|

|

|

|

|||||

|

|

In simple terms, Zacks Rank #3 (Hold) stock CoreWeave (CRWV) is an AI cloud-computing company that functions as a massive computer rental platform, providing super-powered services for artificial intelligence operations and other resource-intensive tasks. The late 2022 launch of OpenAI and Microsoft’s (MSFT) ChatGPT chatbot illustrated how significant AI technology is and is likely to become when it became the fastest-growing consumer application in history. Since then, big-tech, “Magnificent 7” companies like Meta Platforms (META) and Alphabet (GOOGL) have spent hundreds of billions of dollars of CAPEX on data centers and the GPUs that are necessary to train large language models (LLMs) like ChatGPT and Google’s Gemini.

Coreweave, founded in 2017, initially provided data center capability to Bitcoin miners. However, a crypto crash would alter the company’s trajectory the next year forever. Instead of focusing on crypto, CoreWeave’s management team correctly predicted that the next (and much larger) wave of data center demand would come from AI. Thus, the company pivoted, and growth exploded.

In late March, CoreWeave launched its IPO, raising $1.5 billion. While the $1.5 billion was lower than CoreWeave wanted to raise and below Wall Street’s expectations, context is critical. The market conditions at the time were dire, with an intensifying trade war between the world’s two largest economies. In most cases, a tech company would simply shelf its IPO. More importantly, China’s DeepSeek large language model had just launched and claimed to provide a ChatGPT-like product with far less compute.

CoreWeave CEO Mike Intrator would later say that demand had actually picked up in the wake of the DeepSeek madness. Later, Wall Street analysts would also debunk DeepSeek’s claims. Despite the uncertainty and investor skittishness, CRWV management forged ahead and launched the IPO, marking the largest tech IPO in years.

Famed investor Jesse Livermore once proclaimed, “There is nothing new on Wall Street. There can’t be, because speculation is as old as the hills. Whatever happens in the stock market has happened before.” While history doesn’t always repeat exactly, it does tend to rhyme.

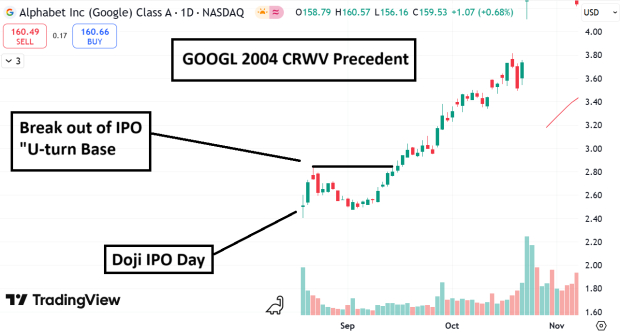

In 2004, GOOGL launched its IPO. GOOGL shares would more than triple in a year, and would never look back. Now, CRWV exhibits some of the same characteristics, including:

· IPO U-turn Base:

In 2004, GOOGL shares spiked in their first few sessions, fell, and finally carved out a short, multi-week rounded base, which I call an IPO “U-turn” base.

CRWV’s current chart pattern mirros the 2004 GOOGL IPO and should act as a valuable precedent for investors.

· Explosive Revenue Growth

In the year prior before its IPO, Google’s revenue jumped from $961.90 million to $2.7 billion. Meanwhile, CoreWeave’s revenue grew at a blistering 725% in the year prior to its IPO.

· Institutional Sponsorship

Deep-pocketed institutional investors drove Google’s mind-boggling ascent, and now they are doing the same for CoreWeave. For instance, Nvidia (NVDA), the undisputed AI leader, owns 6% of CRWV. According to its latest filing BlackRock (BLK), the world’s largest asset manager, owns 250,000 shares. Meanwhile, Fidelity disclosed a 9% stake in the firm earlier this week.

· New Technology Wave

Google benefitted from riding the technological wave known as the internet. Now, CRWV is riding the newest and arguably fastest-growing wave in history: artificial intelligence.

CorewWeave will report earnings after the close today, May 14th. If the company impress Wall Street, the Fibonacci targets are much higher.

Bottom Line

As CoreWeave prepares to unveil its earnings report, the echoes of Google’s historic IPO and the robust institutional backing paint an optimistic picture for this AI cloud-computing pioneer.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 min | |

| 14 min | |

| 16 min | |

| 22 min | |

| 25 min | |

| 40 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite