|

|

|

|

|||||

|

|

PayPal Holdings (NASDAQ: PYPL) stock has taken investors on a roller-coaster ride over the past few years. After a steep decline from its pandemic-era highs, the stock has oscillated between $50 and $90 per share. Today, the stock is priced near its lowest valuation since going public, showing how investor sentiment toward the fintech has soured in recent years.

Under CEO Alex Chriss, who stepped into the top role in 2023, PayPal is working on improving its profit margins and reigniting its growth trajectory. If PayPal's bargain price tempts you, here are a few key things to consider.

PayPal has experienced a notable slowdown in growth. While it once enjoyed rapid revenue and earnings increases, especially during the pandemic when digital payments boomed, the pace has since tapered off.

PayPal faces stiff competition from several big players in the digital payment space. Alternatives like Apple Pay, Google Pay, Shopify Payments, Zelle, and Block's Cash App are all vying for consumers' attention, alongside traditional credit and debit payment methods.

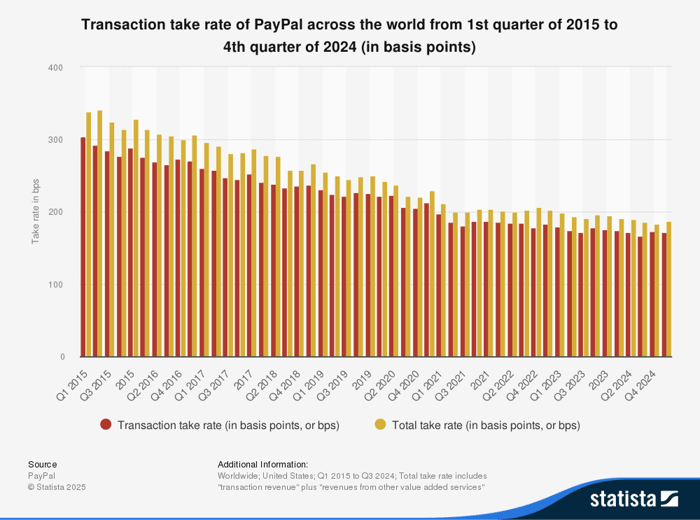

One key area of concern is PayPal's decline in its take rate, which is the percentage of transaction value that the company retains as revenue. As competition in the payment space heats up, PayPal's take rate has slowly declined year after year.

Image source: Statista.

Last year was expected to be a transformational one for PayPal, with investors hoping the company would regain its footing and chart a promising course for the future. Unfortunately, the outlook hasn't been as bright as expected.

The stock price took a hit in February after PayPal released its full-year results for 2024. Among investors' concerns was slow growth in unbranded transactions, prompting fears that the company's aggressive push for profitability and improved margins might stunt its transaction growth instead.

Given the unknown impact of tariffs on consumer spending and the broader economy, PayPal also offered more conservative earnings guidance for the year, even after strong first-quarter results.

PayPal's stock has become significantly more affordable over time. However, as noted above, some of this price drop is due to a slowdown in growth and pressure on the company's take rate. That said, the stock is trading at an attractive price point. In fact, it's one of the cheapest valuations on several measures since it spun off from eBay in 2015.

PYPL PE Ratio data by YCharts

CEO Alex Chriss took the top role as PayPal's chief in September 2023. Chriss came over from Intuit, where he has experience developing the company's small and medium-sized business and played a key role in driving growth.

Under Chriss, PayPal is undertaking several initiatives, like PayPal Complete Payments, to encourage more usage of its branded products. These initiatives aim to boost profit margins and user engagement on PayPal's platform. The company is also leveraging its extensive customer data to help merchants create personalized experiences and encourage repeat purchases.

Last week, the company announced that its ad business, PayPal Ads, would start selling programmatic ads to marketers. This will enable companies to make targeted ads on other publishers' websites, using data from PayPal to create custom advertisements and promos. PayPal sees programmatic ads as a way to enhance its platform, grow ad revenue, and compete with large social networks that dominate the space.

Another positive is that PayPal continues to benefit from a first-mover advantage in the payment space. According to a survey conducted by Motley Fool Money, 85% of all respondents use PayPal. The next-closest competitor is Block's Cash App, with 54% of respondents using the app.

Image source: Getty Images.

PayPal presents a compelling value opportunity for investors, even as its turnaround takes time. The company is working on boosting its margins, expanding its platform adoption, and integrating its services while building up its ad business.

The company believes its shares are undervalued, too. Earlier this year, the board approved a $15 billion stock buyback authorization, allowing it to reduce its outstanding share count and boost earnings per share.

It's been a challenging ride for investors in recent years. That said, I believe PayPal's stock is a buy at today's valuation and that investors willing to hold for the long haul (five years or more) could be handsomely rewarded for their patience.

Before you buy stock in PayPal, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PayPal wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $623,103!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $717,471!*

Now, it’s worth noting Stock Advisor’s total average return is 909% — a market-crushing outperformance compared to 162% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of May 5, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Courtney Carlsen has positions in Alphabet, Apple, Block, and PayPal. The Motley Fool has positions in and recommends Alphabet, Apple, Block, Intuit, PayPal, Shopify, and eBay. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short June 2025 $77.50 calls on PayPal. The Motley Fool has a disclosure policy.

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite