|

|

|

|

|||||

|

|

Monster Beverage Corporation MNST has displayed momentum in the past month, most of which can be attributed to strong first-quarter 2025 results on May 8. The company’s shares have climbed 3.6% following its first-quarter 2025 earnings, hitting a new 52-week high of $62.46 on May 12. Closing at $62.33 yesterday, the stock traded near the 52-week high mark.

Additionally, the company’s strong performance is underpinned by multiple growth drivers. Monster Beverage continues to benefit from increased household penetration and rising per capita consumption of energy drinks. Strong consumer demand, particularly in the United States, has been fueled by new product launches and among them, Monster Energy Ultra Blue Hawaiian has emerged as one of the top-selling offerings. Innovation remains at the core of the company’s strategy as it expands globally with affordable energy drink brands like Predator and Fury, tapping into emerging markets to drive volume growth.

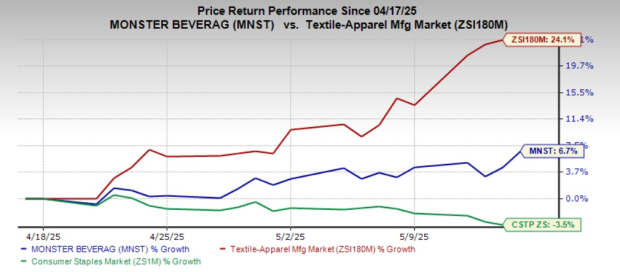

In the past month, Monster Beverage has risen 6.7% compared with the Zacks Beverages - Soft drinks growth of 24.1%. It has outperformed the broader Consumer Staples sector’s decline of 3.5%.

Monster Beverage stock rally after its earnings release highlights investor optimism. The company continues to benefit from the expansion of the energy drinks market and product launches, reinforcing its category strength. Improving margins, supported by easing supply chain pressures and lower input costs, have contributed to its financial stability. MNST outperformed expectations in the first quarter of 2025, surpassing the Zacks Consensus Estimate for earnings per share (EPS). Adjusted EPS (excluding the Alcohol Brands segment) climbed 10.2% year over year to 47 cents, topping forecasts. Gross margin improved by 240 basis points to 56.5%, driven by effective pricing strategies and continued supply chain optimization. These gains highlight the company’s solid operational execution and resilience amid ongoing global challenges.

Consumer demand for energy drinks remains strong, with the U.S. category growing 10% year over year, and Monster’s retail sales rising 8.7% for the 13 weeks ended April 26, 2025, per Nielsen . Momentum extended globally, with notable sales surges in China, Australia and South Korea. Monster also captured market share in several European markets — including Great Britain, Germany and the Netherlands — underscoring the brand’s expanding global footprint and enduring consumer appeal.

In the reported quarter, the impact of tariffs on MNST’s operating results was immaterial. Management highlighted that the tariff backdrop is complicated and dynamic. The company will recognize tariffs on aluminum via the higher Midwest premium and has been reviewing mitigation actions across its business. AAF, its flavor and concentrate subsidiary, intends to establish a facility in Brazil, likely to be operational later in 2026. The company remains excited about its innovation pipeline in 2025.

The Zacks Consensus Estimate for MNST’s 2025 EPS rose by a penny in the last seven days, while 2026 EPS rose by 2 cents in the same period. The upward revisions in earnings estimates indicate that analysts are optimistic about the stock’s performance.

For 2025, the Zacks Consensus Estimate for MNST’s sales and EPS implies 5.9% and 14.8% year-over-year growth, respectively. The consensus mark for 2026 sales and EPS indicates 7.8% and 11.9% year-over-year growth, respectively.

Image Source: Zacks Investment Research

Monster Beverage's recent growth highlights underscore its strong market momentum and operational excellence, with the stock trading near its 52-week high. The company’s first-quarter 2025 results showcased successful pricing actions and effective supply chain optimization, clear indicators of its operational strength despite a challenging global environment. With upwardly revised earnings expectations, Monster Beverage stands out as an attractive option for those seeking long-term returns. The stock currently holds a Zacks Rank #2 (Buy).

Nomad Foods Limited NOMD manufactures, markets and distributes a range of frozen food products in the United Kingdom and internationally. It currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods' current fiscal-year sales and earnings implies growth of 5% and 7.3%, respectively, from the prior-year levels. NOMD delivered a trailing four-quarter earnings surprise of 3.2%, on average.

Mondelez International, Inc. MDLZ manufactures, markets and sells snack food and beverage products in Latin America, North America, Asia, the Middle East, Africa and Europe. It presently carries a Zacks Rank of 2. MDLZ delivered a trailing four-quarter earnings surprise of 9.8%, on average.

The Zacks Consensus Estimate for Mondelez International’s current financial-year sales indicates growth of 4.9% from the year-ago numbers.

Oatly Group AB OTLY, an oatmilk company, provides a range of plant-based dairy products made from oats. It presently carries a Zacks Rank of 2. OTLY delivered a trailing four-quarter earnings surprise of 25.1%, on average.

The consensus estimate for Oatly Group’s current fiscal-year sales and earnings implies growth of 2.7% and 56.6%, respectively, from the year-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite