|

|

|

|

|||||

|

|

The Kroger Co. KR stands out as a compelling value play within the Retail-Supermarkets industry, trading at a forward 12-month price-to-earnings (P/E) ratio of 13.90, well below the industry average of 33.22 and the Retail-Wholesale sector average of 23.96. This undervaluation highlights its potential for investors seeking attractive entry points in the retail space. KR's Value Score of A supports its investment appeal.

Kroger's stock is also trading at a discount compared with its peers, including Walmart Inc. WMT, Sprouts Farmers Market, Inc. SFM and Grocery Outlet Holding Corp. GO.

Walmart, Sprouts Farmers and Grocery Outlet trade at a forward 12-month P/E of 35.82, 30.27 and 17.36, respectively, highlighting KR’s relative valuation advantage.

KR Looks Attractive From a Valuation Standpoint

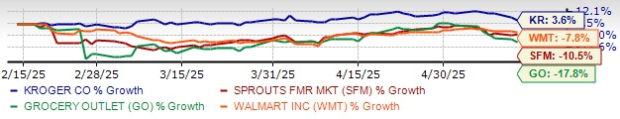

Closing at $67.49 yesterday, shares of Kroger are currently trading 8.3% below its 52-week high of $73.63 reached on April 22, 2025, making investors contemplate their next move. In the past three months, the Kroger stock has gained 3.6%, significantly outperforming the industry’s 6.1% fall. The company’s strategic initiative and operational efficiencies have helped it outpace the broader sector and the S&P 500 index’s respective declines of 5.8% and 5% in the same period.

Kroger Stock’s Past 3-Month Performance

KR fuels growth through digital expansion, strong performance of private label brands, fresh product offerings and partnerships. Ongoing investments in AI and value-driven initiatives support its long-term growth potential. The Kroger stock has also outpaced its peers, with shares of Walmart, Sprouts Farmers Market and Grocery Outlet declining 7.8%, 10.5% and 17.8%, respectively, over the past three months.

This leading traditional supermarket chain is trading above its 100 and 200-day SMAs (simple moving averages) of $65.07 and $60.36, respectively, highlighting a continued uptrend. This technical strength, along with sustained momentum, indicates positive market sentiment and investors’ confidence in KR’s financial health and growth prospects.

KR Trades Above 100 & 200-Day Moving Averages

KR continues to solidify its presence in the retail sector through a customer-centric strategy, high-quality fresh food offerings, and a growing private-label portfolio under its "Our Brands" banner. In 2024, above 90% of households purchased “Our Brands” products, and the company launched more than 900 items, including 370 fresh items, reinforcing its innovation pipeline.

Digital transformation remains a cornerstone of Kroger's growth strategy. Initiatives like the Boost membership program, Delivery Now, and the expansion of customer fulfillment centers have significantly boosted digital engagement. In the fourth quarter, digital sales rose 11%, fueled by increased household participation and higher traffic.

KR's investments in automation and AI-driven inventory management have enhanced operational efficiency, reduced waste and improved margins, positioning the company for scalable long-term growth.

Kroger's alternative profit businesses also delivered strong results, generating $1.35 billion in operating profit in 2024. This growth was supported by a 17% increase in media revenues, underscoring the success of KR's digital engagement strategies. These high-margin revenue streams serve as critical components of Kroger's business model, offering a diversified income source.

Health and Wellness emerged as a key area of strength, particularly in the latter half of 2024. Strong vaccine performance helped offset margin pressures stemming from growth in GLP-1 sales, contributing positively to overall revenues. Kroger's strategic renewal of its agreement with Express Scripts expanded its health services, providing ESI customers with access to prescription medications and health services at Kroger Pharmacies.

From digital innovation and private-label growth to alternative profits and disciplined capital allocation, Kroger is executing across multiple fronts. KR's guidance for 2025 reflects confidence in sustained growth, with expectations for identical sales without fuel to increase 2-3%. Stable margin rates and adjusted earnings per share between $4.60 and $4.80 reinforce a positive outlook and financial stability.

KR’s financial strategy supports long-term shareholder value. The company ended fiscal 2024 with a net total debt-to-adjusted EBITDA ratio of 1.79, comfortably below its target of 2.3-2.5. This provides ample flexibility for capital investment and shareholder returns.

In December 2024, Kroger announced a $7.5-billion share repurchase program, including a $5-billion accelerated share repurchase. In the final quarter, 65.6 million shares were repurchased. KR expects total shareholder return of 8-11% over time, driven by a blend of earnings growth, dividends and buybacks.

Stiff competition amid a backdrop of shifting consumer behavior, shaped by persistent inflation and elevated interest rates, continues to weigh on KR’s growth prospects. These macro pressures are dampening spending patterns, especially among price-sensitive shoppers.

While Kroger has managed to retain some traction with mainstream consumers, the broader retail environment remains a hurdle for achieving meaningful sales acceleration. Total company sales declined 7.4% in the fourth quarter of fiscal 2024.

KR’s fuel operations, a key loyalty driver via fuel rewards, were a drag on both the fourth quarter and fiscal 2024 results. The company experienced lower gallons sold and lower cents-per-gallon margins, with sales impacted by a decline in average retail prices.

The termination of the merger with Albertsons resulted in Kroger retaining $5.8 billion of newly issued debt, following $10.5 billion in total new issuance. As a result, net interest expenses are projected to rise to $650-$675 million in 2025, materially higher than the 2024 reported levels. This increase in financial burden can act as a headwind to net earnings and the cash flow.

While Kroger’s stock presents an attractive valuation and exhibits operational strength through digital innovation, private-label growth and capital discipline, the company faces ongoing headwinds from a challenging retail environment, increased competition and rising financial obligations.

These mixed signals suggest that while KR may offer long-term potential, especially for value-focused investors, caution is still warranted. The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 5 hours | |

| 10 hours | |

| 10 hours | |

| 12 hours | |

| 15 hours | |

| 17 hours | |

| 17 hours | |

| 20 hours | |

| Feb-15 |

Companies Are Replacing CEOs in Record Numbersand Theyre Getting Younger

KR WMT

The Wall Street Journal

|

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite