|

|

|

|

|||||

|

|

Shares of CRISPR Therapeutics CRSP have risen 14% over the past month, likely driven by encouraging results from the first candidates in its in vivo pipeline.

Last month, CRSP reported initial top-line results from an early-stage study on CTX310, its investigational in vivo CRISPR-based gene therapy, designed to target ANGPTL3 for the treatment of atherosclerotic heart disease. Data from the study showed that a single dose of CTX310 led to dose-dependent decreases in both low-density lipoprotein (LDL) and triglyceride (TG) levels, with peak reduction of up to 82% in TG and up to 81% in LDL.

The positive results provide a breather for CRISPR Therapeutics, which had not offered any major pipeline updates last year beyond the approval of Casgevy, also the world’s first gene therapy based on CRISPR technology. Unlike ex vivo therapies like Casgevy, where cells are removed, modified and then inserted back into one’s body, in vivo therapies involve infusing new genes directly into the body. There are currently no approved in vivo therapies based on CRISPR technology.

The CTX310 results also raise excitement around CRISPR Therapeutics’ other in vivo candidate, CTX320, which is being developed in a phase I study for targeting lipoprotein(a), also associated with heart disease. Initial data from this study is expected by the end of this month, which could catalyze the stock if the results mirror CTX310’s results.

While these developments are encouraging, it’s important to note that most of CRSP’s pipeline remains in the early stages of clinical testing. The company also faces potential headwinds from competition in the gene editing space, including both traditional players and emerging gene-editing rivals.

Let us discuss these factors in detail to better analyze how to play the stock.

CRISPR and partner Vertex Pharmaceuticals’ VRTX one-shot gene therapy, Casgevy, was approved in late 2023/early 2024 for two blood disorder indications — sickle cell disease (SCD) and transfusion-dependent beta-thalassemia (TDT) — in the United States and Europe. VRTX leads the global development and commercialization of Casgevy under the terms of the 2021 agreement, with support from CRSP.

Both SCD and TDT indications have a significant unmet medical need. Casgevy offers the potential to alleviate blood transfusion requirements for TDT patients as well as reduce painful and debilitating sickle crises for SCD patients. However, the treatment process remains complex. Patients must first undergo stem cell collection, followed by ex vivo gene editing and reinfusion, making it a labor-intensive and time-consuming therapy.

Despite these hurdles, commercial ramp-up is progressing. As of May 1, more than 65 authorized treatment centers (ATCs) had been activated globally, and nearly 90 patients have had their first cell collection. New patient starts are expected to grow significantly throughout 2025. During its first-quarter earnings release last month, Vertex Pharmaceuticals recorded $14.2 million in product revenues (from Casgevy sales) compared with $8 million in the previous quarter.

CRISPR Therapeutics expects multiple pipeline readouts this year. A steady stream of readouts could help boost the company’s R&D visibility, especially when it seeks to diversify beyond Casgevy.

CRISPR Therapeutics is advancing two next-generation CAR-T therapy candidates — CTX112 targeting CD19-positive B-cell malignancies and CTX131 targeting relapsed or refractory solid tumors — in separate phase I/II studies. It is also evaluating CTX131 in hematological malignancies (including T-cell lymphomas) and CTX112 in autoimmune disorders such as systemic lupus erythematosus, systemic sclerosis and inflammatory myositis. Updates on all these studies are expected throughout this year.

CRSP intends to further expand its in vivo pipeline with two more programs, CTX340 (for refractory hypertension) and CTX450 (for acute hepatic porphyria), before this year’s end.

Some other companies are also using CRISPR technology to address various ailments. One such company is Beam Therapeutics BEAM, which is developing an investigational ex vivo therapy for the SCD indication in a phase I/II study. Beam Therapeutics is also evaluating in vivo therapies for alpha-1 antitrypsin deficiency (AATD) and glycogen storage disease 1a (GSD1a) indications in separate phase I/II studies.

Intellia Therapeutics NTLA is a front-runner in the in vivo therapies space. Intellia is advancing two late-stage candidates — NTLA-2002 for hereditary angioedema (HAE) and nex-z (NTLA-2001) for transthyretin (ATTR) amyloidosis. Intellia Therapeutics plans to submit a regulatory filing with the FDA for the HAE therapy next year.

Casgevy also faces stiff competition from already-approved therapies like bluebird bio’s Zyntelgo (for TDT) and Lyfgenia (for SCD), Bristol Myers’ Reblozyl (for TDT) and Novartis’ Adakveo (for SCD).

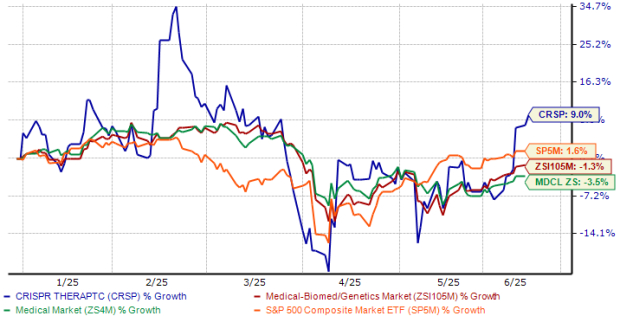

Shares of CRISPR Therapeutics have risen 9% year to date against the industry’s 1% decline, as seen in the chart below. The stock has also outperformed the sector and the S&P 500 Index. Shares of the company are currently trading above their 50-day moving average.

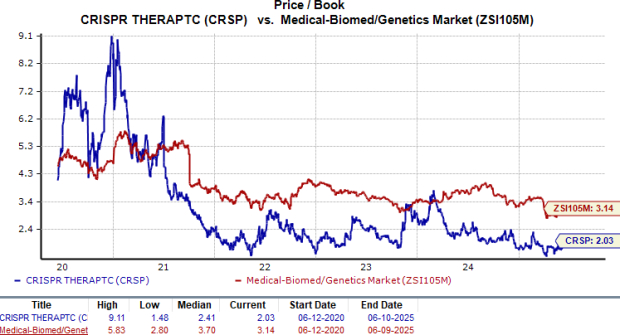

From a valuation standpoint, CRISPR Therapeutics is trading at a discount to the industry. Going by the price-to-book value (P/B) ratio, the company’s shares currently trade at 2.03, lower than 3.14 for the industry. The stock is also trading below its five-year mean of 2.41.

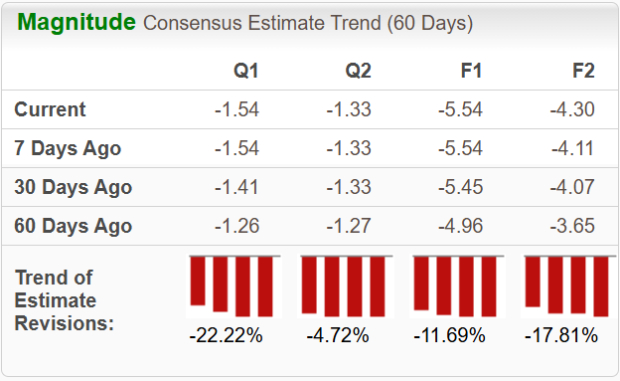

Estimates for CRISPR’s 2025 loss per share have widened from $4.96 to $5.54 in the past 60 days. During the same timeframe, loss per share estimates for 2026 have widened from $3.65 to $4.30.

We would suggest holding on to this Zacks Rank #3 (Hold) stock for now, considering its growth prospects. While we acknowledge that most of CRISPR’s pipeline is still in early-stage development, having a marketed product like Casgevy ensures that it has now overcome its biggest hurdle — the lack of a stable revenue stream. Some of its planned pipeline updates could serve as short-term catalysts for the stock.

With Casgevy sales picking up pace, the company’s strong cash balance of around $1.9 billion (as of March 2025-end) should also comfort investors that it can smoothly carry out its day-to-day operations, including potential late-stage studies on its pipeline candidates. The stock is also currently trading at a discount to the industry, while also showing signs of positive price momentum.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 16 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite