|

|

|

|

|||||

|

|

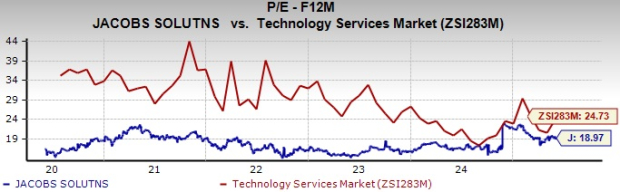

Jacobs Solutions Inc.'s J stock is currently trading at a discount compared with the Zacks Technology Services industry peers. The company’s forward 12-month price-to-earnings (P/E) ratio is 18.97X, which is down from the industry average of 24.73X and the broader Business Services sector’s 22.69X.

Jacobs is also trading currently at a discount compared with similar players like EMCOR Group, Inc. EME, AECOM ACM and Sterling Infrastructure, Inc. STRL. EMCOR, AECOM and Sterling Infrastructure are trading with forward 12-month P/E multiples of 19.75X, 20X and 21.87X, respectively.

In the past month, shares of Jacobs have gained 5% compared with the industry’s and the S&P 500’s increase of 15.7% and 6.3%, respectively. The company has underperformed the industry due to rising direct costs and unfavorable currency movements. However, strong end-market demand, robust project wins and a healthy backlog continue to support growth prospects.

Let us review the key factors supporting the company’s discounted valuation and growth potential.

The company’s solid project backlog and steady contract wins highlight its ability to maintain consistent revenue growth. At the end of second-quarter fiscal 2025, the backlog reached $22.16 billion, up 20% year over year. The Infrastructure & Advanced Facilities segment had a backlog of $21.77 billion compared with $18.13 billion last year. PA Consulting’s backlog grew to $392 million from $344 million, supported by growth in key markets and increased public sector spending.

Ongoing demand in important markets supports steady revenue growth in the near term. For the fiscal third quarter, the company forecasts a 5% to 7% year-over-year increase in net revenues, with most second-half revenues expected to come from its current backlog.

The company continues to make progress in several core markets, supported by ongoing demand, project wins and client investments. Jacobs has seen steady growth in Water and Environmental services, driven by government infrastructure projects and climate resilience efforts. In Life Sciences and Advanced Manufacturing, the company recorded double-digit revenue growth in the second quarter of fiscal 2025, supported by contracts like the engineering and management work for Merck’s $1 billion oncology facility.

In Critical Infrastructure, Jacobs is adapting to changing client priorities linked to increased global travel and transportation upgrades. The company considers global aviation investment a key driver for the Transportation segment, where it leverages consulting and program management expertise.

Jacobs is strengthening its position in the data center space by securing key roles in emerging technology projects across global markets. Furthermore, the company has been selected by PsiQuantum as the owner engineer for a utility-scale quantum computing facility in Brisbane, Australia.

On May 19, 2025, Jacobs collaborated with NVIDIA to support the development of data centers under the NVIDIA Omniverse Blueprint. The effort aims to advance AI factory digital twins by using the platform’s integrated capabilities. (Read more: Jacobs & NVIDIA Partner for AI Factory Digital Twins Blueprint). Recent contract awards reflect Jacobs’ alignment with high-growth markets and support its efforts to maintain steady and profitable expansion.

Backed by the company’s healthy backlog, steady demand across core markets and continued contract wins, the earnings estimate for fiscal 2025 indicates 13.8% year-over-year growth. Although the year’s estimate reflects a downward revision, the growth trend compared with the fiscal-2024 reported value induces optimistic sentiments among investors. The estimate revision trend can be understood in detail from the chart below.

Jacobs continues to face pressure from rising direct costs, due to labor expenses and key operational investments, which may weigh on margins in the near term. Furthermore, the company’s growing international footprint exposes it to currency fluctuations, with a stronger U.S. dollar presenting risks to overseas revenues and profitability. In the first six months of fiscal 2025, Jacobs’ revenues were hit by unfavorable foreign exchange impacts of $2.3 million against favorable impacts of $59 million in the year-ago period. A stronger dollar in fiscal 2025 could negatively impact Jacobs' revenues and operating income due to unfavorable currency translation.

Jacobs remains well-positioned with a strong backlog, consistent contract wins and steady progress across key markets such as infrastructure, life sciences and data centers. These factors support revenue visibility and potential earnings growth. However, rising costs and currency-related pressures may weigh on margins in the near term. Given its discounted valuation, this Zacks Rank #3 (Hold) stock may appeal to investors looking for long-term value. While it may be prudent for investors to monitor the stock for further updates, those already holding shares can consider maintaining their position, given the company’s ongoing efforts to strengthen the business. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 6 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite