|

|

|

|

|||||

|

|

Northrop Grumman Corporation NOC recently achieved a major milestone with the successful operational assessment flight testing of its Integrated Viper Electronic Warfare Suite (“IVEWS”) on U.S. Air Force F-16 jets. The system proved its effectiveness against advanced radar-guided threats in complex, real-world scenarios, strengthening its potential for full-scale production and deployment.

The testing also demonstrated IVEWS’ seamless digital interoperability with Northrop’s SABR radar, enabling simultaneous electronic warfare and targeting. This achievement highlights Northrop’s leadership in next-gen defense technology and reinforces its growth prospects in the defense electronics segment.

With rapidly rising demand for advanced military systems worldwide, this development might encourage investors to add NOC stocks to their portfolios.

However, before making any hasty decision, let’s delve into the company’s year-to-date performance, growth prospects and risks (if any) to investing in the same.

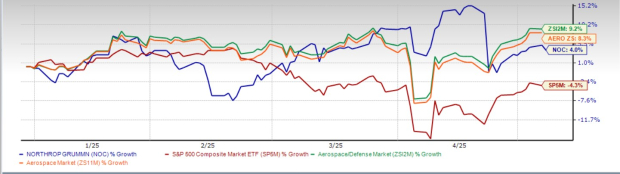

Shares of Northrop have rallied 4% in the year-to-date period, underperforming the Zacks aerospace-defense industry’s growth of 8.3% as well as the broader Zacks Aerospace sector’s growth of 9.2%. NOC, however, surpassed the S&P 500’s fall of 4.3% in the past year.

A similar upward trend can be witnessed in the share price return of other industry players like Embraer ERJ and The Boeing Company BA, which have seen an increase of 26.7% and 5.1%, respectively, in the year-to-date period.

Northrop’s strong presence in Air Force, Space & Cyber Security programs, with its product line being well-positioned in high-priority categories, such as defense electronics, unmanned aircraft and missile defense, has always played the role of a key catalyst in the company’s growth story. Such order flows culminate in a strong backlog count for the company, bolstering its revenue prospects. This might have been reflected in NOC's year-to-date share price hike.

Northrop’s backlog as of March 31, 2025, totaled a solid $92.80 billion. The company expects to recognize approximately 40% and 65% as revenues over the next 12 months and 24 months, respectively, with the remainder to be recognized thereafter.

Northrop’s stable financial position must have also been attracting investors. Its cash and cash equivalents totaled $1.69 billion. Its long-term debt was $14.17 billion as of March 31, 2025, while its current debt was nil. Hence, it would be safe to conclude that the stock holds a strong solvency position, at least in the near term.

Northrop continues to benefit from robust growth opportunities amid rising global security threats and geopolitical tensions. As nations — both developed and developing — boost defense budgets to enhance military capabilities, contractors like Northrop are well-positioned for long-term gains. The current U.S. administration’s strong emphasis on national defense further supports this outlook.

In May 2025, a White House report noted President Trump’s proposal to raise defense spending by 13% to $1.01 trillion for fiscal year 2026. A key focus of the budget is reinforcing U.S. space dominance and strengthening the nation’s nuclear deterrent. These priorities align well with Northrop’s capabilities, particularly its Defense Support Program satellites, which have served as the spaceborne component of NORAD’s Tactical Warning and Attack Assessment system since 1970. These satellites play a critical role in detecting ballistic missile launches and nuclear detonations. As defense priorities evolve, Northrop stands to gain from increased investment in advanced space and missile detection systems.

In line with this, the Zacks Consensus Estimate for NOC’s long-term (three-to-five years) earnings growth is pegged at a solid 3.30%.

Let’s take a quick sneak peek at its near-term earnings and sales estimates to understand how NOC may perform over the next few quarters.

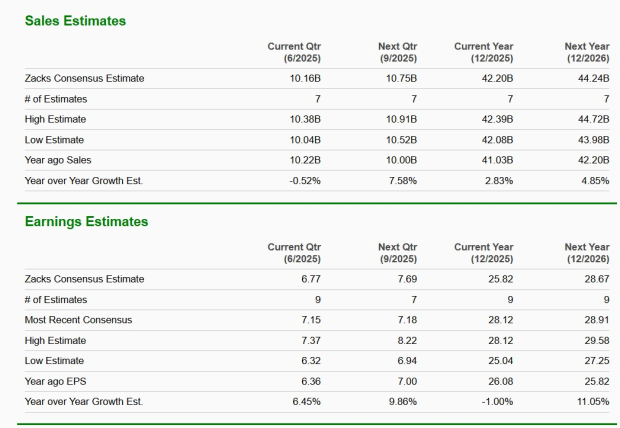

The Zacks Consensus Estimate for NOC’s 2025 and 2026 sales suggests an improvement of 2.8% and 4.9%, respectively, year over year. NOC’s 2025 earnings estimate indicates a year-over-year deterioration of 1%, while that for 2026 implies an improvement of 11.1%.

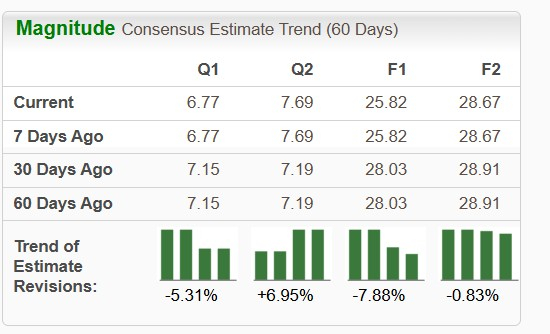

However, the Zacks Consensus Estimate for 2025 and 2026 earnings per share has moved down 7.9% and 0.8%, respectively, over the past 60 days. This indicates analysts’ declining confidence in the stock’s earnings capabilities.

In terms of valuation, NOC’s forward 12-month price-to-earnings (P/E) is 18.18X, a premium to its peer group’s average of 17.47X. This suggests that investors will be paying a higher price than the company's expected earnings growth compared to that of its peer group.

Its industry peer is however trading at a discount compared to Northrop. Embraer's forward 12-month P/E is 17.64X.

Despite its strong standing as a top defense contractor, Northrop faces key industry challenges, notably a skilled labor shortage. The 2024 "On the Horizon" Workforce Study by the Aerospace Industries Association (“AIA”) and PwC highlights a 13% attrition rate among AIA members —well above the U.S. average of 3.8% — driven by high turnover and retirements. This talent gap poses risks to production timelines and quality, as the loss of experienced workers can hinder efficiency. If workforce shortages persist, aerospace-defense stocks like Northrop, Boeing and Embraer may struggle to meet delivery schedules, which might affect their operational performance.

Moreover, Northrop has been experiencing increased manufacturing costs, which led it to incur a $477 million pre-tax loss in the first quarter. If these cost challenges persist, they could affect the company’s overall performance in the coming quarters.

Investors interested in Northrop should wait for a better entry point, considering its premium valuation and downward revision in its near-term earnings estimates.

However, those who already own this Zacks Rank #3 (Hold) company’s shares may stay invested as its financial stability, positive share price performance over the past year and solid backlog count offer solid growth prospects in the long run. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours |

BAE Systems In Buy Zone On Major Contracts; Boeing Lands Defense Awards

BA

Investor's Business Daily

|

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 9 hours | |

| 10 hours | |

| 14 hours | |

| 15 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite