|

|

|

|

|||||

|

|

Shares of Intuitive Surgical ISRG seem to gain momentum after declining between February to April. The stock has risen 12.7% in the quarter so far after declining more than 30% from its all-time high of $616 in January. The recent rally reflects Intuitive Surgical’s strong fundamentals, even amid tariff-related concerns. A temporary U.S.-China trade agreement has eased tariffs for 90 days, likely reducing the projected 170 basis point impact on the cost of goods sold in 2025.

Intuitive Surgical continues to lead the robotic-assisted surgery market, supported by robust revenue growth and rising procedure volumes. Looking ahead into the second half of 2025, the company remains focused on advancing its technology, expanding internationally and enhancing manufacturing efficiency. However, global macroeconomic headwinds remain, particularly with the resurgence of U.S. protectionism under President Trump, heightening the risk of renewed trade tensions.

ISRG reported first-quarter 2025 revenues of $2.25 billion, marking a 19.2% year-over-year increase. This underscores the company’s ability to generate consistent, recurring revenues, now 85% of total earnings. ISRG recorded strong earnings per share (EPS) growth of 20% (to $1.81) and an operating margin of 34.1%. It anticipates a declining operating margin for 2025 due to increased depreciation expenses and a higher mix of lower-margin products like da Vinci 5, Ion and SP.

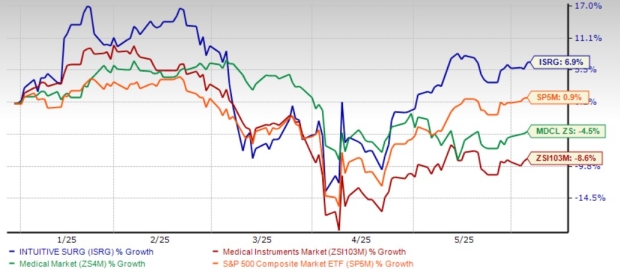

Despite the recent fall in share price, ISRG’s shares are up 6.9%, outperforming the Zacks Medical - Instruments industry’s decline of 8.6% year to date. The broader Zacks Medical sector has declined 4.5% and the S&P 500 Index has increased 0.9% in the same period.

YTD Price Performance

In the first quarter, Intuitive Surgical’s revenue growth was primarily driven by continued strength in da Vinci procedure volumes, along with solid growth in Ion and SP procedures. The company’s strategic price increases helped offset inflationary pressures, further supporting top-line gains.

The growing adoption of the da Vinci 5 system also contributed to the top line, with a broader rollout planned for the second half of the year, which is expected to boost system sales. However, softer demand in Germany, the U.K., and Japan could affect the pace of adoption.

International expansion efforts are gaining momentum, with Ion platform clearance in Australia and its launch in China expected to drive system placements and procedural volumes. Additionally, U.S. clearance of the da Vinci SP SureForm 45 stapler, which enables thoracic and colorectal applications, opens new clinical use cases.

Further upside is expected from the recent FDA clearance of the da Vinci SP surgical system for transanal local excision/resection. This approval supports Intuitive’s move into natural orifice surgery, particularly for minimally invasive colorectal procedures, and should drive future system demand.

ISRG Stock Trades Above 200-Day Average

To fuel further expansion, ISRG plans to market its da Vinci products directly in Italy, Spain, and Portugal, at a cost of EUR 290 million, thereby deepening its customer relationships. Manufacturing expansion continues with the addition of new facilities in California, Germany, and Bulgaria, ensuring scalable production for the Da Vinci 5 and Ion systems. Additionally, digital tools, such as the My Intuitive app and VR simulators, should improve surgeon training and optimize procedural outcomes.

In 2025, Intuitive Surgical anticipates a 170 basis point gross margin headwind driven by newly implemented global tariffs. The added costs primarily stem from three sources — escalating U.S.-China trade tensions, European retaliatory tariffs and limited Mexican exports failing to meet USMCA certification standards. Notably, the company faces steep U.S. tariffs on components imported from China and on finished goods re-entering the country, including Chinese-sourced parts and subassemblies for the Ion platform.

Tariff-related costs are expected to rise sequentially through the year. However, the overall impact may be moderated by recent policy shifts — U.S. tariffs on Chinese imports have been reduced from 145% to 30%, while U.S. exports to China will now face a 10% tariff, down from a prior 125%.

Meanwhile, competitive pressure in the robotic-assisted surgery market continues to intensify. Larger players like Johnson & Johnson JNJ and Medtronic MDT are ramping up investments in the space. Notably, Medtronic has filed for FDA clearance for its Hugo robotic-assisted surgery system, with potential approval anticipated in the second half of 2025. In this environment, maintaining cost efficiency will be critical for Intuitive Surgical.

ISRG’s P/E F12M Higher Than Industry

The share price of ISRG is trading above the significant levels of 50-DMA and 200-DMA, reflecting strength. However, the company’s share flashed a bearish pattern — death cross — on May 1 and is currently seen to form a lower high, raising skepticism about the continuation of its recent rally. Moroever, the stock’s pricey valuation raises concerns. The company is trading significantly higher than the industry. However, it is currently trading below its five-year median, which can act as a cushion against further decline.

ISRG currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Moreover, the Style Scores don’t look quite promising. The company has a Value Score of D and a Growth Score of C. The valuation chart also shows the significant premium for ISRG stock compared with the industry. Moreover, the Momentum score of ‘F’ implies that the stock may trade within the range in the upcoming few months.

As such, we believe that investors may hold the stock for now. Nevertheless, we caution against taking a new position. Strong fundamentals suggest an upside to the share price, but investors should wait for an attractive entry point.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Stock Market Today: Dow Up After New Trump Tariffs; Novo Plunges On Drug Trial Results (Live Coverage)

JNJ

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 |

Stock Market Today: Dow Falls On New Trump Tariffs; Novo Plunges On Drug Trial Results (Live Coverage)

JNJ

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite