|

|

|

|

|||||

|

|

American Airlines AAL and SkyWest SKYW are two well-known names in the Zacks Transportation- Airline industry. American Airlines, based in Fort Worth, TX, is a founding member of the oneworld global alliance. AAL is known for its extensive domestic and international network. The carrier serves over 350 destinations globally, with more than 226 million passengers having boarded its flights in 2024.

On the other hand, SkyWest, founded in 1972, is based in St. George and operates regional jets for major U.S. airlines. SKYW is the holding company for SkyWest Airlines, SkyWest Charter and SkyWest Leasing, an aircraft leasing company. SkyWest Airlines has a fleet of approximately 500 aircraft connecting passengers to over 240 destinations throughout North America.

Given this backdrop, let’s examine closely to find out which airline player currently holds the edge, and more importantly, which might be the smarter investment now.

While releasing its first-quarter 2025 results last month, AAL’s management projected earnings per share to be between 50 cents and $1 in the second quarter of 2025. Due to the tariff-induced economic uncertainties and the resultant reduction in consumer and corporate confidence, AAL decided against giving guidance for a longer period and withdrew its 2025 financial guidance. Management stated that it would provide an update later in the year as visibility improves.

AAL incurred a narrower-than-expected loss in the March quarter, which meant that the company maintained its earnings surprise record, having surpassed estimates in each of the last four quarters.

American Airlines price-consensus-eps-surprise-chart | American Airlines Quote

However, apart from the well-documented tariff-induced slowdown in domestic air travel demand, mishaps like those involving American Eagle Flight 5342 in January put the stock on the back foot. American Eagle, encompassing regional carriers, is a subsidiary of AAL.

AAL’s financial metrics indicate that its leverage is elevated and is a massive negative for its shareholders. The long-term debt burden of the company was $24.7 billion at the end of the first quarter of 2025, translating into a debt-to-capitalization in excess of 100%, which is above the sub-industry’s 70.4%.

High labor costs (expenses on salaries and wages were up 9.2% year over year in the first quarter of 2025), mainly due to the deal with pilots inked in 2023, are hurting AAL’s bottom line.

On a brighter note, the southward movement of oil prices bodes well for AAL’s bottom-line growth. This is because fuel expenses are a significant input cost for the aviation space. Crude oil is struggling in 2025, with prices sliding to multi-month lows. Tariff concerns, weakening consumer confidence and production increase by OPEC+ have all contributed to this downward pressure. As evidence, expenses on aircraft fuel and taxes decreased 13.2% to $2.6 billion in the first quarter of 2025. Average fuel price per gallon (including related taxes) decreased to $2.48 from $2.86 a year ago. The oil price-induced cost relief could support margins and lend ticket pricing flexibility to airlines like AAL in this uncertain era.

SKYW’s track record of successfully meeting the requirements of each of its airline heavyweight partners bodes well for the company. Consequently, revenues from flying agreements (which account for the bulk of the top line) are impressive.

Driven by impressive revenues, SKYW, like AAL, has an impressive earnings surprise track record, having surpassed the Zacks Consensus Estimate in each of the last four quarters.

SkyWest price-consensus-eps-surprise-chart | SkyWest Quote

It is quite evident that the current production delays at plane manufacturer Boeing BA have hurt the fleet-related plans of airline heavyweights in the United States. However, this supply-chain mess worked in favor of SkyWest and improved its pilot-staffing scenario. Due to the Boeing-induced delivery delays, many major airlines have paused/slowed pilot hiring, which, in turn, slowed down the migration of employees from regional to mainline airlines. Some employees even returned to regional airlines like SKYW from major airlines in this scenario to save their jobs. This situation is aiding SKYW’s fleet utilization.

SKYW’s shareholder-friendly approach highlights its financial bliss. To this end, SKYW’s board recently approved a $250 million increase to its existing share repurchase plan, which was approved in May 2023. The plan authorized the repurchase of up to $250 million of SkyWest’s common stock, of which approximately $22 million remained after $12 million was repurchased in April 2025. Following the recent increase, SkyWest is authorized to repurchase up to approximately $272 million of its common stock. Unlike AAL, SKYW’s leverage is not elevated, which is another positive for shareholders.

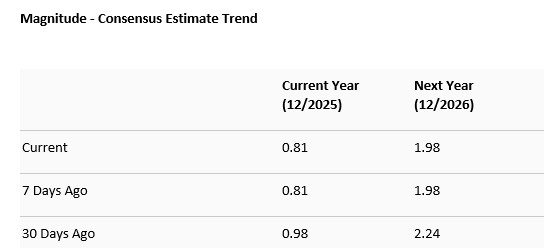

The Zacks Consensus Estimate for AAL’s 2025 and 2026 sales implies a year-over-year increase of 0.7% and 6.7%, respectively. The consensus mark for AAL’s 2025 EPS highlights a 58.3% year-over-year drop mainly due to tariff-induced uncertainties. The 2026 EPS consensus mark indicates a 145.3% year-over-year surge. The EPS estimates for 2025 and 2026 have been trending southward over the past 30 days.

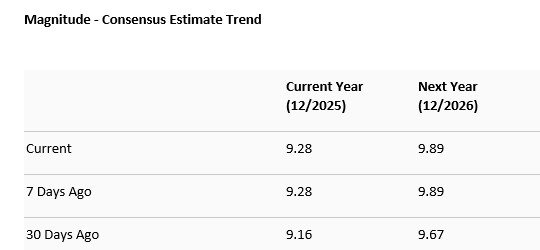

The Zacks Consensus Estimate for SKYW’s 2025 and 2026 sales implies a year-over-year increase of 10.5% and 4.2%, respectively. The consensus mark for SKYW’s 2025 and 2026 EPS implies a 19.4% and a 6.4% year-over-year increase, respectively. Moreover, the EPS estimates for 2025 and 2026 have been trending northward over the past 30 days, unlike AAL.

The tariff-induced uncertainty is hurting all airlines, and AAL and SKYW are no exceptions. A resolution of the problem, hints of which have been emanating lately, will serve both airlines well.

Apart from the tariff-induced uncertainty, headwinds like high debt and labor costs place AAL on the back foot. On the other hand, the focus of regional carriers like SKYW on domestic routes and shorter-haul flights implies that they have lower exposure to the potential ill effects of tariffs on international trade. SKYW’s lower debt levels and shareholder-friendly approach serve it well.

Given these factors, SKYW seems a better pick than AAL now.

While SKYW currently carries a Zacks Rank #2 (Buy), AAL is currently #5 Ranked (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 41 min | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Boeing, Northrop Grumman Stocks Poised To Move On Key Government Approvals

BA

Investor's Business Daily

|

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite