|

|

|

|

|||||

|

|

Titan Machinery Inc. TITN incurred a loss of 58 cents in first-quarter fiscal 2026 (ended April 30, 2025), which was narrower than the Zacks Consensus Estimate of a loss of 79 cents. The company posted earnings of 41 cents per share in the year-ago quarter.

Total revenues were $594 million, down 5.5% from the year-ago quarter. The top line, however, surpassed the consensus mark of $463 million. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Equipment revenues fell 6.7% year over year to $437 million and parts revenues were down 2.4% to $106 million. Revenues generated from service were $44 million, down 2.4% from the year-ago quarter. Meanwhile, rental revenues were $7.9 million compared with $7.3 million in the year-ago quarter.

Titan Machinery Inc. price-consensus-eps-surprise-chart | Titan Machinery Inc. Quote

The cost of sales edged down 0.7% year over year to $503 million. Gross profit fell 25.4% year over year to $91 million. The gross margin was 15.3% compared with 19.4% in the year-ago quarter. Margins were down due to lower equipment margins, driven by high levels of inventory and weak demand.

Operating expenses decreased 2.8% from the year-ago quarter to $96 million. Loss from operations was $5.7 million against the prior year’s income of $22.6 million in the year-ago quarter.

Adjusted EBITDA was a negative $3.9 million against the prior year’s adjusted EBITDA of $24 million.

Agriculture revenues fell 14.1% from the last-year comparable quarter to $384 million. The downside was led by a decline in net farm income and a same-store sales decrease of 14.1%. The segment’s loss before taxes was $13 million against income of $13 million in the year-ago quarter.

Construction revenues were $72 million, up 0.9% from the prior-year comparable quarter, driven by a same-store sales increase of 0.9%. The segment incurred a loss before taxes of $4 million against the year-ago quarter’s income of $0.27 million.

Europe revenues were $94 million, up 44.2% from the year-ago quarter’s $74 million. The segment reported income before taxes of $4.7 million, up from $1.4 million in the first quarter of fiscal 2025.

The Australia segment reported revenues of $44 million, down 1% year over year. It incurred a loss before taxes of $0.5 million in the first quarter of fiscal 2026, down 15.4% year over year.

The cash outflow for operating activities was $6 million against an inflow of $32 million in the first quarter of fiscal 2025.

Titan Machinery ended the fiscal first quarter with a cash balance of $21.5 million compared with $36 million at the end of fiscal 2025. The company’s long-term debt was $154 million compared with $158 million as of the end of fiscal 2025.

The agriculture segment's revenues are predicted to decline 20-25% in fiscal 2026. The Construction segment’s revenues are expected to see a decline of 5-10%. Europe’s revenues are expected to rise 23-28% compared with fiscal 2025. The Australia segment's revenues are expected to decline 20-25%.

The company expects to report a loss of $1.25-$2.00 per share in fiscal 2026, reflecting weak demand.

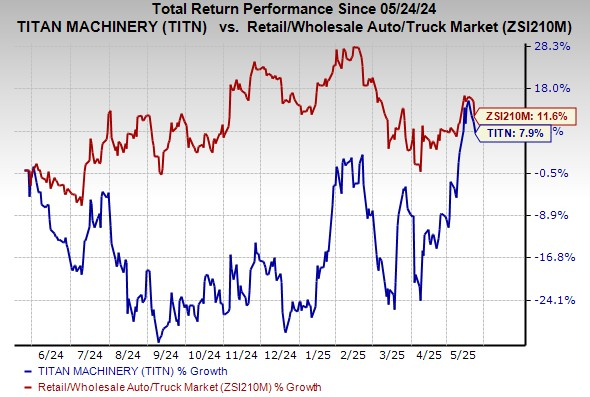

In the past year, shares of Titan Machinery have gained 7.9% compared with the industry’s 11.6% increase.

TITN currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Deere & Company DE reported second-quarter fiscal 2025 (ended April 27) earnings of $6.64 per share, beating the Zacks Consensus Estimate of $5.68. The bottom line decreased 22% from the prior-year quarter on lower shipment volumes.

Net sales of equipment operations (comprising Agriculture, and Turf, Construction and Forestry) were $11.17 billion, down 17.9% year over year. However, net sales topped the Zacks Consensus Estimate of $10.65 billion. Total net sales (including financial services and others) were $12.76 billion, down 16% year over year.

AGCO Corp. AGCO delivered adjusted earnings per share of 41 cents in first-quarter 2025 compared with the prior-year quarter’s $2.32. The reported figure topped the Zacks Consensus Estimate of 3 cents.

AGCO’s net sales decreased 30% year over year to $2.05 billion in the March-end quarter. The top line beat the Zacks Consensus Estimate of $2.02 billion. Excluding the unfavorable currency-translation impacts of 2.4%, net sales fell 27.6% year over year.

CNH Industrial N.V. CNH reported first-quarter 2025 adjusted earnings per share of 10 cents, which declined from 33 cents in the prior-year quarter. The figure, however, surpassed the Zacks Consensus Estimate of earnings of 9 cents.

In the first quarter, CNH Industrial’s net sales declined nearly 21% from the year-ago level to $3.82 billion but topped the Zacks Consensus Estimate of $3.79 billion. The company’s net sales from industrial activities were $3.17 billion, down 23% due to lower shipment volumes.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite