|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The United States-based engineering and construction firms are experiencing a boom in public infrastructure demand fueled by several government initiatives, namely the Infrastructure Investment and Jobs Act (IIJA), CHIPS Act and Inflation Reduction Act (IRA). Reflecting this trend, EMCOR Group, Inc. EME and Quanta Services, Inc. PWR are also gaining due to the ongoing favorable market fundamentals.

EMCOR is one of the leading providers of mechanical and electrical construction, industrial and energy infrastructure, as well as building services for a diverse range of businesses. Quanta is a larger player specializing in utility and energy infrastructure, and it is one of North America’s top contractors in electric power transmission and distribution.

Despite the ongoing tariff-related uncertainties, the public infrastructure spending is at its peak, most likely due to the country’s aim of enhancing supply-chain resilience and boosting domestic manufacturing. Notably, the main uptrend is witnessed across the data center infrastructure and energy transition sectors, which align with both firms’ service offerings and the nature of their businesses. These tailwinds are moreover proving incremental for their backlog growth trends, solidifying long-term revenue visibility and profitability structure.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

This Connecticut-based mechanical and electrical construction, industrial and energy infrastructure, and building services provider is massively gaining from the growing infrastructural demand across the network and communications sector, mainly in data centers. The boost in data center infrastructural demand is supported by the ongoing surge in Artificial Intelligence applications and the focus on digital transformation initiatives. The passing of the CHIPS and Science Act in 2022 is acting in favor of fostering investments in chip production, research and workforce development through increased public funding.

Igniting this uptrend comes the Miller Electric acquisition completed by EMCOR on Feb. 3, 2025. Miller Electric specializes in designing, installing and maintaining complex electrical systems across sectors such as data centers, manufacturing and healthcare. This strategic addition complements EMCOR’s existing electrical construction capabilities in high-growth end markets, while aligning with its growth strategy, the assurance of significant long-term benefits for the company and its shareholders.

The company measures its to-be-realized revenues from received and incomplete contracts through remaining performance obligations (RPOs). As of March 31, 2025, EME reached a record value of $11.75 billion for RPOs, including $1 billion of RPOs from Miller Electric. The value reflects 28% year-over-year growth, mainly attributable to significant growth across network and communications, healthcare, manufacturing and industrial, hospitality and entertainment, and institutional sectors.

Owing to the ongoing favorable market fundamentals, EMCOR has laid out a promising 2025 outlook, which reflects year-over-year growth across its top and bottom lines. It expects full-year revenues to be in the range of $16.1-$16.9 billion, indicating year-over-year growth in the range of 10.5-16%. Non-GAAP earnings per share (EPS) are expected to be between $22.65 and $24.00, up 5.3-11.5% year over year.

This Texas-based infrastructure services provider’s strength lies in its ability to deliver complex, large-scale projects such as power grid modernization, solar and wind farm buildouts and next-gen telecom networks. Amid the favorable public infrastructure spending backdrop, Quanta is strongly benefiting from its involvement in the advancement and implementation of technology solutions throughout the entire decarbonization spectrum. This boost was driven by market strength across electric grids, power generation, technology expansion and energy infrastructure, because of the fundamental transformation across the energy and infrastructure landscape in the United States.

As of March 31, 2025, the company had a total backlog of $35.25 billion, with a 12-month backlog of $19.42 billion. This compares favorably with the total backlog of $29.9 billion and the 12-month backlog of $16.64 billion reported a year ago. The meaningful increases in power demand across the United States, driven by the adoption of new technologies and related infrastructure, including data centers and Artificial Intelligence, are boding well for Quanta and are expected to bolster its prospects through the choppy macro environment.

Thanks to the current favorable market trends, Quanta remains optimistic about its 2025 prospects. For the year, the company expects revenues between $26.7 billion and $27.2 billion, up 13.8% at the midpoint from $23.67 billion reported in 2024. It forecasted adjusted EPS in the range of $10.05-$10.65, indicating 12-18.7% year-over-year growth. Adjusted EBITDA is projected to be between $2.68 billion and $2.81 billion, up from $2.33 billion in 2024.

As witnessed from the chart below, in the past three months, Quanta’s share price performance stands above EMCOR’s.

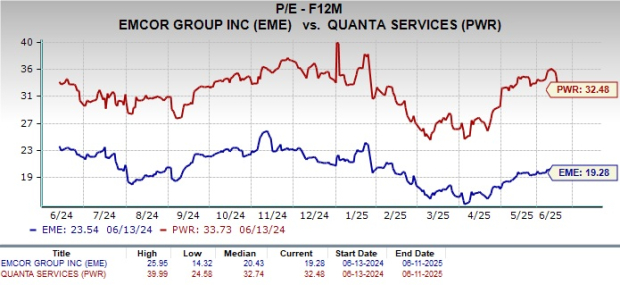

Considering valuation, EMCOR is trading below Quanta on a forward 12-month price-to-earnings (P/E) ratio basis.

Overall, from these technical indicators, it can be deduced that EME stock offers a steady growth trend with a discounted valuation, while PWR stock offers a surge growth trend with a premium valuation.

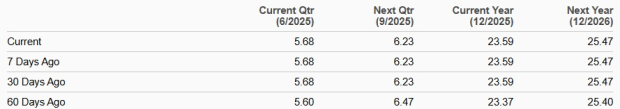

The Zacks Consensus Estimate for EME’s 2025 EPS indicates 9.6% year-over-year growth, with the 2026 estimate indicating an increase of 8%. The 2025 and 2026 EPS estimates have trended upward over the past 60 days.

EME EPS Trend

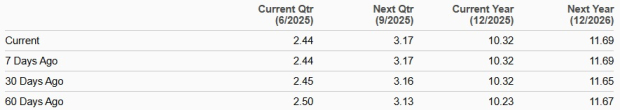

The Zacks Consensus Estimate for PWR’s 2025 and 2026 bottom line implies year-over-year improvements of 15.1% and 13.2%, respectively. Quanta’s 2025 EPS estimates have trended upward over the past 60 days, while the same for 2026 have gone up in the past 30 days.

PWR EPS Trend

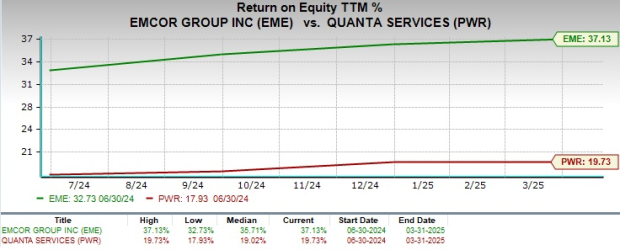

EMCOR’s trailing 12-month ROE of 37.1% far exceeds Quanta’s average of 19.7%, underscoring its efficiency in generating shareholder returns.

For indulging in a steady growth trend with substantial returns, EMCOR stock can be considered a good fit for the portfolio for now. The discounted valuation compared with Quanta stock advocates for an attractive entry point for investors. In the long term, the valuation could move toward a premium, given the strong market fundamentals backing the company’s revenue visibility and profitability.

On the other hand, while discussing Quanta, it can be concluded that this infrastructure stock with diversified market exposure and a clear role in the energy transition is catalyzing its growth trends. However, its premium valuation is a concern, making it difficult for investors to figure out a suitable entry point from a short-term perspective.

Upon comparison, based on the market fundamentals alongside technical indicators, EMCOR, carrying a Zacks Rank #2 (Buy) at present, seems to offer the better upside potential for investors seeking an option with sustainable and steady growth compared with Quanta, which is carrying a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 19 min |

Stock Market Today: Dow Slips After Surprise Jobless Claims; DoorDash Jumps(Live Coverage)

PWR

Investor's Business Daily

|

| 54 min |

Stock Market Today: Dow Slides After Surprise Jobless Claims; AI Stock Jumps (Live Coverage)

PWR

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour |

This S&P 500 AI Data Center Play Eyes New Highs On Earnings; 20% Profit Growth Expected

PWR

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| Feb-18 | |

| Feb-18 |

Walmart To Report Results, Fresh Off New Highs, A New CEO And $1 Trillion Market Cap

PWR

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite