|

|

|

|

|||||

|

|

Energizer Holdings, Inc. ENR reported second-quarter fiscal 2025 results, wherein both net sales and earnings lagged the Zacks Consensus Estimate. Also, the top and bottom lines decreased year over year.

The company reported modest growth in its battery segment but faced declines in Auto Care due to shipment timing shifts. Energizer introduced its new Podium Series, which saw widespread distribution across numerous stores. Gross margins improved, aided by cost-saving initiatives, while strategic refinancing extended the maturity of its credit facilities.

Despite these efforts, ENR lowered its full-year guidance, citing ongoing macroeconomic challenges and adjustments in market conditions. In response to the earnings miss and lowered outlook, shares of Energizer fell 7.8% yesterday.

Energizer Holdings, Inc. price-consensus-eps-surprise-chart | Energizer Holdings, Inc. Quote

Energizer’s adjusted earnings of 67 cents per share missed the Zacks Consensus Estimate of 68 cents. Also, the bottom line decreased 6.9% from the year-ago quarter’s reported figure. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

The company reported net sales of $662.9 million, which lagged the Zacks Consensus Estimate of $669 million and slightly decreased 0.1% from the year-ago quarter’s reported number. Organic net sales increased 1.4% year over year. The metric lagged our prediction of a 2.1% increase.

This organic net sales growth was primarily driven by volume increases of approximately 1.9% in Battery & Lights year over year, resulting from new and expanded distribution. Auto Care volumes remained flat, as gains from new distribution, international expansion and innovation were offset by a shift in the timing of refrigerant sales to the third quarter this year compared with the prior year. These gains were partially offset by planned strategic pricing and promotional investments totaling 0.5%.

Net sales of Energizer's Batteries & Lights segment increased 1.5% year over year to $488 million. The figure beat our estimate of a 1.1% increase. We note that segmental profit decreased 1.1% to $112.3 million.

Meanwhile, net sales in the Auto Care segment decreased 4.1% to $174.9 million from the year-ago period. Segmental profit decreased sharply 12.9% to $35.2 million.

In the fiscal second quarter, adjusted gross profit was $270.4 million, up 0.6% year over year. Energizer’s adjusted gross margin expanded 30 basis points to 40.8%. This improvement was largely driven by Project Momentum, which delivered approximately $16 million in savings during the fiscal second quarter. This benefit was partially offset by increased product costs, including higher freight and warehousing expenses, operating inefficiencies related to the final stages of the network transition under Project Momentum, and the planned strategic pricing and promotional investments mentioned previously. We expected an adjusted gross margin to be 40.5%, flat year over year.

Adjusted SG&A expenses increased 9.3% year over year to $124.5 million. The year-over-year increase was primarily driven by investments in digital transformation and growth initiatives, along with higher legal fees. These increases were partially offset by approximately $4 million in savings from Project Momentum during the quarter.

Adjusted SG&A costs, as a rate of net sales, were 18.8%, up 160 basis points from 17.2% recorded in the prior-year quarter. We expected adjusted SG&A expenses, as a percentage of net sales, to be 18% in the fiscal second quarter. Advertising and Promotion (A&P) expense decreased $0.6 million in the fiscal second quarter, representing 3.1% of net sales compared ith 3.2% in the year-ago period.

Adjusted EBITDA was $140.3 million, down 1.5% year over year, whereas the adjusted EBITDA margin decreased 30 basis points to 21.2%.

As of March 31, 2024, Energizer’s cash and cash equivalents were $139.3 million, with long-term debt of $3.15 billion and shareholders' equity of $133.9 million. The operating cash flow as of the fiscal second quarter was $64.2 million and free cash flow was $8.6 million.

The acquisition of Advanced Power Solutions NV (“APS”) was completed on May 2, 2025.

The company's financial outlook for fiscal 2025 implies a cautious stance amid recent tariff uncertainty and broader economic volatility, which are expected to affect category demand. Although direct tariff impacts have been broadly offset through a combination of sourcing adjustments and pricing strategies, the uncertain macroeconomic environment has led to a more conservative forecast.

For fiscal 2025, both reported and organic net sales are now expected to range from flat to up 2% compared with the company’s previous outlook of 1% to 2% and 2% to 3% growth, respectively, year over year.

Adjusted EBITDA is projected to be between $610 million and $630 million compared with the previous estimation of $625 million to $645 million. Adjusted earnings per share are expected in the range of $3.30 to $3.50 compared with the prior estimate of $3.45-$3.65. The company expects free cash flow to be in the range of 6% to 8% of net sales for fiscal 2025, with an anticipated debt paydown of approximately $100 million.

For the third quarter, the company anticipates reported and organic net sales to be flat to down 2%, with adjusted EPS projected between 55 cents and 65 cents.

This guidance excludes any contribution from the recently acquired APS business in Europe, which is expected to be neutral to adjusted EPS for fiscal 2025.

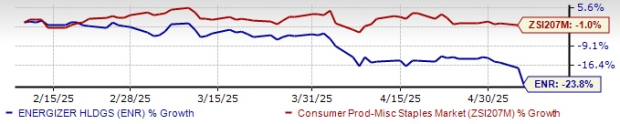

ENR Stock Past Three-Month Performance

Shares of this Zacks Rank #3 (Hold) company have lost 23.8% in the past three months compared with the industry’s decline of 1%.

We have highlighted three better-ranked stocks, namely Nomad Foods Ltd. NOMD, United Natural Foods, Inc. UNFI and Canada Goose GOOS.

Nomad Foods manufactures and distributes frozen foods. NOMD presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NOMD’s current financial-year sales and earnings indicates growth of 7% and 11.4%, respectively. Nomad Foods delivered a trailing four-quarter earnings surprise of 5%, on average.

United Natural is the leading distributor of natural, organic and specialty food and non-food products. It currently carries a Zacks Rank of 2 (Buy).

UNFI delivered a trailing four-quarter earnings surprise of 408.7%, on average. The consensus estimate for United Natural’s current financial-year sales and earnings indicates growth of 1.9% and 485.7%, respectively, from the year-ago period’s reported figures.

Canada Goose is a global outerwear brand. GOOS is a designer, manufacturer, distributor and retailer of premium outerwear for men, women and children. It carries a Zacks Rank #2 at present.

The Zacks Consensus Estimate for GOOS’s current fiscal-year earnings and revenues implies declines of 1.4% and 4.9%, respectively, from the year-ago actuals. Canada Goose delivered a trailing four-quarter average earnings surprise of 71.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 5 hours | |

| 5 hours | |

| 7 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite