|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Lockheed Martin Corp. LMT has recently launched its eighth GPS III satellite (SV08) from Cape Canaveral Space Force Station, Florida. These satellites, enabled to provide enhanced positioning, navigation, and timing (PNT) services for both civilian and military users, support a range of critical applications, including aviation, maritime navigation, land transport, and search and rescue.

The rising demand for secure, high-precision navigation, communications, and defense systems is accelerating satellite deployment and fueling the expansion of the global space economy. In this evolving landscape, Lockheed is well-positioned to benefit, particularly following its successful GPS III SV08 launch, which showcases its ability to rapidly deliver mission-critical space assets. The company offers end-to-end space solutions, from human spacecraft to advanced space-enabled defense technologies, and continues to innovate to maintain a competitive edge.

Recently, Lockheed has enhanced the GPS ground segment by integrating M-Code Early Use, enabling secure military communications for U.S. and allied forces worldwide. As investor interest in space stocks grows, driven by the increasing relevance of satellite-based services and defense technologies, Lockheed stands out as a strong contender for portfolio inclusion.

However, while the company’s recent achievements and strong position in the space sector are noteworthy, prudent investors should avoid making decisions based solely on a single event. A comprehensive evaluation of Lockheed’s long-term growth potential, stock market performance, valuation, and possible risks is essential. Let’s take a deeper look at these factors to assess whether Lockheed offers a compelling investment opportunity right now.

For defense contractors like Lockheed, order flow for its combat-proven weapons from the Pentagon and other U.S. allies remains a major growth driver for its operational results. Notably, the company was successful in securing a handful of multi-million-dollar contracts in the first quarter of 2025, which culminated in a record backlog count worth $173 million as of March 30, 2025. Such a solid backlog count bolsters LMT’s long-term revenue prospects.

On the other hand, an expansionary defense budget also plays a vital role in bolstering U.S.-based defense stocks like Lockheed. To this end, it is imperative to mention that in May 2025, a White House report revealed President Trump’s proposal for a 13% rise in U.S. defense spending to $1.01 trillion for fiscal 2026, emphasizing space dominance, nuclear deterrence, and the development of a next-gen missile defense system — the Golden Dome. As a key player in space and missile defense, Lockheed stands to benefit significantly from this increased budget, which is expected to drive strong revenue growth in the coming quarters through expanded government contracts.

The aforementioned factors thus position Lockheed for robust long-term growth, which is further reflected in the Zacks Consensus Estimate for LMT’s long-term (three-to-five years) earnings growth rate of 10.5%.

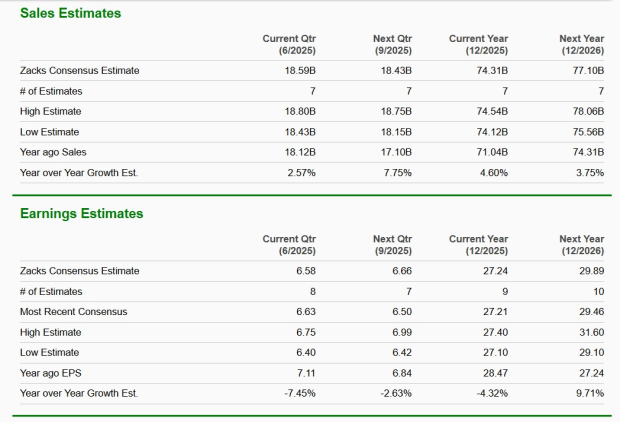

Now let’s take a quick sneak peek at its near-term estimates to check if those mirror a similar growth story.

The Zacks Consensus Estimate for LMT’s 2025 and 2026 sales implies an improvement of 4.6% and 3.8%, respectively, year over year.

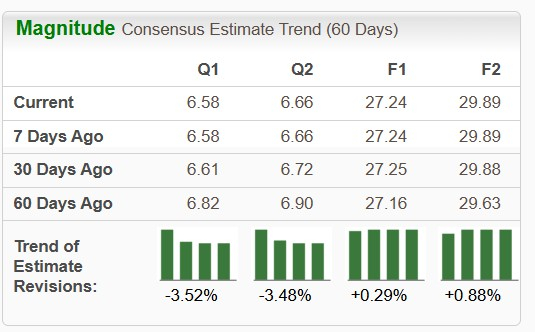

However, its 2025 earnings estimates suggest a dismal performance. Nevertheless, LMT’s 2026 earnings estimate calls for a rise of 9.4%.

On the other hand, the near-term annual bottom-line estimates suggest upward movement over the past 60 days. This indicates analysts’ increasing confidence in the stock’s earnings-generating capabilities.

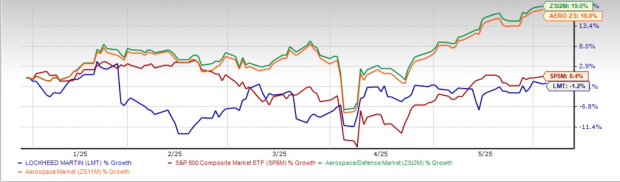

Shares of Lockheed have lost 1.2% in the year-to-date period, underperforming the Zacks Aerospace-Defense industry’s growth of 19% and the broader Zacks Aerospace sector’s rise of 18%. The stock has also lagged the S&P 500’s return of 0.4% during the same period.

On the contrary, LMT’s industry peers, The Boeing Company BA and Embraer S.A. ERJ have gained in the year-to-date period. Shares of ERJ rose 25.3%, while those of BA grew 20.6%.

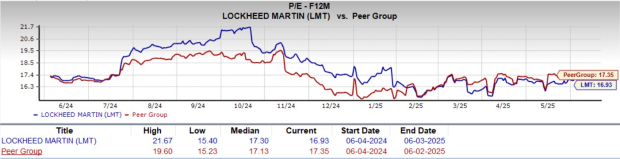

In terms of valuation, LMT’s forward 12-month price-to-earnings (P/E) is 16.93X, a discount to its peer group’s average of 17.35X. This suggests that investors will be paying a lower price than the company's expected earnings growth compared to its peers.

Despite its strong position as a defense contractor, Lockheed faces notable challenges, particularly from labor shortages that affect the broader aerospace-defense industry. According to the 2024 "On the Horizon" Workforce Study by the Aerospace Industries Association and PwC, the sector is grappling with high attrition rates, averaging 13% over the past two years, significantly above the national average of 3.8%. This talent drain, driven by rising retirements, raises concerns over production delays and quality control. As aircraft manufacturers ramp up output post-pandemic, staffing gaps risk disrupting supply chains and timelines.

For prominent defense contractors like Lockheed, Boeing and Embraer, such labor constraints could hinder delivery targets, potentially affecting operational performance and placing downward pressure on their share price if milestones are missed.

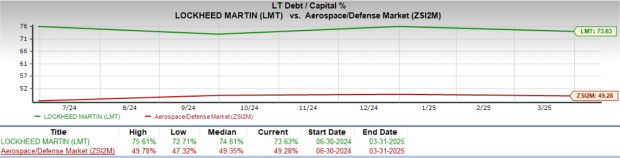

Moreover, LMT’s long-term debt-to-capital ratio is higher than the industry average (as one can see below). Such a high debt-to-capital ratio suggests that the company relies more heavily on debt financing compared to its industry, indicating a higher financial risk and a greater burden on cash flow due to interest payments.

To conclude, investors interested in Lockheed should wait for a better entry point, as its poor 2025 earnings expectation, dismal performance at the bourses, and a relatively high debt load warrant caution despite offering a more favorable P/E ratio than its peers.

However, those who already own this Zacks Rank #3 (Hold) stock may choose to stay invested, as the company’s upbeat sales estimates, recent satellite launches and growing space economy offer solid long-term growth opportunities.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 20 hours | |

| Feb-20 | |

| Feb-20 |

Defense Funds Poised For Breakouts As Trump Readies Potential Iran Strike

LMT BA

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

New Aerospace Stock, Up 110% This Week, Lands Support From GE Aerospace

LMT

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

NASA Boss Blasts Starliner Mission that Left Astronauts in Space for Months

BA

The Wall Street Journal

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite