|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Tapestry, Inc. TPR continues to drive its growth strategy through international expansion. In third-quarter fiscal 2025, the company reported an 8% increase in international revenues at constant currency, reflecting strong performance across key global markets.

Europe was the standout region, with a 35% revenue growth rate, driven by robust local consumer demand and significant customer acquisition, especially among Gen Z. Tapestry views Europe as an underpenetrated market and expects 30% growth for the year, signaling opportunities for expansion.

In the Asia-Pacific region, TPR recorded a 4% revenue increase, with Greater China showing 5% growth despite broader category declines in the market. The company’s success in China is largely due to its targeted approach toward younger consumers, particularly Gen Z, and its strong brand positioning. Tapestry emphasized that it has not observed any adverse impacts of anti-American sentiment, and consumer engagement with its brands remains healthy. The company remains confident in China’s long-term growth potential and continues to invest in the region to capture opportunities.

TPR’s agile and diversified supply chain plays a key role in supporting its international growth. Approximately 70% of its manufacturing is based outside China, mainly in Vietnam, Cambodia and the Philippines. This geographic diversity helps mitigate geopolitical risks and tariff-related impacts. Tapestry has also taken proactive steps like inventory pull-forward and supply-chain optimizations to minimize potential disruptions while maintaining its focus on quality and brand integrity.

Digital expansion is another cornerstone of Tapestry’s international growth strategy. Digital sales grew at a mid-teens rate and now account for roughly 30% of total revenues. This complements strong performance in brick-and-mortar retail, wherein global sales grew at a mid-single-digit rate. The omnichannel approach allows TPR to engage with international customers across both digital and physical platforms, enhancing its reach and customer experience worldwide.

The Coach brand remains a key driver of TPR’s international momentum. The popularity of collections like Tabby and New York has resonated strongly with global consumers, particularly Gen Z. The company’s marketing strategy blends global brand consistency with localized relevance, ensuring strong consumer connections in each market. Experiential retail initiatives, like Coach Play concept stores, are strengthening engagement and driving repeat visits.

The company raised its financial outlook for fiscal 2025. It expects revenues of $6.95 billion, indicating 4% growth from the prior year on a reported basis. This revised forecast is ahead of the previous guidance of 3% growth. Regionally, the company expects sales to grow 3-4% in North America, 30% in Europe, in the low-single digits in Greater China and the high-single digits in other parts of Asia, along with a mid-single-digit decline in Japan. TPR remains confident that international expansion will continue to fuel its long-term growth and market leadership.

TPR is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 16.08X, which positions it at a discount compared with the Retail-Apparel and Shoes industry’s average of 17.41X. Also, TPR is priced lower than the Retail-Wholesale sector’s average of 24.33X.

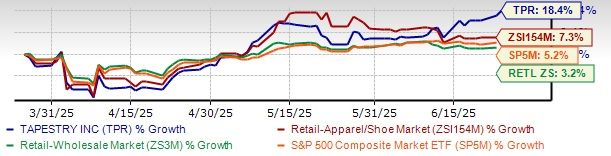

Shares of this Zacks Rank #3 (Hold) company have rallied 18.4% in the past three months compared with the Zacks industry’s 7.3% growth. This leading lifestyle specialty retailer’s ongoing strategic initiative and operational efficiencies have enabled it to outperform the broader sector and the S&P 500 index’s growth of 3.2% and 5.2%, respectively, during the same period.

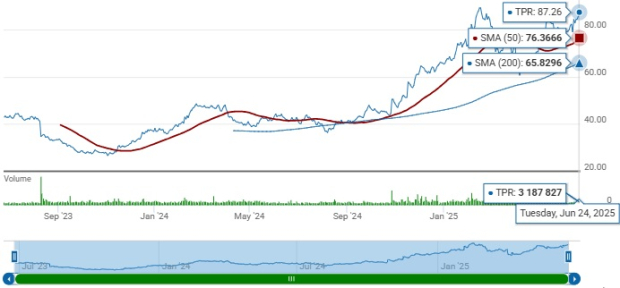

Closing at $87.26 as of yesterday, the TPR stock is trading 4% below its 52-week high of $90.85 attained on Feb. 18, 2025. The stock is trading above its 50 and 200-day SMAs (simple moving averages) of $76.37 and $65.83, respectively, highlighting a continued uptrend.

The positive sentiment surrounding TPR is reflected in the upward revisions in the Zacks Consensus Estimate for earnings. In the past 60 days, the consensus estimate has moved up 13 cents to $5.05 per share for the current fiscal year and by 12 cents to $5.43 for the next fiscal year, indicating year-over-year growth of 17.7% and 7.6%, respectively. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

The Zacks Consensus Estimate for the current and the next fiscal year’s sales is pegged at $6.96 billion and $7.17 billion, implying year-over-year growth of 4.3% and 3%, respectively.

Some better-ranked stocks are Urban Outfitters Inc. URBN, Canada Goose GOOS and Allbirds Inc. BIRD.

Urban Outfitters is a lifestyle specialty retailer that offers fashion apparel and accessories, footwear, home decor and gift products. It currently flaunts a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for URBN’s fiscal 2026 earnings and sales implies growth of 22.2% and 8.5%, respectively, from the year-ago actuals. URBN delivered a trailing four-quarter average earnings surprise of 29%.

Canada Goose is a global outerwear brand. GOOS is a designer, manufacturer, distributor and retailer of premium outerwear for men, women and children. It carries a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Canada Goose’s current fiscal year’s earnings and sales implies growth of 10% and 2.9%, respectively, from the year-ago actuals. Canada Goose delivered a trailing four-quarter average earnings surprise of 57.2%.

Allbirds is a lifestyle brand that uses naturally derived materials to make footwear and apparel products. It carries a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for Allbirds’ current financial year’s earnings implies growth of 16.1% from the year-ago actual. The company delivered a trailing four-quarter average earnings surprise of 21.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| Feb-22 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite