|

|

|

|

|||||

|

|

Roku ROKU and Comcast CMCSA are both active players in the fast-growing streaming market, each with a unique approach. Roku has built its platform around ad-supported streaming and user-friendly content discovery, while Comcast is expanding Peacock through a mix of premium content, live sports and strategic bundling across its broader media and broadband ecosystem.

As consumers spend more time streaming and advertisers shift dollars toward digital platforms, the key question is: Which company is better positioned to benefit in 2025? Let’s compare their performance and strategies to find out.

Roku’s streaming platform showed strong growth in the first quarter of 2025, strengthening its position as a top player in the streaming space. Platform revenues rose 17% year over year to $881 million, supported by growth in both video advertising and streaming service distribution. Roku now reaches over half of all U.S. broadband households, with more than 125 million people using its Home Screen every day to start their TV experience.

A big part of this success was The Roku Channel, which became the #2 app on the platform in the United States based on engagement. Streaming hours on the channel jumped 84% from last year, aided by personalized recommendations shown directly on the home screen. Over 85% of viewing came through these features rather than the app, showing how well Roku guides users to content.

Roku also continues to grow its streaming ecosystem by adding more content and making it easier for users to discover what to watch. Its library includes Roku Originals, live channels and easy access to popular subscription services, all in one place.

With more people watching content through streaming, Roku is in a strong position. Its growing user base, smart content discovery tools and focus on improving the streaming experience make it one of the most reliable platforms in today’s digital viewing market.

Comcast’s streaming business, led by Peacock, continued to grow in the first quarter of 2025. Peacock delivered double-digit revenue growth and narrowed its year-over-year losses by more than $400 million. This improvement was supported by better monetization of paid subscribers, a price increase from 2024 and the addition of Charter subscribers, which helped the platform reach 41 million paid users by quarter-end.

Peacock’s content strategy centers around a wide mix of programming, including NBCUniversal originals, next-day NBC and Bravo shows, Pay-One movies like Wicked and a strong lineup of live sports. This mix is designed to appeal to a broad audience and drive consistent streaming engagement across different user groups.

While digital advertising on Peacock remained relatively stable, the platform is still not profitable. Total advertising revenues for NBCUniversal declined during the quarter due to the timing of sports events and comparisons to a strong political ad year. Even with bundling efforts and expanded ad formats, Peacock’s financial performance remains under pressure.

Despite making clear progress, Peacock still requires heavy investment to stay competitive. Its growing sports portfolio, including new rights like the NBA, adds more cost in the short term. As a result, while subscriber numbers are rising, Peacock continues to operate at a loss, and its long-term path to profitability is still taking shape.

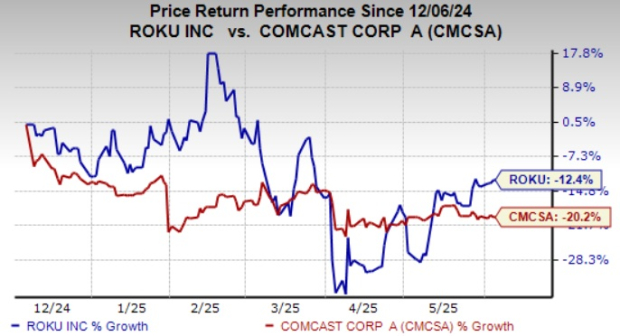

In the trailing six months, Roku shares have lost 12.4% compared with Comcast’s decline of 20.2%. This indicates relatively strong investor sentiment for Roku.

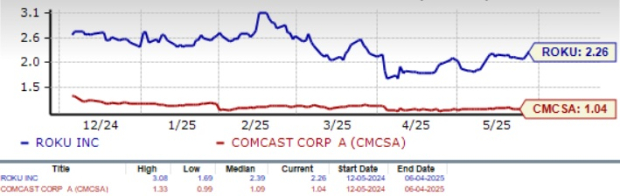

From a valuation standpoint, ROKU’s current forward 12-month P/S ratio of 2.26X is ahead of CMCSA’s 1.04X. Although ROKU is trading at a premium compared to CMCSA, the premium valuation reflects investor confidence in the company's growth potential for the rest of 2025. In contrast, CMCSA’s current forward 12-month P/S ratio indicates more cautious market sentiment around its near-term performance.

The Zacks Consensus Estimate for ROKU’s 2025 loss is pegged at 17 cents per share, which has narrowed by 2 cents over the past 30 days, indicating an 80.9% increase year over year. The consensus estimate for 2025 revenues is pinned at $4.55 billion, suggesting year-over-year growth of 10.54%.

Roku, Inc. price-consensus-chart | Roku, Inc. Quote

The Zacks Consensus Estimate for CMCSA’s 2025 earnings is pegged at $4.35 per share, which has been revised downward by a penny over the past 30 days, indicating a 0.46% increase year over year. The consensus estimate for 2025 revenues is pinned at $122.07 billion, suggesting a year-over-year decline of 1.35%.

Comcast Corporation price-consensus-chart | Comcast Corporation Quote

The positive trend in ROKU’s earnings estimates reflects investors’ confidence in its growth, while the downward revision in CMCSA’s earnings estimate reflects skepticism.

Roku remains the stronger streaming bet for the rest of 2025. The company is growing steadily, with rising platform revenues, increased engagement on The Roku Channel and strong advertiser demand. Its ad tools and partnerships are helping improve monetization, especially among smaller businesses. These results have led to improved earnings expectations and steady investor confidence.

Comcast’s Peacock, on the other hand, is still in the building phase. While subscriber numbers are growing and losses have narrowed, the platform is not yet profitable and continues to require heavy investment. Compared to Roku’s focused, ad-driven model, Peacock’s growth path is slower and more uncertain.

ROKU currently carries a Zacks Rank #2 (Buy), whereas CMCSA has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite