|

|

|

|

|||||

|

|

JD.com JD is slated to report first-quarter 2025 results on May 13.

For the first quarter, the Zacks Consensus Estimate for revenues is pegged at $40.2 billion, indicating growth of 11.63% from the year-ago quarter’s reported figure.

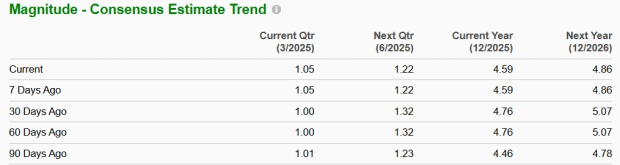

The consensus mark for earnings is pinned at $1.05 per share, suggesting 34.62% growth from the prior-year quarter’s reported number.

See the Zacks Earnings Calendar to stay ahead of market-making news.

In the last reported quarter, the company delivered an earnings surprise of 13.33%. The company’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 25.23%.

Our proven model does not predict an earnings beat for JD.com this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

JD has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

JD.com enters the first quarter of 2025 following a strong fourth quarter in 2024, where revenues grew 13% year over year and non-GAAP net profit increased 34%. However, despite this momentum, investors may want to reassess their positions and remain cautious.

JD’s top-line growth in the fourth quarter was driven by a 16% increase in electronics and home appliances revenues and an 11% rise in general merchandise revenues. This was supported by government stimulus and improvements in supply chain and fulfilment capabilities. However, the company stated that sales of home appliances in early 2025 were temporarily affected due to demand being pulled forward into late 2024.

JD’s business segment faced a significant decline in the prior quarter. Revenues of the segment decreased 31% year over year due to adjustments made with its Jingxi business. The non-GAAP operating loss also widened in this segment, attributable to the Jingxi business adjustments, as the company penetrated into lower-tier markets with an expanded offering of value-for-money products. Lower-tier markets remained a priority for JD in the first quarter of 2025, suggesting that the top line in the business segment was likely still under pressure during the quarter under review.

JD.com has been actively investing in AI across various functions. The company launched an AI shopping assistant called Jinnian and deployed proprietary industrial robotics in its fulfilment centers. These technologies aim to improve operational efficiency, reduce fulfilment costs, and streamline internal workflows. However, the company described these efforts as part of an ongoing, long-term strategy, with many applications still in early stages. As a result, the continued rollout and integration of AI tools, while strategically important, are likely to have increased short-term operating expenses, potentially weighing on near-term profitability.

JD Logistics expanded its presence in Europe by opening its third warehouse in Poland in the first quarter of 2025, adding nearly 10,000 square meters of storage space. JD’s infrastructure investments, including the ongoing warehouse expansion, possibly weighed on margins despite operational efficiency improvements.

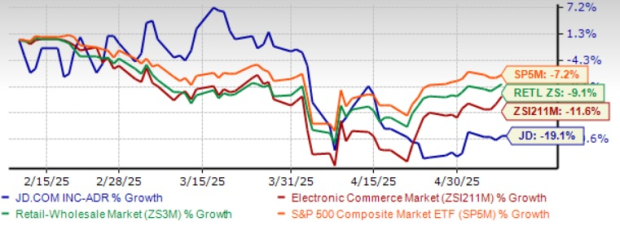

JD.com shares have plunged 19.1% in the past three months compared with the Internet - Commerce industry, the Zacks Retail-Wholesale sector and the S&P 500 index’s decline of 11.6%, 9.1% and 7.2%, respectively.

JD has also underperformed its industry peers, Amazon AMZN, Alibaba BABA and PDD Holdings Inc. Sponsored ADR PDD. Shares of AMZN and PDD have lost 17.6% and 5.5%, respectively, in the past three months, while BABA stock has gained 13%.

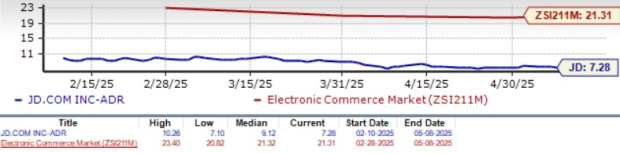

From a valuation perspective, JD currently trades at a forward 12-month P/E ratio of 7.28X, which is well below the Zacks Internet - Commerce industry’s 21.31X. This suggests that investors may be paying a lower price relative to the company's expected earnings growth.

JD.com enters the first quarter of 2025 with solid year-over-year growth expectations, However, investors may want to consider exiting positions given a deteriorating risk and reward profile. Appliance sales are expected to have been negatively impacted due to demand pulled forward in late 2024, while the company’s business segment is expected to have remained under pressure from continued adjustments in its Jingxi business and lower-tier market expansion. Additionally, JD’s aggressive investments in AI, robotics, and international logistics, though strategically important, may elevate short-term operating expenses. Given these short-term headwinds, JD.com remains a stock to avoid until clearer recovery indicators emerge.

Despite strong year-over-year growth estimates, JD.com faces near-term headwinds from Jingxi adjustments, pulled-forward demand and rising expenses from early-stage AI and logistics investments. With weak earnings signals and its stock price underperformance, JD remains unattractive. Investors may prefer to wait for clearer recovery indicators.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 26 min | |

| 39 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite