|

|

|

|

|||||

|

|

Griffon Corporation GFF shares have dropped 19.5% in the past six months, wider than the industry and the S&P 500’s decline of 6.1% and 3.2%, respectively. The company’s performance is also notably weaker than its peers, 3M Company MMM and Carlisle Companies Incorporated CSL, which have gained 11.4% and lost 15.5%, respectively, over the same time frame.

Closing at $67.20 in the last trading session, the stock is trading much below its 52-week high of $86.73 but higher than its 52-week low of $55.01. The building products and equipment manufacturer’s dismal performance can be largely attributed to the softness in the residential construction market, which is amplified by ongoing tariff-related concerns between the US and China.

Let us explore the reasons behind the company’s disappointing movement on the bourses and assess if there is potential for growth.

Griffon has been witnessing persistent weakness in the Consumer and Professional Products (CPP) segment. Reduced consumer demand in North America and the United Kingdom has been weighing on the segment's performance. The CPP segment’s revenues declined 12.9% year over year in the second quarter of fiscal 2025 (ended March 2025). Demand for products like outdoor tools, project tools and outdoor decor and watering products has been particularly weak. Though the company anticipates a healthy demand environment in Australia, weakness in North America and the United Kingdom is expected to persist through fiscal 2025 (ending September 2025).

A typical seasonal drop in residential volumes also hurt the revenues of the Home and Building Products (HBP) segment, which declined 6% in the fiscal second quarter. Amid this, Griffon’s total revenues of $611.7 million missed the consensus estimate and decreased 9% on a year-over-year basis.

A high debt level remains another concern for GFF as it raises financial obligations and may drain profitability. The company’s long-term debt, net in the last five years (fiscal 2020-2024), increased 7.9% (CAGR). Griffon exited the fiscal second quarter with a long-term debt of $1.53 billion. Its current liabilities were at $330.8 million, higher than the cash equivalents of $127.8 million. Also, the stock looks more leveraged than the industry. Its long-term debt/capital ratio is currently pegged at 87.68%, higher than 54.02% of the industry.

Griffon operates in the highly competitive consumer, industrial, and home & building products markets. One of its peers, 3M Company, operates as a diversified technology firm and serves the aerospace, transportation, electronics, safety and industrial end markets. Carlisle, another peer, engages in the manufacture of a wide range of roofing and waterproofing products, engineered products and finishing equipment.

Although revenues from the HBP segment decreased in the fiscal second quarter due to residential sales activity returning to normal seasonality, the resiliency of repair and remodeling activity in the construction sector is expected to aid the segment’s results in the quarters ahead. The U.S. residential construction market is expected to witness a recovery in single-family housing, supported by stable interest rates and builder incentives, which is likely to be beneficial for the segment.

The recovery in the commercial construction market, driven by several projects undertaken by customers, is expected to benefit the segment as well. For fiscal 2025, Griffon expects the HBP segment’s revenues to be flat on a year-over-year basis.

Griffon has been strengthening its business through acquisitions. In July 2024, it acquired an Australia-based company, Pope (a provider of residential watering products). Pope, which has been added to GFF’s CPP segment, has expanded its product portfolio in the Australian market. The acquisition of Pope is anticipated to generate annual revenues of around $25 million and positively impact the company's earnings in the first full year of ownership. In the fiscal second quarter, this buyout contributed 2% to the CPP segment’s revenues.

The company also remains committed to rewarding its shareholders through dividend payouts and share buybacks. In the fiscal second quarter, it paid dividends worth $23.4 million and repurchased shares for $72.9 million. It’s worth noting that in November 2024, Griffon’s board approved a new $400,000 share repurchase authorization. Also, in the same month, the company hiked its quarterly dividend by 20%.

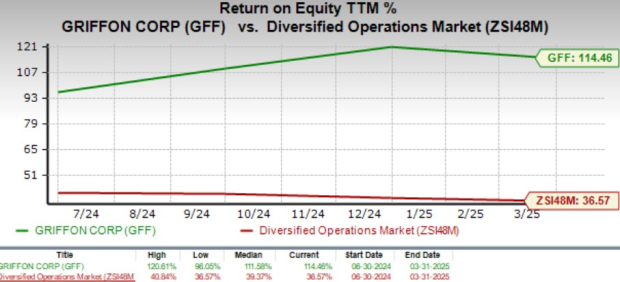

Griffon’s trailing 12-month return on equity (ROE) is indicative of its growth potential. ROE for the trailing 12 months (exiting fiscal second quarter) is 114.46%, significantly higher than the industry’s 36.57%. This reflects the company’s efficient usage of shareholder funds.

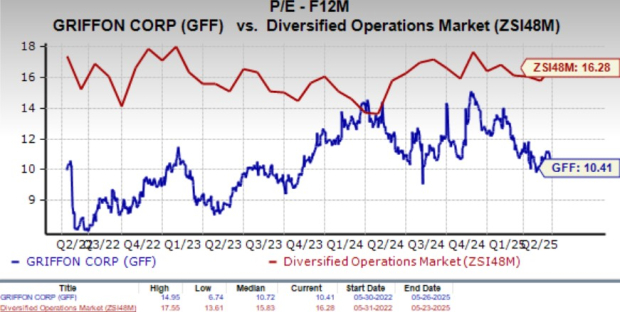

With a forward 12-month price-to-earnings of 10.41X, which is much below the industry average of 16.28X, the stock presents a potentially attractive valuation for investors. The current valuation is below its three-year median of 10.72X. Also, the stock is cheap compared with its peers, 3M Company and Carlisle, which are trading at 18.69X and 16.48X, respectively.

GFF’s earnings estimates for fiscal 2025 have increased 0.5% to $5.71 per share over the past 60 days, while the same for fiscal 2026 (ending September 2026) has been stable at $6.85.

For fiscal 2025, the Zacks Consensus Estimate for GFF’s sales implies a decline of 1.9% year over year, while the EPS estimate indicates 11.5% growth. The consensus mark for fiscal 2026 sales and earnings indicates year-over-year increases of 2.7% and 20.1%, respectively. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

While GFF’s recent share performance and high debt level may prompt caution, its strong fundamentals, anchored by its solid foothold in the industrial, residential and commercial construction markets, highlight its clear competitive edge.

Investors who already own this Zacks Rank #3 (Hold) stock may stay invested as the company's upbeat estimates, attractive valuation and benefits of improving demand across end markets offer solid long-term prospects.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-16 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-10 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite