|

|

|

|

|||||

|

|

Costco Wholesale Corporation COST and Dollar General Corporation DG stand out prominently in the Retail–Discount Stores industry. Costco boasts a substantial market capitalization of approximately $440 billion, operating on a membership-based warehouse model focused on selling bulk goods at discounted prices. The company manages a network of 905 warehouses globally, including 624 in the United States.

In contrast, Dollar General holds a market capitalization of around $19.3 billion and operates a vast network exceeding 20,000 stores across rural, suburban and urban areas. Known for its commitment to everyday low prices and essential household items, Dollar General has carved out a niche as a preferred shopping destination for budget-conscious consumers.

Amid evolving consumer spending patterns and changing economic dynamics, evaluating which of these retailers is better positioned for growth becomes crucial.

Costco’s resilient business model, built around its membership-based structure, remains a major growth driver. High membership renewal rates — 93% in the United States and Canada, and 90.5% globally — combined with efficient supply chain operations and bulk purchasing power, allow Costco to offer competitive pricing that keeps customers loyal. This robust model has allowed Costco to thrive, even during economic downturns.

Members pay an annual fee for access to Costco’s warehouses, where they enjoy significant discounts on a wide range of products. This structure not only ensures a reliable revenue stream but also fosters a sense of value and exclusivity. In the second quarter of fiscal 2025, membership fee income rose 7.4% year over year, aided by a recent fee hike, which added approximately 3% growth in the quarter. The company ended the quarter with 78.4 million paid household members, marking a 6.8% increase year over year.

Costco continuously adapts to market trends and consumer preferences. The company regularly updates its product offerings to include a mix of everyday essentials and unique, high-demand items. Through market analysis and tailored offerings, Costco has expanded its presence, both domestically and internationally. In fiscal 2025, the company plans to open 28 new warehouses — 15 in the United States, three in Canada and seven in other international markets, with three relocations.

Digitization also plays a key role in Costco’s expansion. Comparable online sales jumped 12.6% for the four weeks ended May 4, 2025. Overall, comparable sales rose 4.4% in April, following gains of 6.4% and 6.5% in March and February, respectively. Net sales in April climbed 7% year over year, continuing the strong performance from March and February, which saw increases of 8.6% and 8.8%, respectively.

That said, some challenges linger. Currency headwinds and potential tariffs on key imports could pressure margins. Additionally, as consumers become more cautious with spending, demand for non-essential items has softened — a potential drag on discretionary sales in the near term.

Dollar General has been gaining market share, supported by its resilient product mix, strategic focus on value and real estate expansion. The company’s “back-to-basics” initiative has strengthened its operational foundation, while targeted efforts to reduce shrinkage are beginning to show results. These measures position Dollar General well for sustainable growth in fiscal 2025 and beyond.

Well, Dollar General is planning an extensive 4,885 real estate projects in fiscal 2025. This includes 575 new store openings in the United States and up to 15 outlets in Mexico, 2,000 remodels and 2,250 upgrades under the “Project Elevate” initiative. The Elevate program has demonstrated first-year comparable sales lifts of 3% to 5%, while the complementary “Project Renovate” is designed to deliver an even stronger 6% to 8% uplift.

To complement its physical footprint, Dollar General is expanding its digital capabilities. The retailer is in the early stages of scaling home delivery through a partnership with DoorDash, which is currently live in around 400 stores. Early results are promising, with higher average order values than in-store purchases. The company plans to expand this service to as many as 10,000 stores by the end of fiscal 2025.

Despite these strategic moves, Dollar General guided a challenging first half of fiscal 2025 due to upfront costs associated with remodeling projects and increased labor-related expenses. Management projected earnings per share (EPS) to decline on a year-over-year basis during this period.

Looking further ahead, Dollar General has outlined a clear roadmap. Beginning in fiscal 2025, the company targets annual net sales growth of 3.5%-4%, supported by about 2% new unit growth. From fiscal 2026 onward, the retailer expects same-store sales growth of 2%-3%, with operating margin expansion resuming and potentially reaching 6%-7% by 2028. On an adjusted basis, EPS growth of at least 10% annually is projected, starting in 2026.

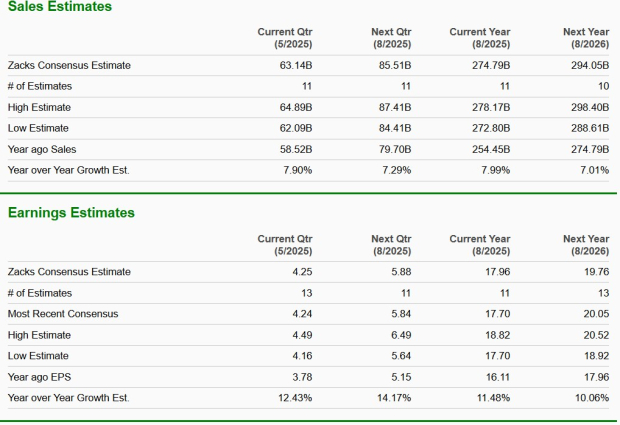

The Zacks Consensus Estimate for Costco’s current fiscal year sales and EPS implies year-over-year growth of 8% and 11.5%, respectively. The consensus estimate for EPS for the current fiscal year has risen by a penny to $17.96 over the past 30 days. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

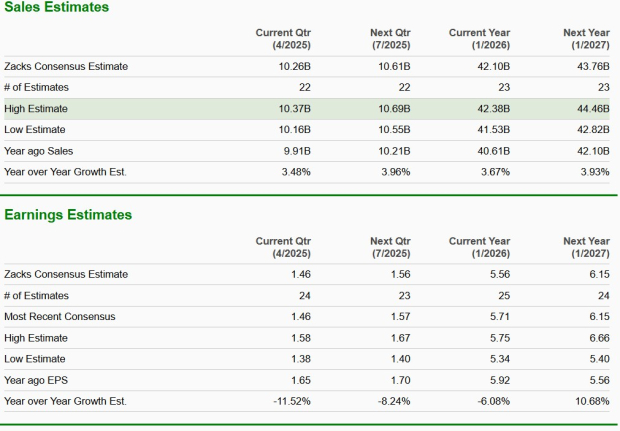

The Zacks Consensus Estimate for Dollar General’s current fiscal year sales suggests year-over-year growth of 3.7%, while for the EPS, the same indicates a decline of 6.1%. The consensus estimate for EPS for the current fiscal year has increased by a penny to $5.56 over the past 30 days.

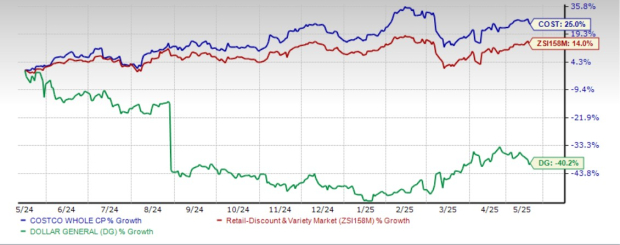

Despite operating in the same industry, the stock trajectories of Costco and Dollar General have moved in starkly opposite directions. Shares of Costco have advanced 25% over the past year, outpacing the industry’s modest rise of 14%. In contrast, Dollar General shares have plunged 40.2%, underperforming both its peer and the industry.

Costco is trading at a forward 12-month price-to-earnings (P/E) ratio of 51.56, higher than its one-year median of 50.33. Meanwhile, Dollar General’s forward P/E ratio stands at 15.32, above its median of 13.62.

When compared with Dollar General, Costco emerges as the stronger investment bet. Its membership-driven model provides consistency, while its ability to adapt through digital expansion and international growth reinforces its competitive edge. Although Dollar General is taking bold steps to revitalize its business, the company is still in a transitional phase marked by execution risks and near-term headwinds. Costco’s stability, customer loyalty and operational momentum make it the more compelling choice in the current retail landscape. Costco carries a Zacks Rank #2 (Buy), while Dollar General currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 4 hours | |

| 4 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite