|

|

|

|

|||||

|

|

BlackRock BLK and Blackstone BX are leading U.S.-based asset management firms. While BLK focuses on public market investments and exchange-traded funds (ETFs), BX specializes in alternative assets like private equity and real estate.

The asset management industry is currently benefiting from investors' shift toward higher-yielding investment vehicles like equity funds, alternative assets and long-term bond funds. Also, deregulation is expected to open up access to cryptocurrencies and the previously untapped retirement market. Further, the growing adoption of tokenized assets – the tokenization of traditional assets, such as real estate and equities, is attracting investor interest. Together, these trends are expected to drive continued growth in assets under management (AUM). In this evolving landscape, BLK and BX seem to be well-positioned to capitalize on these tailwinds.

Now the question arises: which asset manager, BlackRock or Blackstone, deserves a place in your portfolio? Let’s examine their fundamentals, financial performance and growth prospects to determine which stock presents a more compelling opportunity right now.

BlackRock, one of the world’s largest asset managers (total AUM of $11.58 trillion as of March 31, 2025), has been expanding its footprint in domestic and global markets through acquisitions. Since 2024, the company has acquired the remaining 75% stake in SpiderRock Advisors, Global Infrastructure Partners (GIP) and London-based Preqin. Additionally, in December 2024, it announced a deal to acquire HPS Investment, which has almost $148 billion in AUM. These deals represent a strategic expansion of BlackRock’s Aladdin technology business into the rapidly growing private markets data segment.

Further, BlackRock has been focusing on diversifying its product suite and revenue mix, which, along with strategic acquisitions, has been contributing to its AUM’s growth over the years. AUM witnessed a five-year (2019-2024) compound annual growth rate (CAGR) of 9.2%, with the uptrend persisting in the first quarter of 2025 amid macroeconomic headwinds. The momentum will likely continue as efforts to strengthen iShares unit (offering more than 1,400 ETFs globally) and ETF operations (it received approval for spot Bitcoin and ether ETFs), and increased focus on the active equity business are expected to offer support.

These efforts are likely to bolster BLK’s revenue mix, reduce top-line concentration risk and allow it to serve a broader range of clients, aiding AUM growth. The company’s GAAP revenues witnessed a CAGR of 7% over the last five years ended 2024, with momentum persisting in the first quarter of 2025. Moreover, the combination of HPS Investment, Preqin and GIP data with the company’s alternative asset management platform, eFront, will drive solid revenue growth.

However, the uncertainties surrounding the impact of tariff policies and geopolitical risks are likely to weigh on BlackRock’s revenues to some extent.

Blackstone, one of the world’s largest alternative asset managers (total AUM of $1.17 trillion as of March 31, 2025), has been successfully raising money despite several near-term headwinds. Fundraising for the global private equity and real estate funds resulted in the company’s ‘dry powder’ or the available capital of $177.2 billion as of March 31, 2025.

With substantial investable capital, Blackstone is well-positioned to take advantage of market dislocations. The company maintains a strong long-term conviction in key sectors such as digital infrastructure, energy and power, life sciences, alternatives and the recovery in commercial real estate. Additionally, accelerating growth in India and Japan offers attractive opportunities, supporting a strategic deployment of capital.

Further, in April, Wellington, Vanguard and Blackstone announced the formation of an alliance to develop simplified multi-asset investment solutions combining public and private markets. Aiming to broaden investor access to institutional-quality portfolios, the collaboration leverages each firm’s strengths to address long-term diversification and return challenges in wealth and asset management.

However, tighter credit markets, higher-for-longer interest rates, slower deal activity in private equity and real estate, reduced realizations adversely impacting performance fees and concerns about exit opportunities are expected to hamper Blackstone’s near-term prospects. Additionally, the biggest factor influencing its financials will likely be the ongoing uncertain operating backdrop because of the Donald Trump administration’s trade policy.

Management believes that deal activities are expected to remain muted for the time being as the tariff plans have led to heightened ambiguity. This has also resulted in caution in the IPO market. Hence, it will not be easy for Blackstone to record growth in transaction advisory revenues and net realized performance income in the near term.

The Zacks Consensus Estimate for BLK’s 2025 and 2026 earnings indicates a 2.9% and 12.5% growth for 2025 and 2026, respectively. Over the past week, earnings estimates for 2025 and 2026 have been revised upward. This indicates analysts’ bullish sentiments.

Likewise, analysts are optimistic about BX’s prospects. The consensus mark for 2025 and 2026 earnings suggests a 3% and 33.2% increase. Also, over the past seven days, earnings estimates for both years have been revised north.

While 2025 started on a positive note, the operating backdrop gradually turned pessimistic as the year progressed because of Trump’s trade policy ambiguity and its adverse impact on the economy and the Federal Reserve’s monetary policy. As such, this year, shares of BlackRock and Blackstone have declined.

Valuation-wise, BLK is currently trading at a price-to-book (P/B) of 3.10X, higher than its five-year median of 2.97X. The BX stock, on the other hand, is currently trading at a P/B of 5.37X, which is higher than its five-year median of 3.85X.

Therefore, BlackRock is inexpensive compared to Blackstone.

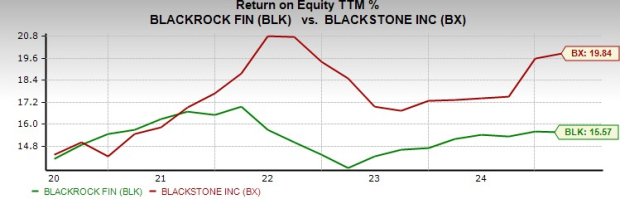

Meanwhile, BX’s return on equity (ROE) of 19.84% is above BLK’s 15.57%. So, Blackstone uses shareholder funds more efficiently to generate profits than BlackRock.

BlackRock appears to be the stronger pick for 2025 given its diversified growth strategy, robust AUM expansion and momentum in ETF and private market offerings. Strategic buyouts like GIP, Preqin and HPS Investment will enhance its data and alternatives platform, while the exposure to spot crypto ETFs and strong iShares presence position it well to capture evolving investor demand. Its consistent revenue and earnings growth also suggest resilience in uncertain macro conditions.

Blackstone, while still a formidable player in alternatives, faces near-term headwinds from tighter credit conditions, muted deal activity and geopolitical uncertainties. Despite strong fundraising and sizable investable capital, deployment challenges may delay monetization. While its ROE outpaces BLK’s, BlackRock’s broader product suite and valuation advantage make it a more compelling buy for 2025.

At present, BLK carries a Zacks Rank #3 (Hold), while BX has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite