the fiscal first quarter, and 42 cents of benefit from cyberattack insurance recovery expected this fiscal year.

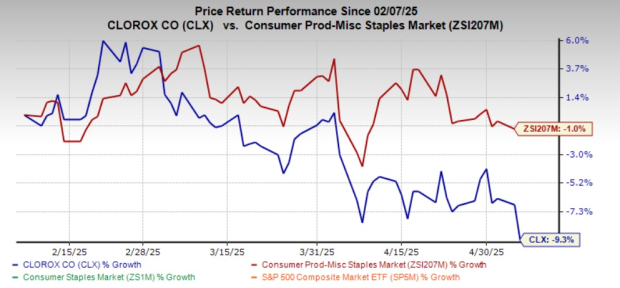

Shares of this Zacks Rank #3 (Hold) company have lost 9.3% in the past three months compared with the industry’s decline of 1%.

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural carries a Zacks Rank of 2 (Buy). UNFI delivered a trailing four-quarter earnings surprise of 408.7%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus estimate for United Natural’s current fiscal-year sales and earnings implies growth of 1.9% and 485.7%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 408.7%, on average.

Mondelez International, Inc. MDLZ manufactures, markets and sells snack food and beverage products in Latin America, North America, Asia, the Middle East, Africa and Europe. It presently carries a Zacks Rank of 2. MDLZ delivered a trailing four-quarter earnings surprise of 9.8%, on average.

The Zacks Consensus Estimate for Mondelez International’s current financial-year sales indicates growth of 4.9% from the year-ago numbers.

BRF Brasil Foods SA BRFS, formerly Perdigao S.A., is a Brazil-based food company. It carries a Zacks Rank #2 at present. BRFS delivered a trailing four-quarter average earnings surprise of 9.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-21 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite