|

|

|

|

|||||

|

|

Last Friday, Exxon Mobil Corporation XOM reported first-quarter 2025 earnings, which exceeded expectations. This was driven by higher production from Guyana, the Permian Basin and structural cost savings, all contributing to a strong business outlook.

Before analyzing the factors driving this positive outlook, let’s first review the first-quarter results.

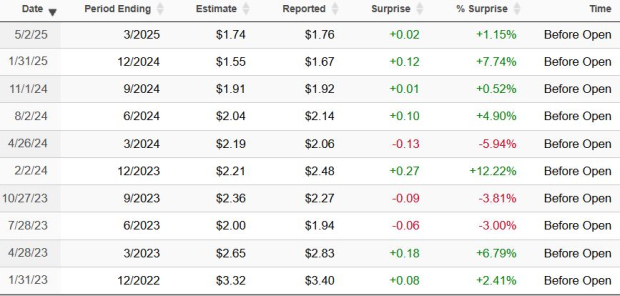

ExxonMobil reported earnings per share of $1.76 (excluding identified items), which beat the Zacks Consensus Estimate of $1.74. The bottom line, however, declined from the year-ago level of $2.06.

Total quarterly revenues of $83.13 billion missed the Zacks Consensus Estimate of $84.15 billion. The top line, however, increased marginally from the year-ago figure of $83.08 billion.

Chevron Corporation CVX and BP plc BP are two other prominent integrated energy companies. Both have already reported results.

With a strong focus on strengthening its presence in the Permian, ExxonMobil completed the acquisition of Pioneer Natural Resources Company on May 3, 2024. With 1.4 million net acres of the combined company in the Delaware and Midland basins, having an estimated 16 billion barrels of oil equivalent resource, ExxonMobil has greatly transformed its upstream portfolio.

The Pioneer Natural acquisition's average annual synergy, which XOM earlier estimated at roughly $2 billion over 10 years, has now been revised upward to more than $3 billion annually.

Similar to its operations in the Permian, ExxonMobil boasts a robust project pipeline in offshore Guyana resources. Notably, Guyana operations have achieved a production rate of 650,000 barrels per day within just 10 years of the initial oil discovery.

Along with the first-quarter earnings results, XOM noted that it is launching 10 advantageous projects this year that will generate more than $3 billion in earnings next year. These projects are termed advantageous because they can produce substantial cash flows even in an unfavorable commodity pricing environment, as the focus remains on premium products, while gaining entry to key markets, and adhering to or staying under budget.

Among the notable projects is a large chemical plant in China. The project was under budget and commenced ahead of schedule, aiding XOM in capitalizing on attractive local demand while addressing tariff concerns. These advantageous projects will help XOM achieve its goal of increasing cash flow by $30 billion by the decade's end.

Chevron reported adjusted first-quarter earnings per share of $2.18, beating the Zacks Consensus Estimate of $2.15. The outperformance stemmed from higher-than-expected U.S. natural gas production in the company’s key upstream segment. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

However, the bottom line of CVX came well below the year-ago adjusted profit of $2.93 due to weaker oil price realizations and a dip in refined product sales margins.

The company generated revenues of $47.6 billion. The sales figure missed the Zacks Consensus Estimate of $48.7 billion and decreased 2.3% year over year. For more details, read our blog: Natural Gas Lifts Chevron Q1 Earnings Amid Oil Weakness.

BP reported first-quarter 2025 adjusted earnings of 53 cents per American Depositary Share on a replacement-cost basis, excluding non-operating items. The figure lagged the Zacks Consensus Estimate of 56 cents. The bottom line also declined from the year-ago reported figure of 97 cents.

BP’s total quarterly revenues of $47.9 billion lagged the Zacks Consensus Estimate of $57.2 billion and declined from $49.9 billion reported a year ago.

The weak quarterly results can be primarily attributed to lower liquid price realizations and weaker refining margins. Lower contributions from the company's customers and products business also affected the results. For more details, read our blog: BP's Q1 Earnings & Revenues Miss Estimates on Weak Refining.

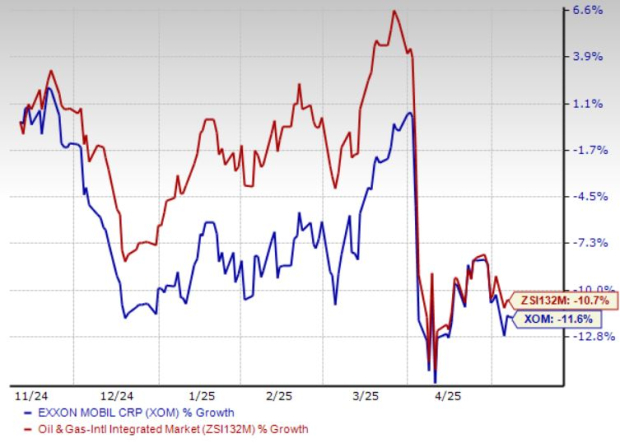

To reshape its portfolio toward more profitable projects, XOM has divested $24 billion in non-core assets since 2019. Despite these positive developments, the stock declined 11.6% in the past six months, underperforming the 10.7% plunge of the composite stocks belonging to the industry.

Six-Month Price Chart

Among the possible negative factors that could continue to hurt ExxonMobil’s stock price is its chemicals business, which is facing challenges because of oversupply concerns.

Moreover, XOM is currently dealing with two major legal challenges. One is against the European Union, which introduced a special windfall tax on unusually high profits earned by energy companies. The integrated energy giant believes this tax is unfair and is taking legal action to challenge it.

The second case involves the California Attorney General, who has accused XOM of misleading the public about the environmental benefits of its advanced plastic recycling technology. The company strongly disagrees with the accusation and is defending itself in court.

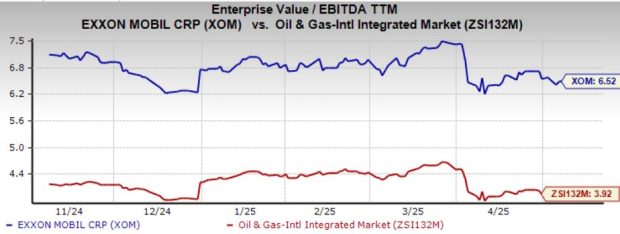

Despite the stock price decline, with several uncertainties engulfing the business, XOM appears relatively overvalued. The stock is trading at a 6.52x trailing 12-month Enterprise Value to Earnings Before Interest, Taxes, Depreciation and Amortization (EV/EBITDA), which is at a premium compared with the broader industry average of 3.92x.

Considering the uncertainty and expensive valuations, it might not be the right time to bet on the stock. Those who have already invested may retain the stock, which carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Saudi Aramco begins Jafurah condensate exports with sales to US and India

XOM CVX

Offshore Technology

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 |

Trump And Iran Put Oil Prices Near Six-Month Highs But This Energy Industry Was Already Rallying

XOM CVX

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite