|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Coty Inc. COTY posted third-quarter fiscal 2025 results, wherein both top and bottom lines missed the Zacks Consensus Estimate. Both net sales and earnings also experienced year-over-year declines.

The company's soft third-quarter performance was impacted by foreign exchange headwinds and broader market challenges. However, Coty remains well-positioned heading into fiscal 2026, backed by a solid strategic and financial foundation. Despite weaker revenue results, the company is moving forward with a multi-pronged attack plan centered on innovation, expanded distribution and improved operational efficiency.

Management has identified fiscal 2025 as a transitional year, particularly for the Prestige segment, which is contending with a slowing fragrance market, tough comparisons following a blockbuster innovation cycle and efforts to normalize elevated retailer inventories. In the Consumer Beauty segment, Coty is recalibrating its approach to address divergent market trends between cosmetics and fragrances. The focus is on boosting profitability in cosmetics while accelerating growth in mass fragrances, where the company holds a leadership position. Organizational restructuring and a reinforced cost-saving program are expected to further support long-term growth.

In the fiscal third quarter, Coty delivered adjusted earnings of 1 cent per share, which missed the Zacks Consensus Estimate of 5 cents. Also, the bottom line declined from 5 cents reported in the year-ago quarter. (Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.)

Coty price-consensus-eps-surprise-chart | Coty Quote

Coty’s net revenues were $1,299.1 million, down 6% year over year. The metric reflected a 3% adverse impact from unfavorable foreign currency exchange. Quarterly net revenues missed the Zacks Consensus Estimate of $1,305 million.

On a like-for-like (“LFL”) basis, Coty’s net revenues dipped 3%, reflecting a 3% decrease in Prestige and a 5% decline in Consumer Beauty. We expected LFL revenues to decrease 1.5%.

The company saw continued e-commerce sell-out in both Prestige and Consumer Beauty in the fiscal third quarter, which accounts for roughly 20% of its sales.

The adjusted gross margin was 64.3%, contracting 50 basis points (bps). Reported gross margin decreased 70 bps to 64.1%, reflecting a normalization from the elevated levels observed in the prior-year quarter.

Coty reported an adjusted operating income of $147.9 million, a 3% increase from the prior year’s level. The company's adjusted operating margin was 11.4%, expanding 100 bps year over year.

The adjusted EBITDA of $204.2 million rose 2% year over year. The adjusted EBITDA margin was 15.7%, reflecting an increase of 130 bps, driven by short-term savings.

Prestige: Net revenues in the segment were $829.4 million, accounting for 64% of total company sales. This represented a 4% drop on a reported basis, including a 1% headwind from foreign exchange. On a LFL basis, revenues declined 2.5%. This drop was caused by softer prestige makeup sales, a moderating prestige fragrance category and tough comparisons due to major fragrance launches in the prior-year quarter.

The segment's adjusted operating income was $158.8 million, up from $147.3 million reported in the year-ago quarter. The adjusted operating margin was 19.1%, up 210 bps year over year. The Prestige fragrance category continues to outpace the beauty market, increasing in mid-single-digit percentage in the reported quarter.

Looking ahead, the Prestige segment is set to benefit from a strong innovation pipeline, including blockbuster product launches planned for both the first and second halves of fiscal 2026. The company also plans to extend one of its major brands into the U.S. market. A new brand launch is scheduled for Amazon in the fall. Additionally, the segment will pursue further expansion into scenting, ultra-premium fragrances, body mists and pen sprays, underscoring its focus on diversification and premiumization.

Consumer Beauty: Net revenues amounted to $469.7 million, accounting for 36% of total sales. This represented a 9% decline on a reported basis, hurt by a 4% headwind from foreign exchange. The decline was primarily caused by weaker performance in color cosmetics and body care, alongside the foreign exchange impact. These pressures were partially offset by growth in mass fragrance and mass skincare.

The segment reported an adjusted operating loss of $10.9 million compared with a loss of $3.4 million in the prior-year quarter. The adjusted loss margin was 2.3%, down from an adjusted operating loss margin of 0.7% reported in the year-ago quarter. The global mass beauty market growth slowed to a low-single-digit pace, below the nearly 10% growth in the prior-year quarter, benefiting from inflation-related pricing.

For fiscal 2026 and beyond, the Consumer Beauty segment is focused on driving growth through a robust pipeline of innovation and channel expansion. Building on the success of the adidas Vibes collection, the company plans to introduce new innovations under its key mass fragrance brands, along with launching co-developed fragrance lines in partnership with major retailers.

The portfolio will also expand into adjacent categories such as body mists. In cosmetics, the company aims to introduce advanced technologies, particularly in mascara and nail products. These efforts will be supported by an increased focus on high-impact channels, including e-commerce and TikTok Shop.

Coty’s Americas segment reported net revenues of $529.7 million, accounting for 40.8% of total sales. This reflected a 10% decline on a reported basis, including a 4% headwind from foreign exchange and a 6% decline on a LFL basis. The decline was primarily caused by lower Prestige revenues in the United States, largely due to tough comparisons against elevated innovation levels in the prior year and a higher level of retailer stock entering the period. Additionally, Consumer Beauty sales in the United States were negatively impacted by market softness during the quarter, while body care revenues in Brazil also declined.

Coty’s EMEA segment generated net revenues of $610 million, accounting for 47% of total sales. This marked a 3% decline on a reported basis, including a 2% negative impact from foreign exchange and reflected lower reported revenues in both the Consumer Beauty and Prestige segments. On an LFL basis, EMEA net revenues decreased 1% in the fiscal third quarter.

Coty’s Asia Pacific segment reported net revenues of $159.4 million, representing 12.3% of total sales. This reflected a 5% decline on a reported basis, primarily caused by lower Prestige revenues in mainland China and the Asia Travel Retail channel. On an LFL basis, Asia Pacific net revenues declined 4%.

The company ended the quarter with cash and cash equivalents of $243.5 million and net long-term debt of $3,796.1 million. For the nine months ended March 31, 2025, cash provided by operating activities amounted to $409.4 million.

As fiscal 2025 marks a transitional year for Coty, it is focused on resetting the baseline, particularly in the fiscal third quarter and more so in the fiscal fourth quarter. This includes right-sizing retailer inventories to align with current demand trends, reallocating resources within Consumer Beauty to prioritize high-margin categories, scaling cosmetics innovations and maintaining disciplined promotional activity to protect brand equity. These actions aim to position Coty for a gradual improvement in sales trends throughout fiscal 2026, supported by major launches across both divisions, geographic and channel expansion, and incremental pricing gains.

In parallel, Coty is implementing strategic interventions to strengthen the business heading into fiscal 2026 and beyond. This includes enhanced fixed cost and productivity savings to protect profitability and reinvest in its brands, along with organizational and leadership changes in key markets like the United States to drive better execution and sell-out performance.

Given ongoing category trends and its proactive measures, the company expects a high single-digit LFL sales decline in the fiscal fourth quarter, resulting in a 2% LFL decline for fiscal 2025. Reported sales are projected to decline mid-single digits, including an estimated 3% headwind from foreign exchange.

Coty reaffirms its expectation of fiscal 2025 gross margin expansion to approximately 65% and anticipates EBITDA margin growth of about 70 basis points to roughly 18.5%, at the lower end of the guidance. This implies broadly flat EBITDA for fiscal 2025, including a low single-digit foreign exchange headwind.

Lower interest expense and a reduced tax rate are expected to support relatively stronger earnings per share performance, with 49-50 cents forecasted for fiscal 2025, near the low end of the previous guided range.

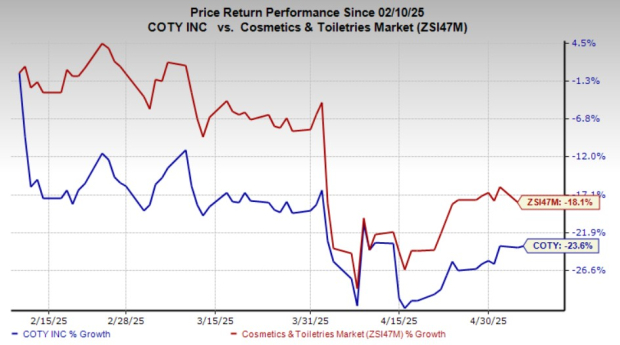

Shares of this Zacks Rank #4 (Sell) company have lost 23.6% in the past three months compared with the industry’s 18.1% decline.

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus estimate for United Natural’s current fiscal-year sales and earnings implies growth of 1.9% and 485.7%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 408.7%, on average.

Mondelez International, Inc. MDLZ manufactures, markets and sells snack food and beverage products in Latin America, North America, Asia, the Middle East, Africa, and Europe. It presently carries a Zacks Rank of 2. MDLZ delivered a trailing four-quarter earnings surprise of 9.8%, on average.

The Zacks Consensus Estimate for Mondelez International’s current financial-year sales indicates growth of 4.9% from the year-ago numbers.

BRF S.A. BRFS raises, produces and slaughters poultry and pork for processing, production and sale of fresh meat, processed products, pasta, margarine, pet food and other products. It currently carries a Zacks Rank of 2. BRFS delivered a trailing four-quarter earnings surprise of 9.6%, on average.

The Zacks Consensus Estimate for BRF S.A.'s current fiscal-year sales indicates growth of 0.3% from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite