|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Coinbase Global COIN reported mixed first-quarter 2025 results, wherein the bottom line beat the Zacks Consensus Estimate but the top line missed the same. Total trading volume increased 26% year over year. Adjusted EBITDA was $929.9 million in the reported quarter, which fell 8.3% from the year-ago quarter.

Given President Trump’s supportive stance on crypto and his push for clearer regulatory frameworks, Coinbase, the crypto leader, is well-positioned to benefit from broadening its asset offerings to include more cryptocurrencies and tokenized equities, expanding its global footprint, and leveraging increased market volatility. With 83% of its revenues derived from the United States—a country emerging as a potential crypto hub—companies see COIN’s platform as the preferred choice for businesses aiming to incorporate cryptocurrency into their operations.

COIN’s first-quarter 2025 earnings per share of $1.94 beat the Zacks Consensus Estimate by 4.9%. The bottom line increased 17.6% year over year. Total revenues of $2 billion missed the Zacks Consensus Estimate by 4.1%. The top line increased 24% year over year. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Total transaction revenues increased 18.2% year over year to $1.3 billion in the quarter. The growth was attributed to increases in consumer transaction revenues, institutional transaction revenues, and other transaction revenues. The Zacks Consensus Estimate was pegged at $1.3 billion.

Total subscription and services revenues increased 36.3% year over year to $698.1 million in the reported quarter. The growth was driven by higher Stablecoin revenues. The Zacks Consensus Estimate was pegged at $698 million.

Total operating expenses increased 51.5% to $1.3 billion in the quarter due to higher sales and marketing and general and administrative expenses.

For the second quarter of 2025, Coinbase expects subscription and services revenues to be in the range of $600-$680 million. It expects growth in Stablecoin revenues to be offset by a decline in blockchain rewards revenues due to lower asset prices. It estimates transaction expenses to be in the mid-to-high teens as a percentage of net revenues.

Shares of Coinbase have lost 19.7% year to date compared with the industry’s decline of 8.7%, the sector’s drop of 2.6% and the Zacks S&P 500 composite’s decline of 4.4%.

Shares of Robinhood Markets HOOD, a crypto-oriented company, have gained 46.7% year to date, while those of Interactive Brokers Group, Inc. IBKR have gained 5.1% in the same time frame.

Robinhood has grown from a brokerage largely centered on digital asset trading into a more mature and diversified platform, with a focus on expanding its market footprint and customer base. The company continues to enhance its product portfolio to attract new users and strengthen its market position.

Interactive Brokers is widely recognized for its advanced electronic trading platforms and broad access to global markets. The firm employs proprietary technology to automate nearly every component of the brokerage process — from trade execution and risk management to compliance and client onboarding — enabling highly efficient operations with minimal human intervention and significantly lower costs than conventional brokers.

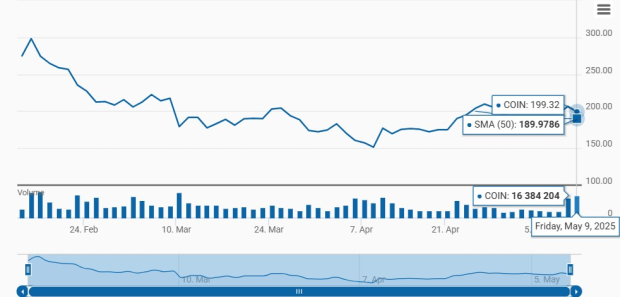

Shares of COIN have been trading above their 50-day simple moving average for some time, signaling a short-term bullish trend and making it an attractive option for investors from a technical perspective.

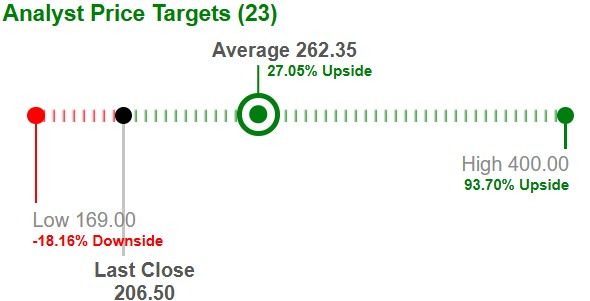

Based on short-term price targets offered by 23 analysts, the Zacks average price target is $262.35 per share. The average suggests a potential 27.1% upside from the last closing price.

The Zacks Consensus Estimate for 2025 and 2026 has moved 5.1% and 2.7% south, respectively, in the last seven days.

The stock is overvalued compared to its industry. It is currently trading at a price-to-earnings multiple of 28.45, higher than the industry average of 17.52. Its Value Score of D suggests that the stock is not so cheap and indicates a stretched valuation at this moment.

Shares of Robinhood Markets and Interactive Brokers are also trading at multiples higher than the industry average.

As the largest registered crypto exchange in the United States, Coinbase is well-placed to take advantage of increased market volatility and rising crypto asset prices. It stands to benefit from stronger banking relationships, the acquisition of new licenses, and the development of customized products that cater to diverse customer needs.

With a focus on growth, Coinbase is actively increasing its market share in both the U.S. spot and derivatives markets, while also expanding its product range and extending its global presence.

COIN recently agreed to buy Deribit, the world’s leading crypto-options exchange with over $30 billion of open interest and $1 trillion in trading volume outside the United States in 2024. This buyout, once it materializes, will make Coinbase the number one crypto derivatives platform globally by open interest. Its other global expansion includes foraying into Argentina and India.

Its robust liquidity enables ongoing strategic investments aimed at enhancing its service offerings and driving future growth.

The increasing adoption of Stablecoins is expected to further boost Coinbase’s revenues. The company has posted positive EBITDA for nine consecutive quarters, driven by its subscription-based business model.

Aiming to bring crypto utility to a global audience, Coinbase plans to onboard over a billion users into the crypto economy. To achieve this, the company is heavily investing in key infrastructure and platforms, such as Layer 2 solutions, its Base network and stablecoins.

Coinbase is a fundamentally strong company. It exited 2025 with $10.2 billion in resources, which is defined as cash & cash equivalents and USDC, up $9.8 billion from the 2024 end level. Leverage ratio has been improving and compares favorably with the industry average. Also, its higher times interest earned implies that the company can comfortably service its debt.

COIN’s return on equity in the trailing 12 months was 20.2%, higher than the industry average of 16.2%, reflecting efficiency in utilizing shareholders’ funds.

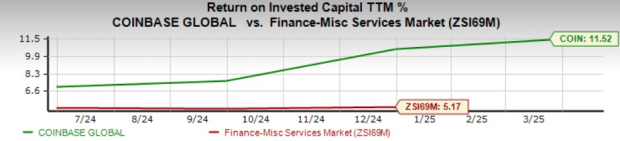

The return on invested capital in the trailing 12 months was 10.5%, which compared favorably with the industry average of 5.2%. This reflects the insurer’s efficiency in utilizing funds to generate income.

Fluctuations in crypto asset prices pose a significant risk to Coinbase’s financial stability. A decline in the value of Bitcoin, Ethereum, and other cryptocurrencies could weigh on profitability, erode the worth of its digital asset holdings, and constrain future cash flows. Such conditions could also impact Coinbase’s liquidity and its capacity to meet financial commitments.

Having said that, Coinbase continues to pursue growth by expanding its footprint in the crypto space, increasing its market share in spot trading for both retail and institutional clients, and improving the trading experience through ongoing innovation.

Given its premium valuation and muted analyst sentiment, it is better to adopt a wait-and-see approach for this Zacks Rank #3 (Hold) stock presently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours |

Cathie Wood Sells More DraftKings. Goldman Cuts Robinhood Target Due To These Metrics.

HOOD

Investor's Business Daily

|

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 12 hours | |

| 17 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Why Robinhood And Bloom Energy Show The Perils Of Investor Preconceptions

HOOD

Investor's Business Daily

|

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite