|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Core Laboratories Inc. CLB has experienced a year-to-date (“YTD”) stock price decrease of 29.7%, significantly underperforming the broader oil and gas sector and the oil and gas field services sub-industry’s decline of 1.2% and 12.7%, respectively. In comparison, competitors such as Oceaneering International OII, Halliburton HAL and RPC Inc. RES were down 22.8%, 21.8% and 16.5%, respectively. This steeper drop suggests that Core Laboratories may be facing company-specific challenges beyond broader industry headwinds.

The sharp drop in share price raises an important question for investors, whether this is a chance to buy at a low point or a warning sign of more serious problems ahead.

Core Laboratories holds a key position in the oil and gas industry, offering specialized services that range from analyzing reservoir rock and fluid samples to improving well productivity. The company is structured around two primary business segments. First, Reservoir Description is dedicated to studying petroleum reservoirs through detailed analysis of rock and fluid properties. Second, Production Enhancement focuses on boosting output through well completion, stimulation and abandonment techniques.

In a simple word, Houston, TX-based oil and gas equipment and services company helps oil companies get more oil and gas. The company tests rock and fluid properties and provides services to improve drilling.

CLB reported adjusted earnings of 8 cents per share in the first quarter of 2025, missing the Zacks Consensus Estimate of 15 cents. The weaker performance was primarily caused by the underperformance of the Reservoir Description segment.

On the other hand, CLB reported total costs and expenses of $119.2 million in the first quarter, increasing 1.6% from the year-ago quarter’s level.

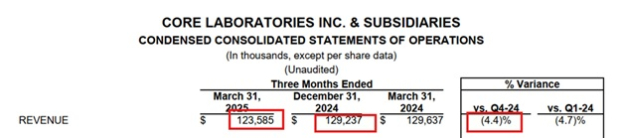

Sequential Revenue Decline Indicates Weak Momentum: Core Laboratories’ first-quarter 2025 revenues fell 4.4% sequentially to $123.6 million from $129.2 million in fourth-quarter 2024. This decline reflected weakened customer activity across both Reservoir Description and Production Enhancement segments. The softness in international activity, particularly in Asia-Pacific and Africa, indicates that customer spending is not recovering as expected post-COVID and North America’s activity is also trending downward.

A contracting top line in a supposedly upcycle environment signals risk to revenue growth momentum.

Tariff and Sanction Risk Remains Elevated: CLB’s management acknowledged that recently expanded sanctions and tariffs have already disrupted laboratory assay services and delayed product sales, including a $1.1 million international order in the first quarter. Although mitigations are underway, ongoing geopolitical risks from Russia, Ukraine, the Middle East and potential trade conflicts expose CLB to revenue shocks. Regulatory overhang could continue to impair visibility.

Declining ROIC Suggests Weak Capital Efficiency: Core’s return on invested capital (“ROIC”) for first-quarter 2025 was just 8.3%, which is relatively low for an asset-light company in the oilfield services sector. This raises concerns about how efficiently the firm is converting invested capital into value. As industry peers like Oceaneering International, Halliburton and RPC show improvements in capital discipline, Core’s lagging ROIC may indicate a weakening competitive position.

Minimal Dividend Yield and Shareholder Return: CLB continues to pay a nominal quarterly dividend of 1 cent per share, just 4 cents annually, despite operating in a sector where peers like Oceaneering International, Halliburton and RPC offer more substantial capital returns. The company repurchased $2 million worth of shares in the first quarter, but this buyback is modest relative to cash flow profile and its peers. Investors seeking income or more aggressive capital return strategies may find better options elsewhere.

Currency Headwinds and Regional Risk: Core noted that its business in Latin America faced foreign currency exchange (“FX”) headwinds in the first quarter. While the company continues to service long-standing clients in the region, macroeconomic instability and volatile currencies can erode margins and add unpredictability to earnings. As many oilfield service providers move away from FX-sensitive areas, Core’s continued exposure raises concerns about earnings quality and predictability.

High Sensitivity to Oil Price Volatility: CLB's performance is tightly linked to crude oil demand, which faces uncertainty due to OPEC+ production increases and U.S. tariffs. The company noted that U.S. onshore activity, key for Production Enhancement, is highly sensitive to oil price swings. With the Energy Information Administration forecasting minimal U.S. production growth in 2025-2026, Core Lab's domestic revenues may stagnate. While international demand is projected to grow (0.7-1.3 million barrels/day in 2025), near-term volatility could delay client investments in reservoir optimization services.

Core Laboratories offers specialized services critical to oilfield efficiency, but its sharp underperformance signals deeper issues. Weak earnings, falling revenues and exposure to geopolitical and currency risks point to structural challenges, not temporary setbacks. With low returns and minimal shareholder value, this is not a bargain, but a warning. Investors are advised to refrain from buying the dip.

This Zacks Rank #5 (Strong Sell) company is facing several challenges that are dragging down its stock performance. The company reported a sequential revenue decline of 4.4% in first-quarter 2025, caused by weak customer activity and softness in key regions like Asia-Pacific and Africa. Geopolitical risks, including tariffs and sanctions, are disrupting operations and delaying international sales. CLB’s low ROIC suggests declining capital efficiency.

Additionally, minimal shareholder returns, FX-related headwinds in Latin America and high sensitivity to oil price volatility further cloud its growth outlook. Unless the company shows improved financial results and greater operational stability, investors may be better off exploring other opportunities in the oil and gas sector.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite