|

|

|

|

|||||

|

|

During Tuesday’s trading session, Barclays BCS shares climbed to a new 5-year high of $17.87 on the NYSE. Investor optimism stems from the company’s solid financial performance and outlook.

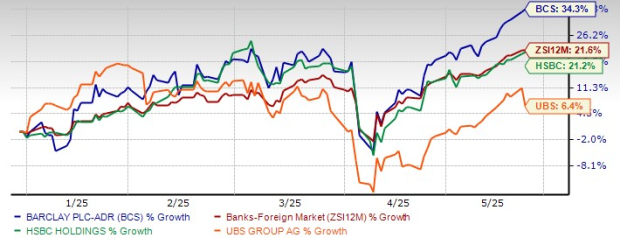

The year 2025 has so far been a good one for BCS, with the stock soaring 34.3% and outperforming the industry’s growth of 21.6%. Further, it has fared better than peers – HSBC Holdings HSBC and UBS Group AG UBS – in the same time frame.

Barclays YTD Price Performance

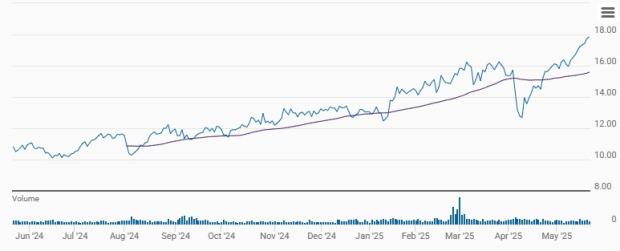

Technical indicators suggest strength for Barclays. The stock is trading above its 50-day moving average. It signals robust upward momentum and price stability for BCS.

Barclays 50-Day Moving Average

This also underscores positive market sentiments and confidence in Barclays' financial health and prospects as it continues to simplify operations and focus on core businesses.

Let’s find out whether Barclays’ current rally has legs or it's time to sell.

Barclays has been restructuring its global footprint to reduce costs and complexity. In February, the London-based bank sold its Germany-based consumer finance business, Consumer Bank Europe, to BAWAG P.S.K. This sale is part of the company's broader strategy to exit retail banking in Europe, responding to shifts in consumer behavior post-pandemic. This will support Barclays financially by freeing up significant capital, improving its balance sheet and enabling better resource allocation to high-growth areas.

Further, Barclays is partnering with Brookfield Asset Management Ltd. to revamp its payment acceptance business, investing £400M, while Brookfield may acquire up to 80% ownership. The move lets Barclays unlock long-term value, streamline operations and tap Brookfield’s transformation expertise. This will boost competitiveness in a high-growth sector while retaining client access and the Barclaycard Payments brand.

Additionally, as part of the company’s plan to streamline its operations and improve efficiency, as outlined in the Investor Update in February 2024, Barclays is taking cost-saving measures. These structural cost actions resulted in gross savings of £1 billion in 2024 and are projected to achieve gross efficiency savings of £0.5 billion this year. Management anticipates total gross efficiency savings of £2 billion by the end of 2026.

Moreover, last November, BCS acquired Tesco’s retail banking business. The move complements its existing business and strengthens its position in the market. The collaboration builds on Barclays UK’s existing strategic partnerships with other leading U.K. retail, consumer electronics and loyalty program brands. The company now expects Tesco’s 2025 net interest income (NII) to be £500 million, up from the previous target of £400 million.

The company also revised its group NII number for 2025. Barclays expects the metric to be more than £12.5 billion, up from prior guidance of £12.2 billion. Of this, Barclays UK is projected to generate NII of more than £7.6 billion.

Despite the uncertain macroeconomic environment, Barclays’ capital position remains robust. Given the solid balance sheet position, the company consistently rewards shareholders. It has been paying dividends regularly and plans to keep the total dividend payout stable at the 2023 level with progressive dividend growth. Further, Barclays intends to return at least £10 billion of capital to shareholders between 2024 and 2026 through dividends and share buybacks, with a preference for buybacks.

The Zacks Consensus Estimate for Barclays’ 2025 and 2026 revenues suggests a year-over-year increase of 11% and 5%, respectively.

Sales Estimates

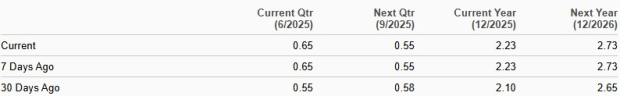

Also, the consensus estimate for BCS’ earnings suggests a 21.2% and 22.6% jump for 2025 and 2026, respectively. Earnings estimates for both years have been revised upward over the past 30 days.

Estimate Revision

BCS stock is currently trading at a 12-month trailing price-to-tangible book (P/TB) of 0.75X. This is below the industry’s 2.51X and shows that the stock is inexpensive at present.

Price-to-Tangible Book Ratio (TTM)

Barclays stock is also inexpensive compared with HSBC and UBS Group. At present, HSBC has a P/TB of 1.08X and UBS Group’s P/TB is 1.33X.

Barclays' robust capital position, business simplifying initiatives and cost-saving plans will drive growth. Strong brand value, relatively lower rates and a global network are expected to act as tailwinds. In 2025, the company is likely to reap the benefits of its cost-saving and business-streamlining efforts.

Given its favorable long-term prospects and lower valuation, investors should consider buying BCS stock at the current levels before it's too late.

Barclays currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite