|

|

|

|

|||||

|

|

As the shift toward clean energy accelerates amid intensifying electricity demand, investors interest in renewable-focused utility stocks like AES Corporation AES and Exelon Corp EXC are increasing. Both these companies are investing heavily in infrastructural developments to strengthen their grid resilience, transmission and distribution lines as well as expand their exposure to renewable energy generation.

While AES is a diversified global power company that generates electricity from multiple sources like natural gas, renewables and some legacy coal-fired units, Exelon is one of America’s largest utility providers, concentrating on the transmission and distribution of clean energy.

As factors like rapid data center expansion, electric vehicle adoption, grid modernization and broader decarbonization goals are accelerating the investment trend in the U.S. utility sector, both AES and EXC are well-positioned to benefit. Now, to determine which one of these stocks presents a stronger investment opportunity, let’s take a closer look.

Recent Achievements: Per its first-quarter 2025 results, since February 2025, AES signed new long-term Power Purchase Agreements (PPAs) for 443 megawatts (MW) of solar and energy storage. More recently, in May, the company signed two long-term PPAs with Meta to support the latter’s data centers with 650 MW of solar capacity.

Looking ahead, the company expects to complete the construction of the majority of its 11.9 GW backlog of signed contracts with investment-grade, large corporate customers through 2027. Such notable PPAs and contract backlog should drive strong financial results for AES in the years to come.

Financial Stability: The company ended the first quarter of 2025 with cash and cash equivalents (including marketable debt securities) of $2.55 billion, up from $2.04 billion at the end of 2024. However, as of March 2025, it reported a long-term debt of $26.41 billion and a current debt of $4.17 billion. This indicates a relatively weak financial position, which could limit the company's ability to reliably fund its ongoing operations and future growth plans.

Challenges to Note: AES Corp. faces multiple challenges that may concern investors. A key issue is the decline in wholesale electricity prices, primarily due to increasing low-cost renewable energy sources, cheaper natural gas and demand-side efficiencies. This trend is likely to persist, potentially putting pressure on AES’ revenues. Additionally, the company’s hydroelectric assets remain vulnerable to unfavorable weather patterns, especially in countries like Panama, Brazil, Colombia and Chile. Reduced water inflows can limit power generation, forcing AES to purchase electricity to meet contractual obligations, which is likely to impact its bottom-line performance.

Recent Achievements: Exelon ended the first quarter of 2025 on a solid note, with its earnings per share having increased 35.3% from the prior-year quarter. The company also reported year-over-year revenue growth of 11.1%.

In May 2025, Exelon’s ComEd segment got approval from the Illinois Commerce Commission for its second Beneficial Electrification Plan, which will invest about $168 million from 2026 to 2028.

Looking ahead, Exelon plans to invest nearly $38 billion in its regulated utility operations from 2025 to 2028, reflecting a 10% increase from the prior plan. Such an investment strategy should help improve EXC’s grid reliability and may boost its customer base, thereby bolstering its revenues.

Financial Stability: The company ended the first quarter of 2025 with cash and cash equivalents (including marketable debt securities) of $1.58 billion, up from $0.90 billion at the end of 2024. However, as of March 2025, it reported a long-term debt of $45.73 billion and a current debt of $2.54 billion. This indicates a relatively weak financial position, which could limit the company's ability to reliably fund its ongoing operations and future growth plans.

Challenges to Note: Exelon faces challenges from changing technologies and weather conditions. Rising usage of energy efficiency of lighting, appliances, equipment and building materials might reduce energy consumption. This may lower demand for Exelon’s transmission and distribution services, adversely impacting its profitability. Additionally, extreme weather conditions or damage resulting from storms may put pressure on transmission and distribution systems of utility providers like EXC, resulting in increased maintenance costs.

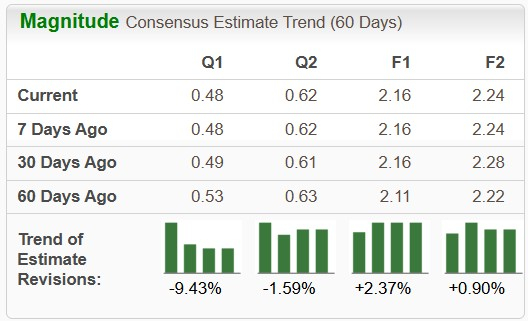

The Zacks Consensus Estimate for AES’ 2025 earnings per share (EPS) is pegged at $2.16, which indicates year-over-year growth of 0.9%. The company’s EPS estimates have also been trending upward over the past 60 days. The consensus estimate for 2025 revenues is pegged at $12.56 billion, which indicates year-over-year growth of 2.3%.

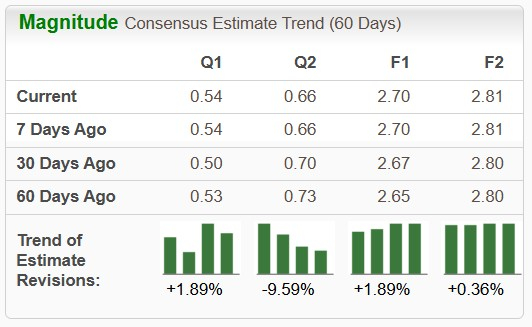

The Zacks Consensus Estimate for EXC’s 2025 EPS is pegged at $2.70, which indicates year-over-year growth of 8%. The company’s EPS estimates have also been trending upward over the past 60 days. The consensus estimate for 2025 revenues is pegged at $24.20 billion, which indicates year-over-year growth of 5.1%.

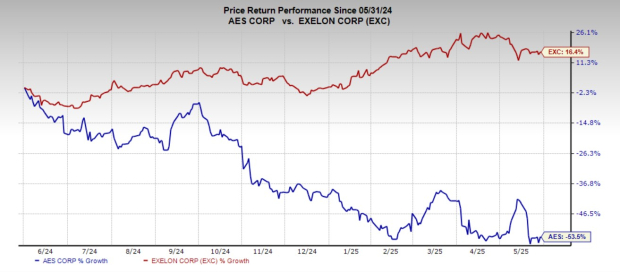

EXC has outperformed AES over the past year. Shares of EXC gained 16.4% against shares of AES, which declined 53.5%.

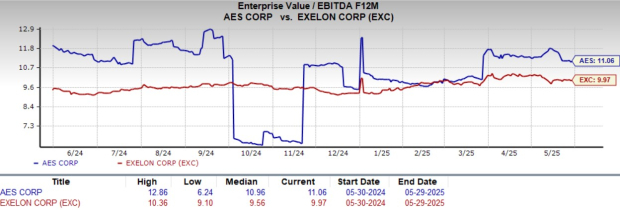

AES shares are expensive on a relative basis, with its forward 12-month Enterprise Value/EBITDA (EV/EBITDA F12M) being 11.06X compared with EXC’s EV/EBITDA F12M of 9.97X.

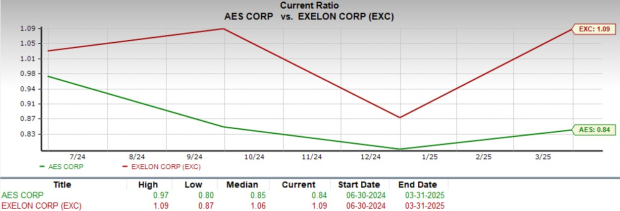

Exelon has a current ratio of 1.09 compared with AES’ 0.84. A current ratio above one indicates that the company can comfortably meet its short-term liabilities. In contrast, AES’ current ratio below one raises concerns about its short-term liquidity.

Exelon has a total debt-to-capital ratio of 63.09%, which is significantly lower than AES’ total debt-to-capital ratio of 79.83%. This indicates that EXC maintains a more balanced capital structure and is less dependent on debt financing.

Both AES and EXC are key utility players with increased focus in the clean energy space, but EXC currently appears to be the more attractive investment opportunity.

EXC offers a more attractive valuation, higher short-term liquidity and stronger capital structure. While AES is actively expanding its renewable capacity, its high debt levels and weaker financial ratios raise concerns about its stability.

For investors looking for a clean energy-focused utility with better financial strength and capital structure, EXC seems to be the better choice right now.

EXC currently carries a Zacks Rank #2 (Buy), while AES holds a Zacks Rank #3 (Hold). You can see the full list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite