|

|

|

|

|||||

|

|

Ciena Corporation CIEN is scheduled to report second-quarter fiscal 2025 results on June 5, before market open.

The Zacks Consensus Estimate for earnings is pegged at 52 cents per share, implying a 92.6% increase from the year-ago level.

The consensus estimate for revenues is pegged at $1.1 billion, suggesting a 20.3% rise from the prior-year level. For the fiscal second quarter, management expects revenues to be in the range of $1.05 billion to $1.13 billion.

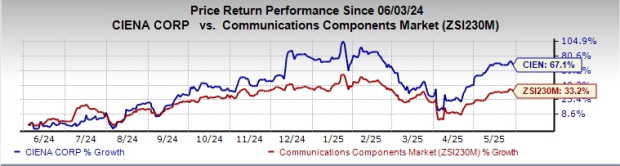

Ciena’s earnings surpassed the Zacks Consensus Estimate in three of the last four quarters while lagging in one. It delivered a trailing four-quarter earnings surprise of 40%, on average. Shares of the company have soared 67.1% in the past year compared with the Zacks Fiber Optics industry's growth of 33.2%.

Ongoing demand for high-speed connectivity driven by artificial intelligence (AI) and cloud services is likely to have aided Ciena's top-line performance in the fiscal second quarter. The proliferation of AI applications and increased cloud adoption are driving substantial network traffic, benefiting Ciena's core offerings. The company continues to witness strong, broad-based momentum across its portfolio of critical technologies serving both service provider and cloud provider customers.

Ciena is strategically positioned to benefit from the ongoing investments in AI and cloud infrastructure. Its optical networking solutions are essential for high-speed data transmission between data centers, a critical requirement for AI workloads. Continued advancements in optical networking technologies position Ciena favorably in the market. We estimate sales from optical networking to reach $678.8 million in the fiscal second quarter, up 21% year over year.

The surging adoption of Blue Planet software is another tailwind. We expect revenues from Blue Planet Automation Software and Services to climb 50% year over year to $21.8 million in the quarter. Ciena’s interconnects portfolio is also gaining momentum and offers strong growth potential, especially with AI in metro data center campuses and future in-data center use. Interconnects refer to tech that connects and links data centers, including pluggables and components.

CIEN’s WaveLogic portfolio is key to building top-tier network backbones for the AI and cloud economy, both on land and undersea. Its WaveLogic 6 Extreme technology is gaining traction, with 20 new customers added in the fiscal first quarter, indicating strong market acceptance. Management plans to launch its 800G WaveLogic 6 nano pluggable in the first half of fiscal 2025, with deployments later for Metro DCI use. It also supports the first 1.6T Coherent-Lite solution for 2–20 km campus use, set for 2026.

Ciena Corporation price-eps-surprise | Ciena Corporation Quote

However, potential disruptions due to tariffs and global macroeconomic uncertainties could adversely impact supply chains and customer spending patterns. Heavy reliance on a few customers and intense competition in the communications networking equipment, software and services market are likely to have weighed on CIEN’s performance in the fiscal second quarter.

For the fiscal second quarter, revenues from Global Services and Platform Software and Services are pegged at $156.3 million and $117.9 million, up 16.1% and 38% year over year.

In May 2025, Ciena’s Blue Planet software was adopted by Telefonica Germany to create one of Europe’s first public cloud platforms for network automation and 5G monetization. The software helps manage and automate the network, including tools for inventory, orchestration and 5G network slicing, supporting Telefonica’s IT and network transformation.

Blue Planet was also leveraged by Swisscom to modernize its assurance systems. Blue Planet’s Unified Assurance and Analytics (UAA) will help manage faults and performance across Swisscom’s network, starting with access and transport, and later covering mobile backhaul and B2B services.

In March 2025, Ciena and Lumen Technologies completed a successful trial of a 1.2 terabit wavelength service throughout 3,050 kilometers (more than 1,800 miles) on Lumen’s Ultra-Low-Loss fiber network. This achievement marks the longest 1.2 terabit non-regenerated signal ever recorded.

Our proven model predicts an earnings beat for CIEN in this earnings season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is exactly the case here.

CIEN has an Earnings ESP of +20.10% and a Zacks Rank #3 at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Here are some companies which, according to our model, also have the right combination of elements to post an earnings beat this season:

Dollar Tree DLTR currently has an Earnings ESP of +5.49% and a Zacks Rank of 3. The company is likely to register top and bottom-line declines when it reports first-quarter fiscal 2025 results on June 4. The consensus mark for DLTR’s quarterly revenues is pegged at $4.5 billion, which indicates a plunge of 40.5% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dollar Tree’s earnings has moved up a couple of cents to $1.20 per share in the past 30 days. The consensus estimate indicates a drop of 16.1% from the year-ago quarter’s actual. DLTR delivered a negative trailing four-quarter earnings surprise of 8.4%, on average.

Dollar General Corporation DG currently has an Earnings ESP of +2.64% and a Zacks Rank #3. The Zacks Consensus Estimate for first-quarter fiscal 2025 earnings per share has increased a penny in the past 30 days to $1.47, implying a 10.9% year-over-year decline. DG is slated to release quarterly results on June 3.

The Zacks Consensus Estimate for quarterly revenues is pegged at $10.3 billion, which indicates an increase of 3.7% from the figure reported in the prior-year quarter. DG delivered a trailing four-quarter earnings surprise of 1.2%, on average.

lululemon athletica LULU currently has an Earnings ESP of +1.82% and a Zacks Rank of 3. LULU is slated to report first-quarter fiscal 2025 results on June 5. The Zacks Consensus Estimate for its quarterly revenues is pegged at $2.4 billion, indicating 6.6% growth from the figure reported in the year-ago quarter.

The consensus estimate for LULU’s earnings has been pegged at $2.58 per share, indicating a drop of 1.6% from the year-ago quarter’s actual. LULU has a trailing four-quarter earnings surprise of 6.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite