|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

RTX Corp. RTX recently revealed that its PhantomStrike radar has completed its inaugural flight test in Ontario, CA. During the test, PhantomStrike effectively tracked multiple airborne targets and delivered high-resolution terrain mapping, demonstrating its advanced capabilities.

It is the industry’s first fully air-cooled, fire-control radar, engineered for long-range threat detection, tracking and targeting. Amid the evolving landscape of the global threat environment, such an announcement involving an affordable fire control radar coming at nearly half the price of its traditional peers might ignite significant interest among defense investors and motivate them to add RTX to their portfolio.

However, before making any investment decision, it's essential to assess RTX’s share price trends in recent times, its growth prospects and potential risks (if any) to investing in the same. A closer look at these factors will provide investors with a more informed perspective.

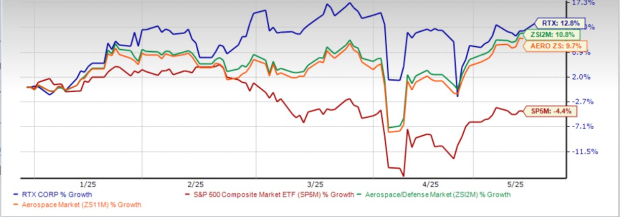

RTX’s shares have surged an impressive 12.8% in the year-to-date period, outperforming the Zacks Aerospace-Defense industry’s rise of 10.8% and the broader Zacks Aerospace sector’s growth of 9.7%. RTX has also outpaced the S&P 500’s decline of 4.4% in the same period.

Other defense players, such as The Boeing Company BA and Leidos Holdings LDOS, have delivered similar stellar performances. Shares of BA and LDOS have risen 12% and 8.4%, respectively, year to date.

The steadily growing global air traffic has been bolstering both commercial OEM and aftermarket sales for RTX, reinforcing investor confidence in this stock (as duly reflected in its strong year-to-date performance). Reflecting this momentum, RTX’s Collins Aerospace segment reported an 8% year-over-year increase in first-quarter 2025 revenues, partly driven by a 13% rise in commercial aftermarket sales.

Meanwhile, the Pratt & Whitney unit posted 14% growth in first-quarter sales, supported by a 28% surge in commercial aftermarket sales and a 3% increase in commercial OEM. These gains were primarily fueled by higher volume and favorable mix across both large commercial engines and Pratt Canada, along with increased deliveries in commercial OEM business. The robust performance across both units highlights RTX’s strong positioning in the commercial aerospace sector and underscores its ability to capitalize on the ongoing increase in air travel demand.

Looking ahead, the outlook for the commercial aerospace market and consequently RTX’s commercial segment remains promising. According to the International Air Transport Association report released in December 2024, global passenger traffic is expected to grow at an average annual rate of 3.8% over the next 20 years, adding over 4.1 billion new passenger journeys by 2043 compared to 2023.

This projected surge in air travel is likely to drive demand for new aircraft, thereby bolstering Boeing’s commercial airplane segment’s sales as well as RTX’s commercial OEM and aftermarket sales.

At the same time, ongoing geopolitical tensions and global security challenges are expected to sustain strong demand for defense solutions. RTX and LDOS, both notable U.S. defense contractors, are well-positioned to capitalize on these trends. This is evident from RTX’s robust defense backlog, which was $92 billion as of March 31, 2025. Together, these commercial and defense tailwinds underscore RTX’s solid long-term growth potential.

In line with this, the Zacks Consensus Estimate for RTX’s long-term earnings growth rate is pegged at a solid 9.3%.

Now, let's take a look at its near-term earnings and sales estimates to see if they also reflect a similar picture.

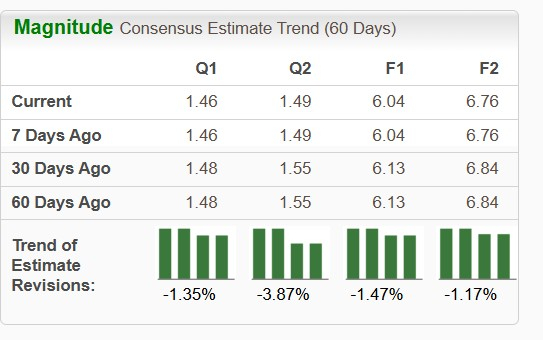

The Zacks Consensus Estimate for second-quarter and full-year 2025 revenues suggests a solid improvement of 4.9% and 4.2%, respectively, from the prior-year levels. The earnings estimate figures also indicate a similar picture. The estimates for 2026 sales and estimates also imply an improvement of 5.8% and 11.9%, respectively, from 2025-estimated figures.

However, the downward revision witnessed in the company’s near-term earnings estimate over the past 60 days indicates declining investor confidence in the stock.

Despite the aforementioned growth opportunities, there are certain risks to investing in RTX stock. One notable headwind plaguing stocks like RTX, which operate in the commercial aerospace sector, is the supply-chain issue.

Notably, the global supply-chain disruption that was exacerbated during the COVID period remains a major challenge affecting global trade and, thereby, the aerospace sector. In its December 2024 report, the International Air Transport Association announced that it expects severe supply-chain issues to continue to affect the aviation industry into 2025. This, in turn, may cause aerospace-defense stocks like RTX, Boeing and Leidos to experience failure in delivering its finished products to customers within the stipulated timeframe.

Moreover, the uncertainties created by the recently imposed import tariffs by the U.S. government and counter-tariffs by countries in retaliation, as well as their resultant impact on global trade policy, may adversely affect RTX’s previously issued 2025 outlook with respect to its results of operations and cash flows.

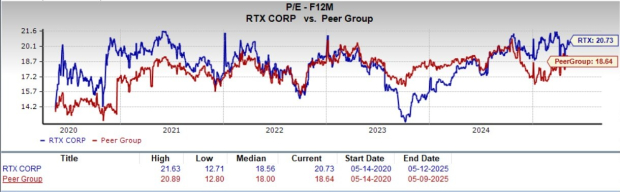

In terms of valuation, RTX’s forward 12-month price-to-earnings (P/E) is 20.73X, a premium to its peer group’s average of 18.64X. This suggests that investors will be paying a higher price than the company's expected earnings growth compared to that of its peer group. The stock’s forward 12-month P/E also seems stretched when compared to its five-year median value, 18.56.

Investors interested in RTX stock should wait for a better entry point, considering its premium valuation and downward revision in earnings estimates. However, those who already own this Zacks Rank #3 (Hold) stock may continue to do so, taking into account its upbeat sales and earnings estimate, solid performance at the bourses and long-term growth opportunities.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 |

Defense Funds Poised For Breakouts As Trump Readies Potential Iran Strike

BA

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite