|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Starbucks Corporation SBUX and Dutch Bros Inc. BROS are both prominent players in the U.S. specialty coffee market but operate with distinct models. Starbucks, a global icon with over 40,000 stores, has long defined premium coffeehouse culture, while Dutch Bros is a fast-growing challenger focused on drive-thru convenience, youth-oriented branding and customer engagement.

The broader U.S. coffee market remains resilient in 2025, fueled by strong consumer loyalty, daily ritual-driven demand, and growing adoption of mobile ordering and digital rewards. Premium beverage innovation, experiential store formats and daypart expansion (especially morning and afternoon traffic) continue to be key battlegrounds.

Innovations in eco-friendly brewing, ready-to-drink formats and sustainable packaging are reshaping consumer behavior, while regional dynamics like rising North American home consumption and European export demand are broadening the industry's reach. Despite challenges like climate impacts and rising tea consumption, the coffee sector remains one of the most dynamic in the food and beverage industry.

Per the report, the global coffee market is projected to grow from $145.84 billion in 2025 to $201.41 billion by 2032, marking a steady CAGR of 4.72%. Ground coffee remains a dominant force, with its segment expected to rise from $41.24 billion to $58.35 billion over the same period.

Against this dynamic backdrop, both Starbucks and Dutch Bros are actively adapting their models to capture future opportunities. But for investors, the central question remains: Which coffee stock offers a more compelling opportunity in 2025? Let’s take a closer look at both.

Starbucks is executing a sweeping turnaround strategy dubbed “Back to Starbucks,” which centers on improving the customer and partner (employee) experience. This includes enhancements to store operations, labor deployment, customer service, and menu offerings, all aimed at restoring growth and profitability.

A major pillar of this strategy is the rollout of a new green apron service model across thousands of U.S. stores. This labor and algorithm-driven system is designed to improve peak-hour throughput and elevate the quality of customer interactions. Starbucks is also investing in digital features like scheduled mobile pickup and revamped order sequencing to reduce wait times and boost app usage.

Meanwhile, the company is making significant changes to store design and ambiance to reclaim its “third place” identity, a welcoming environment between home and work. With updated seating, expanded refill policies, and regional renovations planned, Starbucks aims to drive higher in-store engagement and longer visits.

Internationally, Starbucks is seeing momentum return in key markets like the U.K., Japan and Canada. In China — its second-largest market — early signs of stabilization are emerging as the company refines its offerings and pricing strategies.

Product innovation remains key to the strategy. Starbucks is streamlining its menu and adding culturally relevant limited-time offerings. A new health-forward beverage platform, improved cold coffee capabilities, and expanded artisanal food options are all in testing phases, with plans for broader rollout.

While Starbucks remains committed to its long-term growth ambitions, near-term hurdles continue to pose challenges. In the fiscal first quarter, global comparable store sales fell on a year-over-year basis, largely due to weaker performance in the United States and a decline in transaction volumes. Margin pressures have intensified as the company ramps up investments in labor and supply chain infrastructure. Although several strategic initiatives are in motion, a meaningful recovery in earnings is expected to take time. Looking ahead, ongoing macroeconomic headwinds and elevated operating costs could dampen momentum.

Dutch Bros is one of the most compelling growth stories in U.S. food and beverage. With a goal of reaching 2,029 shops by 2029, the company is executing on a disciplined expansion plan backed by strong leadership development, market planning, and real estate optimization. Its shop pipeline remains robust, and newer locations are outperforming expectations in terms of productivity and transaction growth.

Dutch Bros continues to push innovation through vibrant LTOs, experiential merchandise drops, and targeted marketing. Recent product launches such as the Sweet Cereal Sips and Spring Fever Dream Trio have helped the brand maintain momentum even against difficult comps. The brand also drives engagement through Dutch Rewards, a highly personalized loyalty program that now accounts for the majority of transactions across its system.

On the technology front, the company’s Order Ahead platform is gaining adoption and proving especially effective in capturing morning demand, a daypart where speed and convenience are paramount. Simultaneously, Dutch Bros is piloting a limited food menu, designed to enhance morning traffic without disrupting operations. The food initiative, though still in its early stages, represents a promising future sales layer.

Operationally, the company is laser-focused on maintaining quality while scaling. It has improved throughput, invested in leadership development, and moved toward capital-light, build-to-suit lease models to enhance new shop economics and accelerate expansion. Nonetheless, Dutch Bros is still in an aggressive growth phase and faces the risks typical of rapid scaling, including execution consistency, regional saturation concerns, and infrastructure strain. Its smaller national footprint also makes it more sensitive to localized economic pressures.

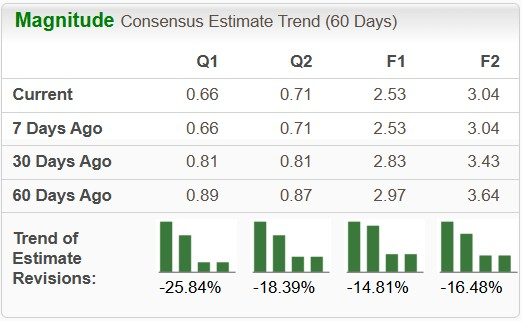

The Zacks Consensus Estimate for Starbucks’ fiscal 2025 sales suggests year-over-year increase of 2% while earnings per share (EPS) indicate a decline 23.6%. In the past 60 days, earnings estimates for fiscal 2025 have declined 14.8%.

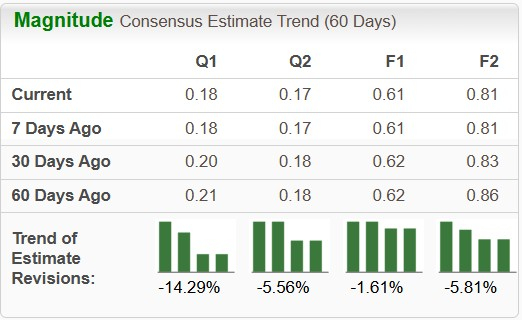

The Zacks Consensus Estimate for Dutch Bros’ 2025 sales and EPS suggests year-over-year increases of 23.5% and 24.5%, respectively. In the past 60 days, earnings estimates for 2025 have declined 1.6%.

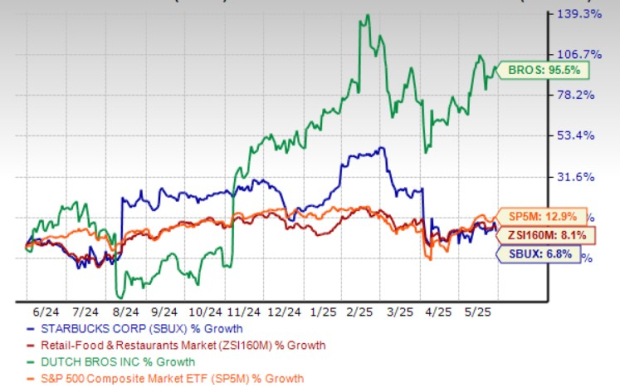

Starbucks stock has gained 6.8% in the past year, underperforming its industry and the S&P 500’s rise of 8.1% and 12.9%, respectively. Meanwhile, Dutch Bros’ shares have surged 95.5% in the same time.

Starbucks is trading at a forward 12-month price-to-sales (P/S) ratio of 2.49X, below the industry average of 4.06X over the last year. BROS’ forward 12-month P/S multiple sits at 6.61X over the same time frame.

Both Starbucks and Dutch Bros are navigating a resilient and evolving coffee industry, leveraging innovation, digital engagement, and strategic expansion to capture market share in 2025. Dutch Bros stands out with its rapid growth trajectory, strong brand engagement, and superior earnings momentum. Its agile drive-thru model, vibrant product innovation and improving shop economics give it a competitive edge, especially among younger, on-the-go consumers.

Starbucks, meanwhile, offers unmatched global scale, a deeply entrenched brand, and a comprehensive turnaround plan aimed at revitalizing in-store experiences and boosting operational efficiency. While its transformation is promising, near-term headwinds — including margin pressures, softening traffic, and execution risks — could weigh on investor confidence.

Backed by stronger top and bottom-line growth estimates, robust stock performance, and elevated investor sentiment, Dutch Bros holds the edge as the more compelling coffee stock for 2025.

Starbucks has a Zacks Rank #4 (Sell) while Dutch Bros presently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite