|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

As global air travel rebounds and defense budgets expand amid escalating geopolitical risks, investors are increasingly drawn to aerospace leaders Boeing BA and Airbus EADSY. The companies’ strong presence across both commercial aviation and defense sectors positions them well to capitalize on this growth, making them compelling choices for long-term investment.

U.S.-based Boeing maintains a diversified business portfolio that includes commercial aircraft, defense systems, and space technologies, with robust connections to the U.S. Department of Defense, which supports a major portion of its long-term growth prospects. On the other hand, Europe-based Airbus operates an integrated model, but possesses a stronger presence in commercial aerospace while gradually growing its defense and space divisions.

With both these companies riding the powerful waves of defense modernization and airline fleet upgrades, the pressing question that aerospace-focused investors may face is: which stock stands out as the stronger aviation titan? Let’s delve deeper to find an answer to this.

Both Boeing and Airbus hold dominant positions in the aerospace sector, but differ notably in terms of financial stability and growth drivers.

Despite recent financial challenges, including setbacks from the 737 Max program and labor strikes in late 2024, Boeing delivered more commercial jets in the first quarter of 2025 compared to the previous year, supported by strong global air travel demand. This robust demand also boosted Boeing’s global services business, resulting in a solid 17.7% increase in first-quarter sales that improved the company’s financial position.

At the end of the first quarter, Boeing held $23.67 billion in cash and equivalents, with current debt of $7.93 billion, well below its cash balance, indicating strong near-term solvency. However, its long-term debt remained high at $45.69 billion. Boeing also successfully reduced its operating cash outflow to $1.62 billion from $3.36 billion a year ago, reflecting gradual financial recovery, particularly in its commercial segment.

A major growth driver for Boeing’s defense business is the U.S. government’s increased defense spending. The proposed 13% budget hike for fiscal 2026 by President Trump, including funding for the F-47 sixth-generation fighter aircraft, manufactured by Boeing, should significantly benefit the company. Boeing’s Defense, Space & Security division further strengthens revenue prospects with a substantial backlog of $61.57 billion as of March 31, 2025.

Innovative programs like the MQ-25, which recently advanced to final assembly, demonstrate Boeing’s commitment to expanding its defense market share through cutting-edge technology. Overall, Boeing shows signs of steady recovery and growth, bolstered by strong defense contracts and improving commercial operations.

Airbus, on the other hand, has maintained more financial stability in recent times, thanks to a stronger balance sheet and consistent deliveries. EADSY’s commercial aircraft deliveries outpaced Boeing’s for the fifth consecutive year, reinforcing its market leadership (a trend we observed in the first quarter of 2025 as well).

A comparative analysis of the company’s balance sheet items shows that its cash balance came in higher than its current debt at the end of the first quarter of 2025. Its operating cash flow also improved from the 2024-end level.

Backed by growing air travel and defense orders, Airbus’ first-quarter revenues registered a solid year-over-year improvement. Looking ahead, Airbus is ramping up its A320neo production, targeting 75 units per month by 2026, which should further bolster its commercial revenues.

As far as the company’s defense and space business segment is concerned, this unit registered a 30% year-over-year order growth in the first quarter, which bolsters its future revenue generation prospects.

Boeing faces significant execution and reputational risks, mainly due to ongoing quality control problems in its commercial division, especially with the 737 MAX program. A labor strike in September 2024, combined with these issues, caused a temporary production halt, leading to a large buildup of inventory. As of March 31, 2025, Boeing held around 35 undelivered 737-8 aircraft produced before 2023, scheduled for delivery this year.

Notably, 25 of these jets are destined for Chinese customers, raising concerns about timely deliveries amid escalating U.S.-China trade tensions. Failure in delivering these aircraft on time could negatively impact Boeing’s Commercial Airplanes (“BCA”) segment, potentially leading to weaker financial performance in the upcoming quarters.

Airbus, on the other hand, although benefits from a more stable commercial aircraft production environment, is not immune to risks. The company faces challenges from supply-chain bottlenecks, particularly in engine deliveries, and rising input costs. Moreover, in April 2025, the Trump administration imposed a 10% tariff on all imports, including aircraft, and additional reciprocal tariffs on specific countries, including the European Union. These tariffs might affect Airbus, particularly its ability to deliver aircraft to U.S. airlines.

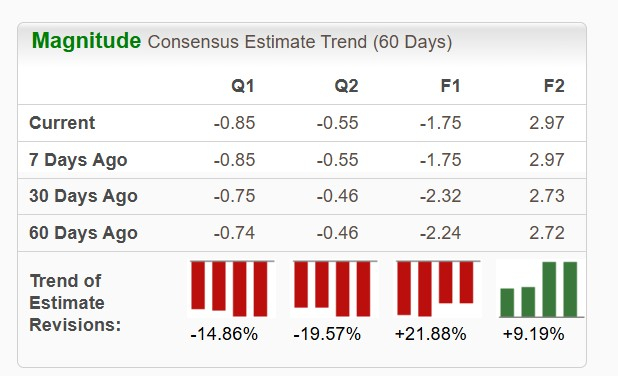

The Zacks Consensus Estimate for Boeing’s 2025 sales implies a year-over-year surge of 25.6%, and the same for its loss also suggests an improvement. Moreover, the stock’s bottom-line estimates show mixed movement over the past 60 days.

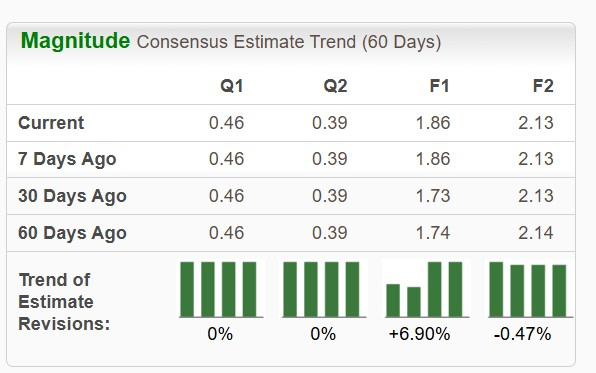

The Zacks Consensus Estimate for Airbus’ 2025 sales implies a year-over-year surge of 10.4%, while that for its earnings suggests an improvement of 28.3%. Further, the stock’s 2025 bottom-line estimates have been trending northward over the past 60 days, while the same for 2026 had a downward trend.

BA (up 13%) has outperformed EADSY (up 6.4%) over the past three months and has done the same in the past year. Shares of BA have surged 18.1%, while those of EADSY have gained 5.4%.

EADSY is trading at a forward sales multiple of 1.68X, below BA’s 1.73X.

The image below shows that BA’s Return on Invested Capital (“ROIC”) came in below EADSY’s. Its negative figure suggests that the American jet giant is not generating enough profit from its investments to cover the cost of its capital.

Considering both Boeing and Airbus as long-term investments, Airbus currently appears to hold an edge for investors seeking stability and growth.

EADSY’s stronger balance sheet, consistent commercial deliveries and a strong defense order backlog underpin its solid financial health. Additionally, Airbus’ upcoming estimates reflect positive earnings and sales momentum. In contrast, Boeing, despite its diversified portfolio and strong defense contracts, faces ongoing execution risks tied to its 737 MAX program and concerns over inventory build-up.

Therefore, risk-averse investors looking for better stability and capital efficiency may add EADSY to their portfolio. However, investors with a higher risk appetite, betting on a rebound, might continue to keep Boeing in their portfolio with its recent revenue growth and improving cash flow signaling recovery potential.

While Airbus holds a Zacks Rank #2 (Buy), Boeing carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours |

NASA Boss Blasts Starliner Mission that Left Astronauts in Space for Months

BA

The Wall Street Journal

|

| 3 hours |

Boeing, Northrop Moving On Orders, Approvals; Plus Airbus' Engine Issue

BA

Investor's Business Daily

|

| 4 hours | |

| 7 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 15 hours | |

| 19 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite