|

|

|

|

|||||

|

|

MP Materials MP has signed a Memorandum of Understanding with Saudi Arabian mining company, Maaden, to explore and develop a fully integrated, end-to-end rare earth supply chain in Saudi Arabia. This partnership aims to cover the entire value chain from mining, separation and refining to magnet production.

Rare earth magnets are vital in critical technologies spanning transportation, energy, robotics and aerospace. Backed by Saudi Arabia’s abundant energy resources, advanced infrastructure and strategic location, this collaboration aims to diversify and expand the global rare earth supply chain. This will help meet rising demand from fast-growing industries.

Maaden, the Middle East’s largest mining and metals company, reported SAR 32.5 billion ($8.7 billion) in revenues for 2024. It operates 17 mines and production sites, exporting to 55 countries. Maaden is investing in technology and workforce development to develop and position mining as the Kingdom’s third major economic pillar.

MP Materials is the largest producer of rare earth materials in the Western Hemisphere. Headquartered in Las Vegas, NV, the company owns and operates the Mountain Pass Rare Earth Mine and Processing Facility, the only rare earth mining and processing site of scale in North America. The company is also developing a rare earth metal, alloy and magnet manufacturing facility in Fort Worth, TX, where it will produce and sell magnetic precursor products and anticipates manufacturing neodymium-iron-boron (NdFeB) permanent magnets by the end of 2025.

Rare earth products are critical inputs in hundreds of existing and emerging clean-tech applications, including electric vehicles and wind turbines, as well as robotics, drones and defense applications. The market is currently dominated by China, and there has been an increasing focus on developing domestic REE capabilities independent of China.

MP Materials reported first-quarter 2025 results on May 8, with revenues rising 25% year over year to $60.8 million but missing the Zacks Consensus Estimate of $64 million.

It reported record (neodymium and praseodymium) NdPr production of 563 metric tons in the quarter, a 330% surge from the year-ago quarter. Sales volumes for NdPr were up 246% year over year to 464 metric tons, attributed to the shift to production of midstream products, mainly NdPr oxide. The Materials Segment’s revenues increased 14% to $55.6 million in the quarter as higher sales volumes were offset by a 16% decline in realized pricing.

REO production increased 10% year over year to 12,213 metric tons on higher recoveries from the continued implementation of Upstream 60K optimizations. Due to company’s ramp-up in midstream operations, a major part of the REO production was used to produce separated rare earth products rather than being sold as rare earth concentrate. Sales volumes, thus, plunged 33%, resulting in a $10 million decline in rare earth concentrate revenues.

The Magnetics segment made its first metal deliveries in March, generating revenues of $5.2 million for the quarter.

MP Materials reported a loss of 12 cents per share in the quarter. It was wider than the Zacks Consensus Estimate of a loss of 10 cents per share and the year-ago quarter’s loss of four cents on higher production costs.

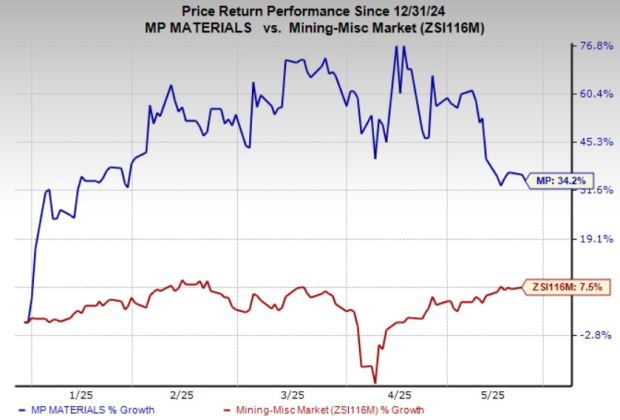

MP Materials shares have moved up 34.4% year to date, outperforming the industry’s growth of 7.5%.

MP Materials currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Agnico Eagle Mines AEM and Hawkins HWKN, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has an average trailing four-quarter earnings surprise of 11.10%. The Zacks Consensus Estimate for Carpenter Technology’s fiscal 2025 earnings is pegged at $7.27 per share, indicating 53.4% year-over-year growth. Carpenter Technology shares have surged 38% so far this year.

Agnico Eagle Mines has an average trailing four-quarter earnings surprise of 8.2%. The Zacks Consensus Estimate for AEM’s fiscal 2026 earnings is pegged at $4.54 per share, indicating year-over-year growth of 12.7%. Agnico Eagle Mines shares have appreciated 40% so far this year.

The Zacks Consensus Estimate for Hawkins’ fiscal 2026 earnings is pegged at $4.54 per share, indicating year-over-year growth of 12.7%. HWKN shares have gained 2.5 year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 6 hours | |

| 7 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite